Question: Need some more help, need to understand the reasoning too please. P78 Common stock value: Constant growth Use the constantgrowth dividend model (Gordon growth model)

Need some more help, need to understand the reasoning too please.

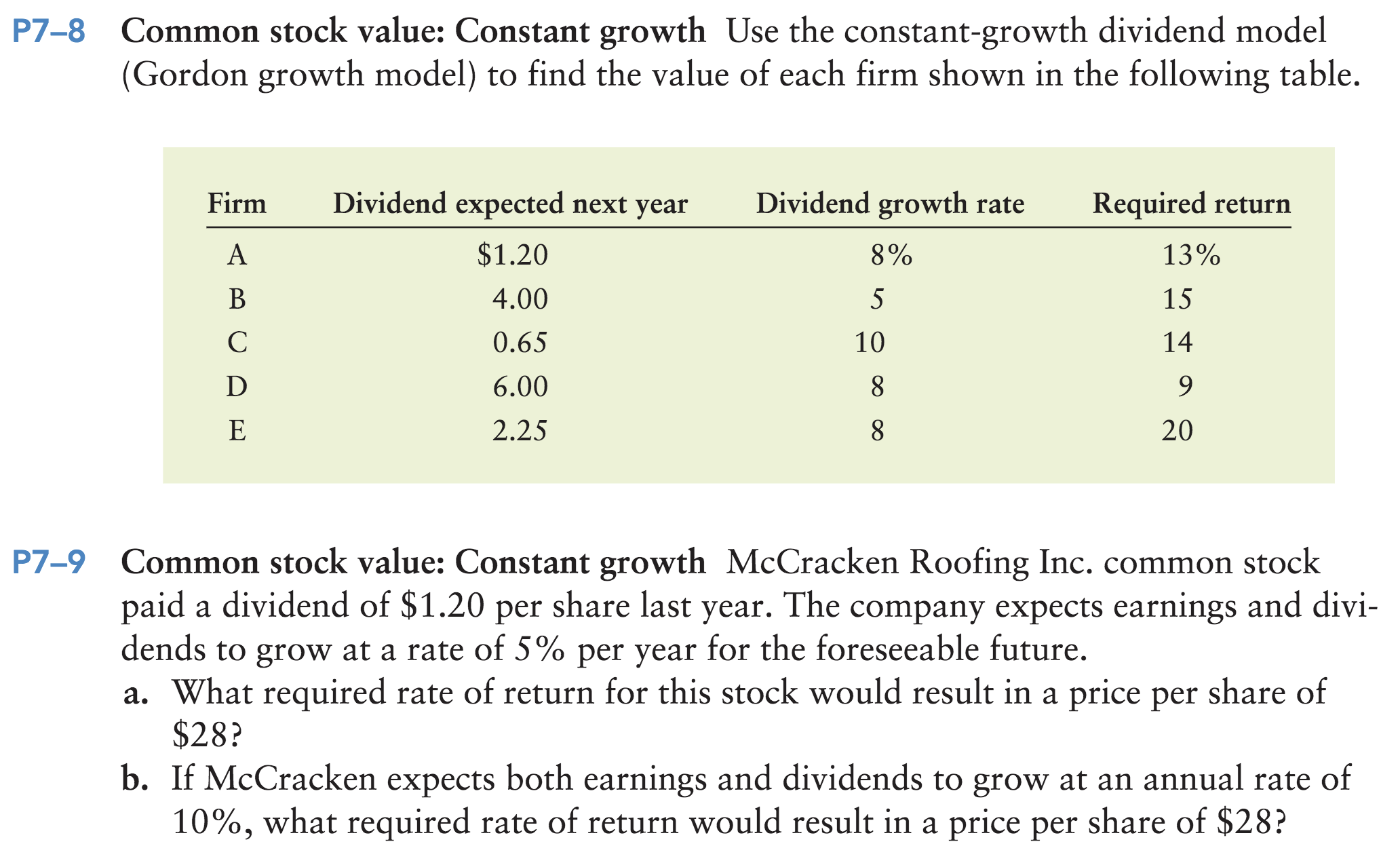

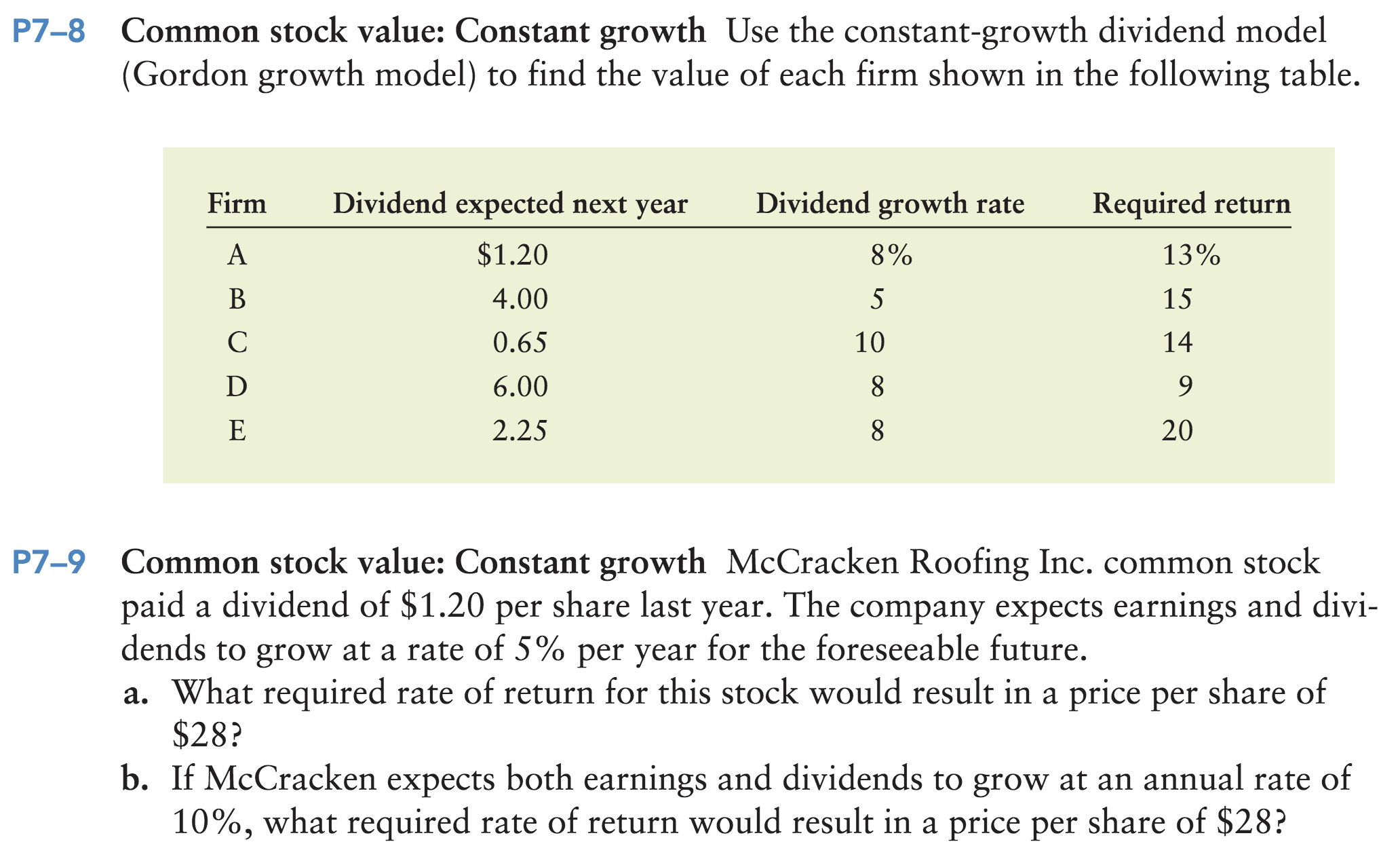

P78 Common stock value: Constant growth Use the constantgrowth dividend model (Gordon growth model) to find the value of each firm shown in the following table. Firm Dividend expected next year Dividend growth rate Required return A $1.20 8% 13% B 4.00 5 15 C 0.65 10 14 D 6.00 8 9 E 2.25 8 20 P79 Common stock value: Constant growth McCracken Roofing Inc. common stock paid a dividend of $1.20 per share last year. The company expects earnings and divi dends to grow at a rate of 5% per year for the foreseeable future. a. What required rate of return for this stock would result in a price per share of $2 8 P b. If McCracken expects both earnings and dividends to grow at an annual rate of 10%, What required rate of return would result in a price per share of $28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts