Question: Need some help with this Coding problem pls help using(anaconda, python) PLS help #3 Problem #3: Tax . In the United States, different tax rates

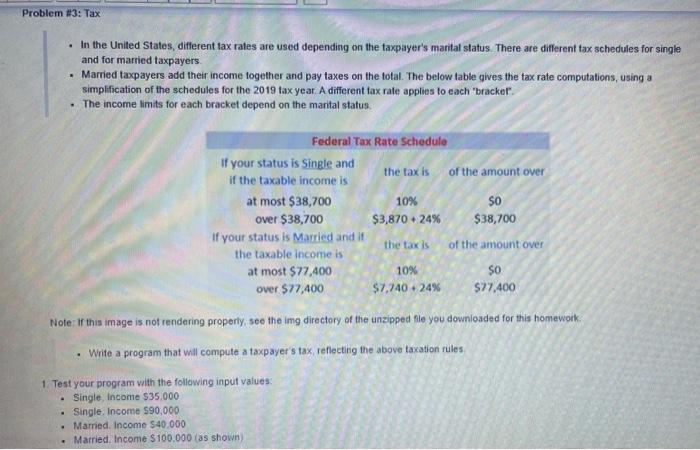

Problem #3: Tax . In the United States, different tax rates are used depending on the taxpayer's marital status. There are different tax schedules for single and for married taxpayers Married taxpayers add their income together and pay taxes on the total. The below table gives the tax rate computations, using a simplification of the schedules for the 2019 tax year. A different tax rate applies to each bracket". The income limits for each bracket depend on the marital status Federal Tax Rate Schedule If your status is Single and if the taxable income is the tax is of the amount over at most $38,700 10% So over $38,700 $3,870.24% $38,700 If your status is Married and if the taxis of the amount over the taxable income is at most $77,400 10% $0 over $77,400 $7,740.24% $77,400 Note: If this image is not rendering properly, see the img directory of the unzipped nle you downloaded for this homework Write a program that will compute a taxpayer's tax reflecting the above taxation rules 1. Test your program with the following input values: Single Income $35.000 Single, Income $90,000 Married, Income $40.000 Married Income $100.000 (as shown) Problem #3: Tax . In the United States, different tax rates are used depending on the taxpayer's marital status. There are different tax schedules for single and for married taxpayers Married taxpayers add their income together and pay taxes on the total. The below table gives the tax rate computations, using a simplification of the schedules for the 2019 tax year. A different tax rate applies to each bracket". The income limits for each bracket depend on the marital status Federal Tax Rate Schedule If your status is Single and if the taxable income is the tax is of the amount over at most $38,700 10% So over $38,700 $3,870.24% $38,700 If your status is Married and if the taxis of the amount over the taxable income is at most $77,400 10% $0 over $77,400 $7,740.24% $77,400 Note: If this image is not rendering properly, see the img directory of the unzipped nle you downloaded for this homework Write a program that will compute a taxpayer's tax reflecting the above taxation rules 1. Test your program with the following input values: Single Income $35.000 Single, Income $90,000 Married, Income $40.000 Married Income $100.000 (as shown)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts