Question: Need some help with this question, thank you 4. (20 points) Assume that today you borrow $450 from a bank with an interest rate of

Need some help with this question, thank you

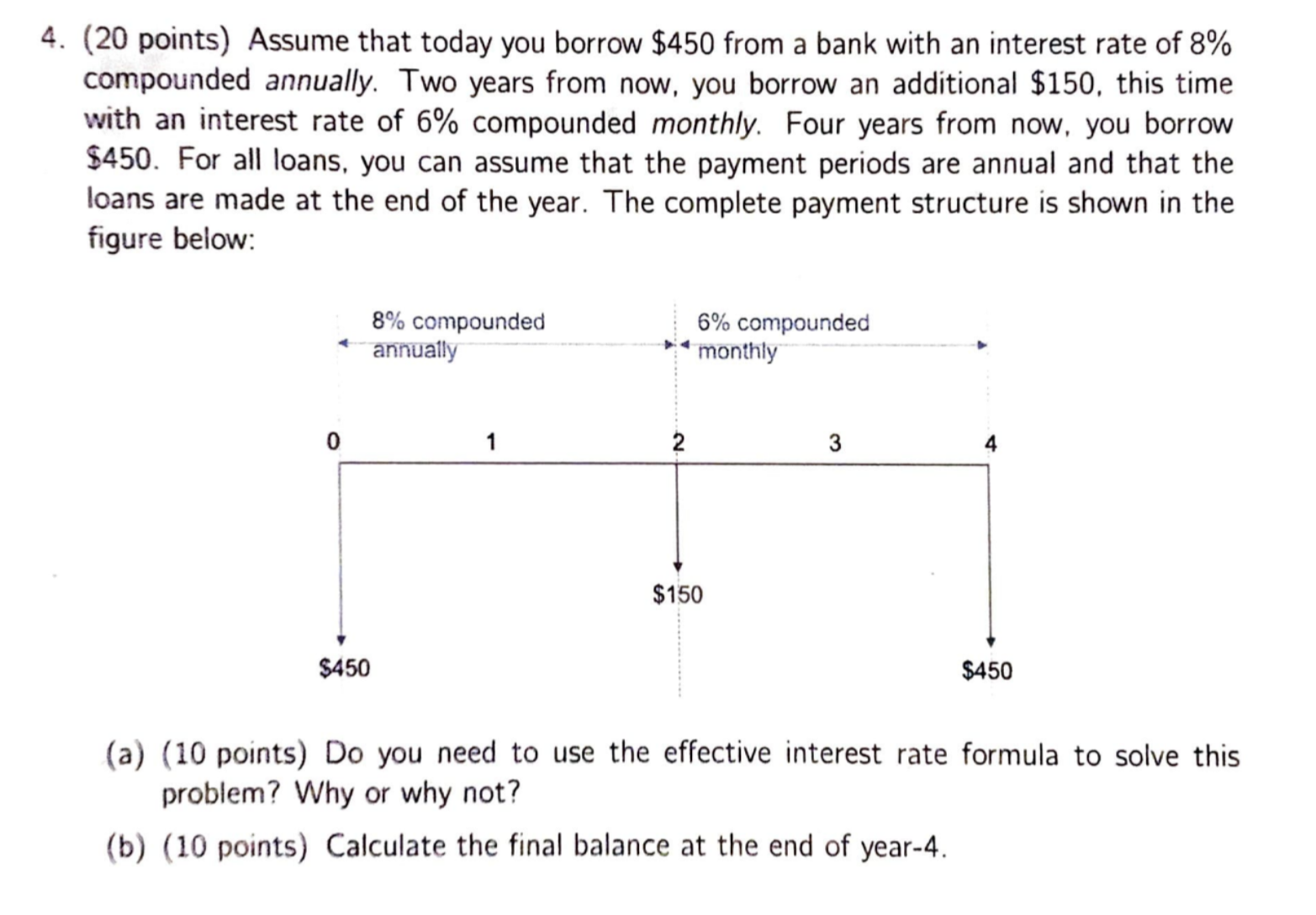

4. (20 points) Assume that today you borrow $450 from a bank with an interest rate of 8% compounded annually. Two years from now. you borrow an additional $150, this time with an interest rate of 6% compounded monthly. Four years from now. you borrow $450. For all loans. you can assume that the payment periods are annual and that the loans are made at the end of the year. The complete payment structure is shown in the gure below: 8% compounded ; 6% compounded " annually "i' monthly ' ' $450 $450 (a) (10 points) Do you need to use the effective interest rate formula to solve this problem? Why or why not? (b) (10 points) Calculate the final balance at the end of year-4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts