Question: Need some help with these journal entries. Please show steps on how to get the amounts for the entries. Thanks Cash $2,830,725 Accounts Payable 103,000

Need some help with these journal entries. Please show steps on how to get the amounts for the entries. Thanks

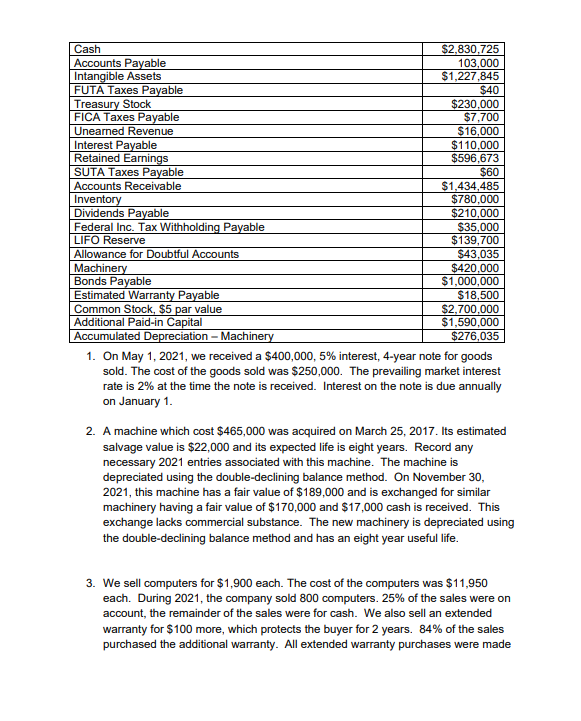

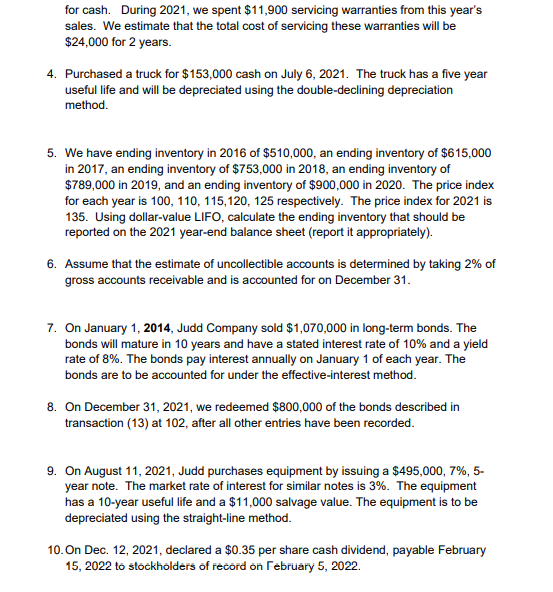

Cash $2,830,725 Accounts Payable 103,000 Intangible Assets $1,227,845 FUTA Taxes Payable $40 Treasury Stock $230,000 FICA Taxes Payable $7,700 Unearned Revenue $16.000 Interest Payable $110,000 Retained Earnings $596,673 SUTA Taxes Payable $60 Accounts Receivable $1,434,485 Inventory $780,000 Dividends Payable $210,000 Federal Inc. Tax Withholding Payable $35,000 LIFO Reserve $139,700 Allowance for Doubtful Accounts $43,035 Machinery $420,000 Bonds Payable $1,000,000 Estimated Warranty Payable $18,500 Common Stock $5 par value $2,700,000 Additional Paid-in Capital $1,590,000 Accumulated Depreciation - Machinery $276,035 1. On May 1, 2021, we received a $400,000, 5% interest, 4-year note for goods sold. The cost of the goods sold was $250,000. The prevailing market interest rate is 2% at the time the note is received. Interest on the note is due annually on January 1. 2. A machine which cost $465,000 was acquired on March 25, 2017. Its estimated salvage value is $22,000 and its expected life is eight years. Record any necessary 2021 entries associated with this machine. The machine is depreciated using the double-declining balance method. On November 30, 2021, this machine has a fair value of $189,000 and is exchanged for similar machinery having a fair value of $170,000 and $17,000 cash is received. This exchange lacks commercial substance. The new machinery is depreciated using the double-declining balance method and has an eight year useful life. 3. We sell computers for $1,900 each. The cost of the computers was $11,950 each. During 2021, the company sold 800 computers. 25% of the sales were on account, the remainder of the sales were for cash. We also sell an extended warranty for $100 more, which protects the buyer for 2 years. 84% of the sales purchased the additional warranty. All extended warranty purchases were made for cash. During 2021, we spent $11,900 servicing warranties from this year's sales. We estimate that the total cost of servicing these warranties will be $24,000 for 2 years. 4. Purchased a truck for $153,000 cash on July 6, 2021. The truck has a five year useful life and will be depreciated using the double-declining depreciation method. 5. We have ending inventory in 2016 of $510,000, an ending inventory of $615,000 in 2017, an ending inventory of $753,000 in 2018, an ending inventory of $789,000 in 2019, and an ending inventory of $900,000 in 2020. The price index for each year is 100, 110, 115,120, 125 respectively. The price index for 2021 is 135. Using dollar-value LIFO, calculate the ending inventory that should be reported on the 2021 year-end balance sheet (report it appropriately). 6. Assume that the estimate of uncollectible accounts is determined by taking 2% of gross accounts receivable and is accounted for on December 31. 7. On January 1, 2014, Judd Company sold $1,070,000 in long-term bonds. The bonds will mature in 10 years and have a stated interest rate of 10% and a yield rate of 8%. The bonds pay interest annually on January 1 of each year. The bonds are to be accounted for under the effective-interest method. 8. On December 31, 2021, we redeemed $800,000 of the bonds described in transaction (13) at 102, after all other entries have been recorded. 9. On August 11, 2021, Judd purchases equipment by issuing a $495,000, 7%, 5- year note. The market rate of interest for similar notes is 3%. The equipment has a 10-year useful life and a $11,000 salvage value. The equipment is to be depreciated using the straight-line method. 10. On Dec. 12, 2021, declared a $0.35 per share cash dividend, payable February 15, 2022 to stockholders of record on February 5, 2022. Cash $2,830,725 Accounts Payable 103,000 Intangible Assets $1,227,845 FUTA Taxes Payable $40 Treasury Stock $230,000 FICA Taxes Payable $7,700 Unearned Revenue $16.000 Interest Payable $110,000 Retained Earnings $596,673 SUTA Taxes Payable $60 Accounts Receivable $1,434,485 Inventory $780,000 Dividends Payable $210,000 Federal Inc. Tax Withholding Payable $35,000 LIFO Reserve $139,700 Allowance for Doubtful Accounts $43,035 Machinery $420,000 Bonds Payable $1,000,000 Estimated Warranty Payable $18,500 Common Stock $5 par value $2,700,000 Additional Paid-in Capital $1,590,000 Accumulated Depreciation - Machinery $276,035 1. On May 1, 2021, we received a $400,000, 5% interest, 4-year note for goods sold. The cost of the goods sold was $250,000. The prevailing market interest rate is 2% at the time the note is received. Interest on the note is due annually on January 1. 2. A machine which cost $465,000 was acquired on March 25, 2017. Its estimated salvage value is $22,000 and its expected life is eight years. Record any necessary 2021 entries associated with this machine. The machine is depreciated using the double-declining balance method. On November 30, 2021, this machine has a fair value of $189,000 and is exchanged for similar machinery having a fair value of $170,000 and $17,000 cash is received. This exchange lacks commercial substance. The new machinery is depreciated using the double-declining balance method and has an eight year useful life. 3. We sell computers for $1,900 each. The cost of the computers was $11,950 each. During 2021, the company sold 800 computers. 25% of the sales were on account, the remainder of the sales were for cash. We also sell an extended warranty for $100 more, which protects the buyer for 2 years. 84% of the sales purchased the additional warranty. All extended warranty purchases were made for cash. During 2021, we spent $11,900 servicing warranties from this year's sales. We estimate that the total cost of servicing these warranties will be $24,000 for 2 years. 4. Purchased a truck for $153,000 cash on July 6, 2021. The truck has a five year useful life and will be depreciated using the double-declining depreciation method. 5. We have ending inventory in 2016 of $510,000, an ending inventory of $615,000 in 2017, an ending inventory of $753,000 in 2018, an ending inventory of $789,000 in 2019, and an ending inventory of $900,000 in 2020. The price index for each year is 100, 110, 115,120, 125 respectively. The price index for 2021 is 135. Using dollar-value LIFO, calculate the ending inventory that should be reported on the 2021 year-end balance sheet (report it appropriately). 6. Assume that the estimate of uncollectible accounts is determined by taking 2% of gross accounts receivable and is accounted for on December 31. 7. On January 1, 2014, Judd Company sold $1,070,000 in long-term bonds. The bonds will mature in 10 years and have a stated interest rate of 10% and a yield rate of 8%. The bonds pay interest annually on January 1 of each year. The bonds are to be accounted for under the effective-interest method. 8. On December 31, 2021, we redeemed $800,000 of the bonds described in transaction (13) at 102, after all other entries have been recorded. 9. On August 11, 2021, Judd purchases equipment by issuing a $495,000, 7%, 5- year note. The market rate of interest for similar notes is 3%. The equipment has a 10-year useful life and a $11,000 salvage value. The equipment is to be depreciated using the straight-line method. 10. On Dec. 12, 2021, declared a $0.35 per share cash dividend, payable February 15, 2022 to stockholders of record on February 5, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts