Question: Need some help with the question attached as images, thank you! Question 8 Cannondale Company purchased an electric wax melter on April 30, 2014, by

Need some help with the question attached as images, thank you!

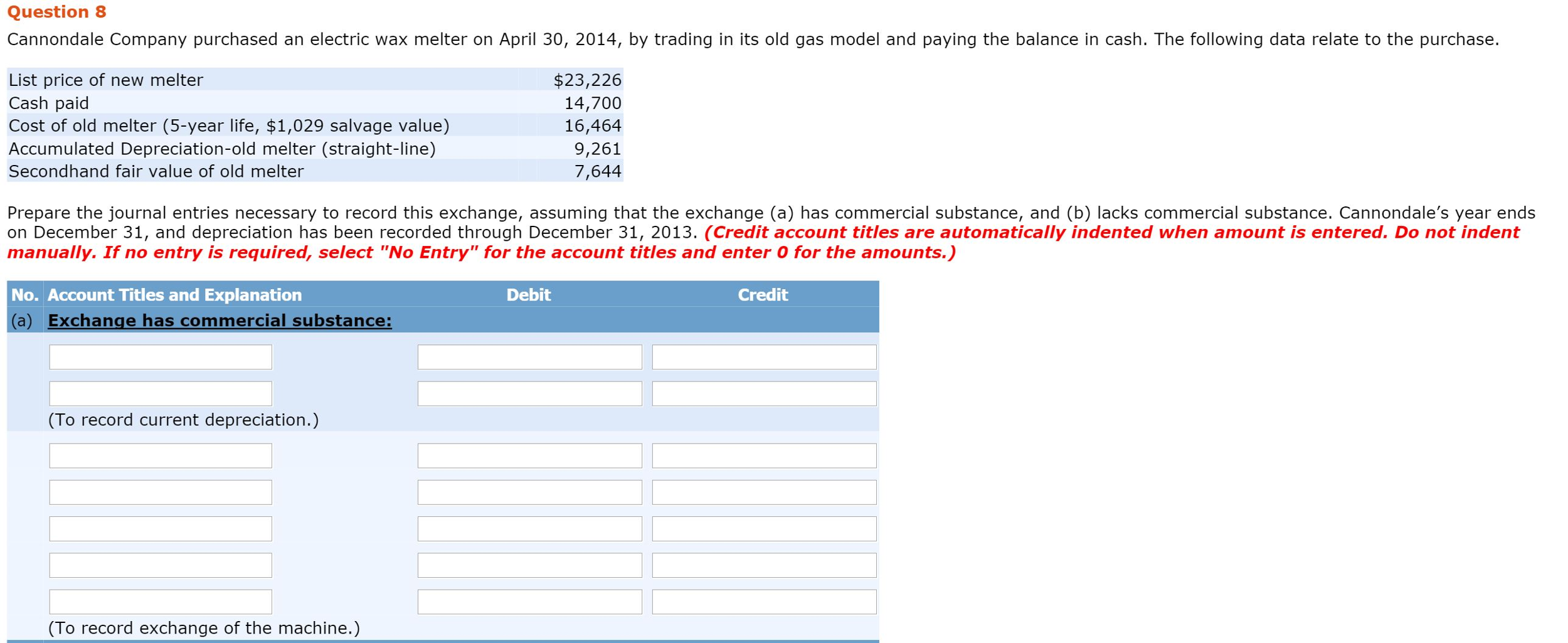

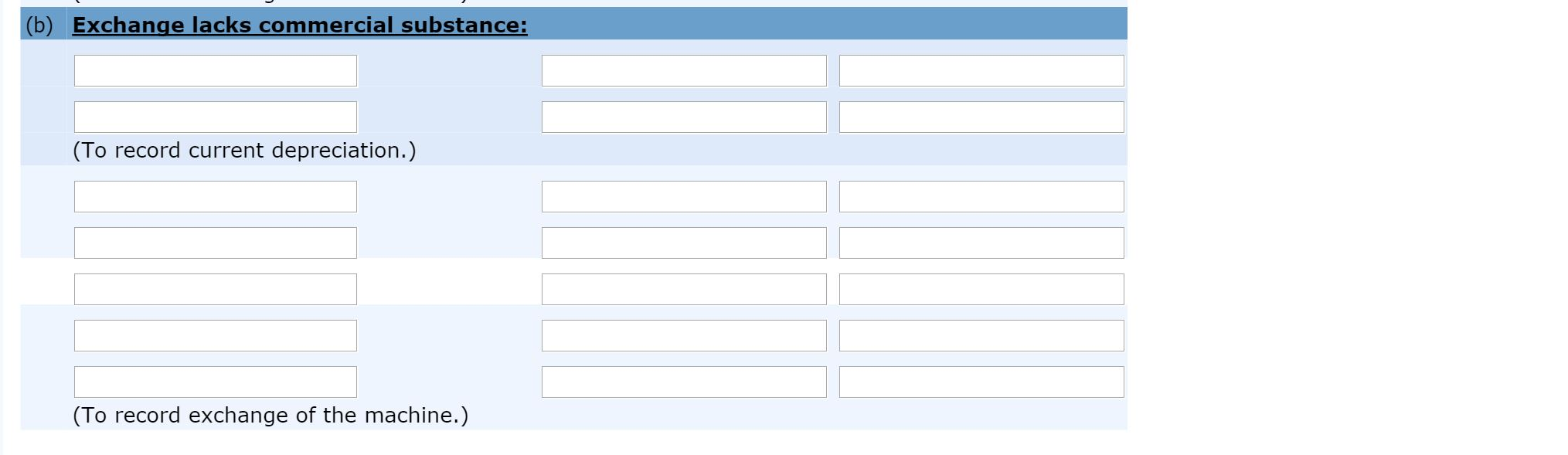

Question 8 Cannondale Company purchased an electric wax melter on April 30, 2014, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. List price of new melter Cash paid Cost of old melter (5-year life, $1,029 salvage value) Accumulated Depreciation-old melter (straight-line) Secondhand fair value of old melter $23,226 14,700 16,464 9,261 7,644 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Cannondale's year ends on December 31, and depreciation has been recorded through December 31, 2013. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Credit No. Account Titles and Explanation a) Exchange has commercial substance: Debit (To record current depreciation.) (To record exchange of the machine.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts