Question: need some help with this problem. i will give you a good rate. thank you in advance (please table below) Mr. and Mrs. Lay's taxable

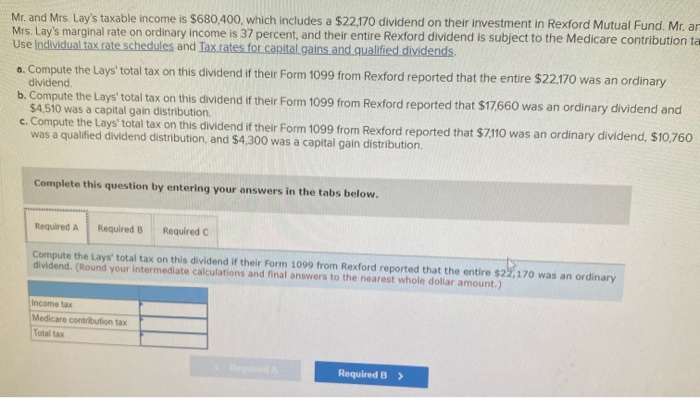

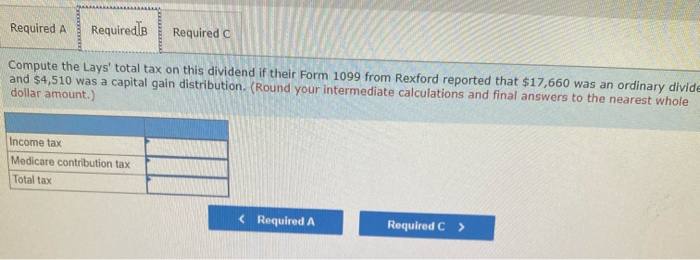

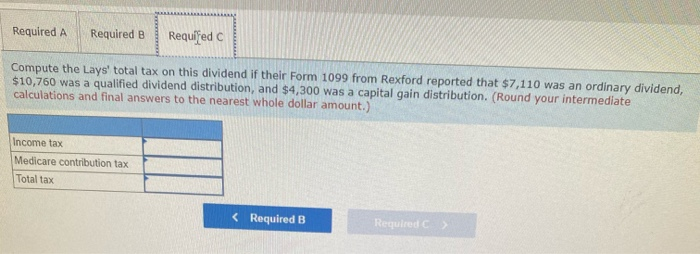

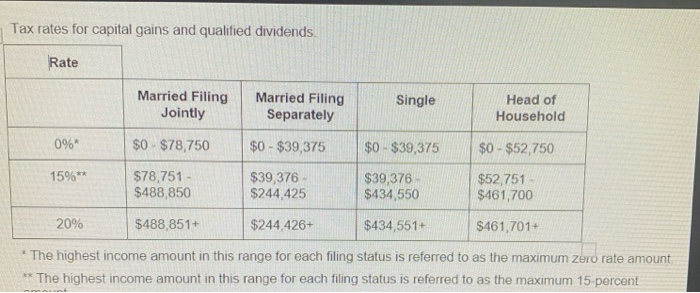

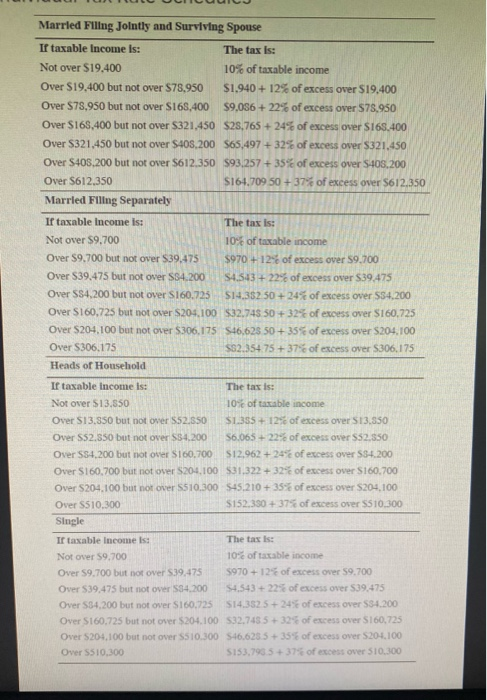

Mr. and Mrs. Lay's taxable income is $680,400, which includes a $22,170 dividend on their investment in Rexford Mutual Fund. Mr. ar Mrs. Lay's marginal rate on ordinary income is 37 percent, and their entire Rexford dividend is subject to the Medicare contribution ta Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. a. Compute the Lays' total tax on this dividend if their Form 1099 from Rexford reported that the entire $22,170 was an ordinary dividend b. Compute the Lays' total tax on this dividend if their Form 1099 from Rexford reported that $17,660 was an ordinary dividend and $4,510 was a capital gain distribution c. Compute the Lays' total tax on this dividend if their Form 1099 from Rexford reported that $7,110 was an ordinary dividend, $10,760 was a qualified dividend distribution, and $4,300 was a capital gain distribution Complete this question by entering your answers in the tabs below. Required A Required B Required Compute the Lays' total tax on this dividend if their Form 1099 from Rexford reported that the entire $22,170 was an ordinary dividend. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Income tax Medicare contribution tax Totalt Required B > Required A Requiredlo Required Compute the Lays' total tax on this dividend if their Form 1099 from Rexford reported that $17,660 was an ordinary divide and $4,510 was a capital gain distribution. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Income tax Medicare contribution tax Total tax Required A Required B Required Compute the Lays' total tax on this dividend if their Form 1099 from Rexford reported that $7,110 was an ordinary dividend, $10,760 was a qualified dividend distribution, and $4,300 was a capital gain distribution. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Income tax Medicare contribution tax Total tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts