Question: need some help with question 5, thanks Rawr is a manufacturer of dehydrated cat treats located in Oakland, CA. The company has two production processes:

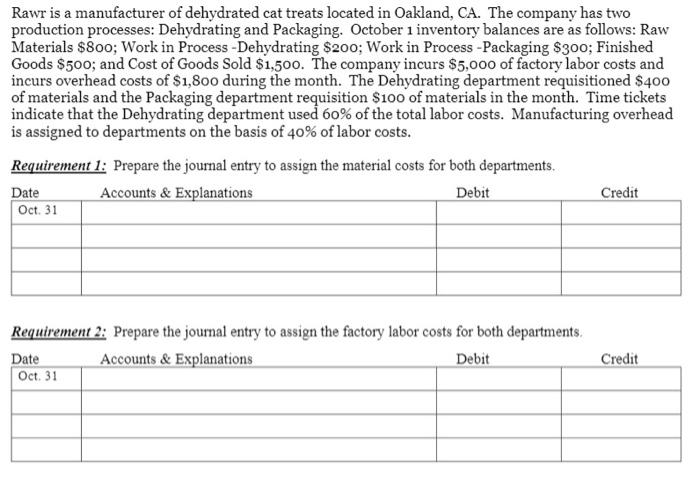

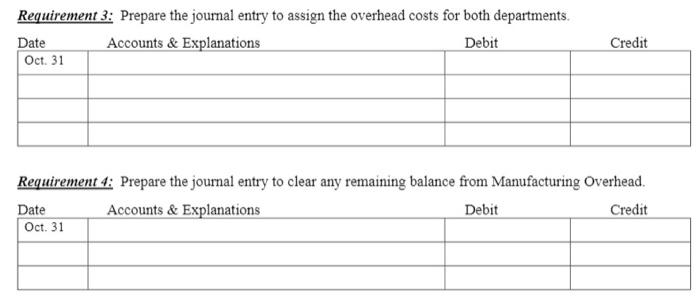

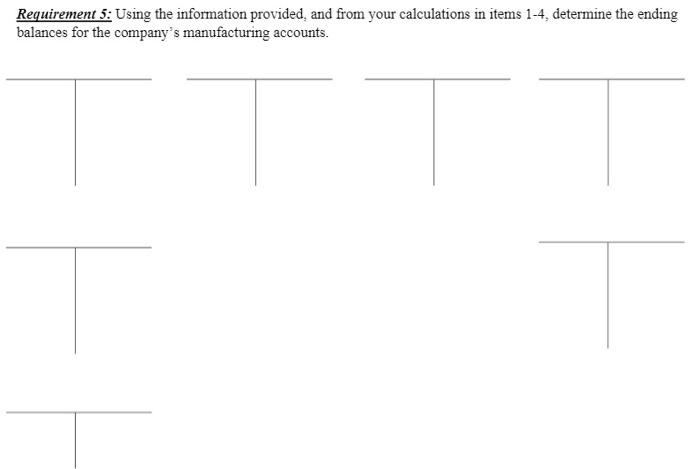

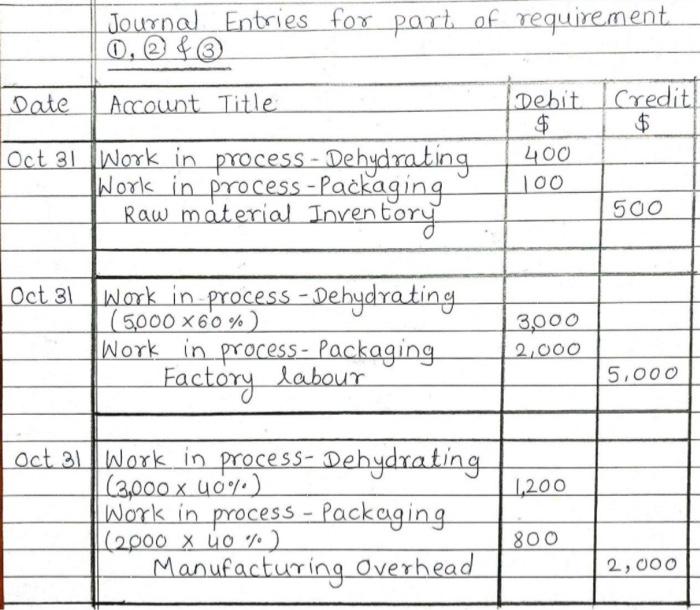

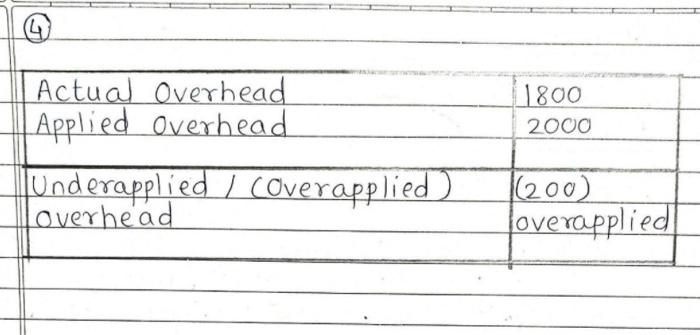

Rawr is a manufacturer of dehydrated cat treats located in Oakland, CA. The company has two production processes: Dehydrating and Packaging. October 1 inventory balances are as follows: Raw Materials $800; Work in Process - Dehydrating $200; Work in Process - Packaging $300; Finished Goods $500; and Cost of Goods Sold $1,500. The company incurs $5,000 of factory labor costs and incurs overhead costs of $1,800 during the month. The Dehydrating department requisitioned $400 of materials and the Packaging department requisition $100 of materials in the month. Time tickets indicate that the Dehydrating department used 60% of the total labor costs. Manufacturing overhead is assigned to departments on the basis of 40% of labor costs. Requirement 1: Prepare the journal entry to assign the material costs for both departments. Date Accounts & Explanations Debit Credit Oct 31 Requirement 2: Prepare the journal entry to assign the factory labor costs for both departments. Date Accounts & Explanations Debit Oct. 31 Credit Requirement 3: Prepare the journal entry to assign the overhead costs for both departments. Date Accounts & Explanations Debit Oct. 31 Credit Requirement 4: Prepare the journal entry to clear any remaining balance from Manufacturing Overhead. Date Accounts & Explanations Debit Credit Oct. 31 Requirement 5: Using the information provided, and from your calculations in items 1-4, determine the ending balances for the company's manufacturing accounts. 1800 2000 Actual Overhead Applied Overhead underapplied / coverapplied) Overhead 11200) overapplied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts