Question: Need step by step solution. 7. Suppose a State of New York bond will pay $1,000 ten year s from now. If the going interest

Need step by step solution.

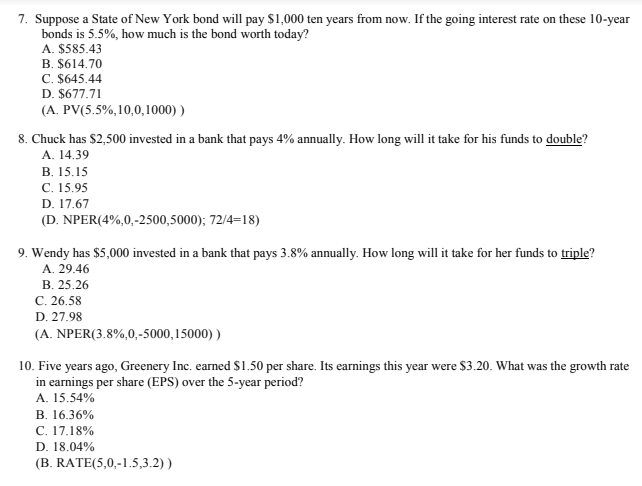

7. Suppose a State of New York bond will pay $1,000 ten year s from now. If the going interest rate on these 10-year bonds is 5.5%, how much is the bond worth today? A. $585.43 B. $614.70 C. $645.44 D. $677.71 (A PV(5.5%, 10.0, 1000) ) 8. Chuck has $2,500 invested in a bank that pays 4% annually. How long will it take for his funds to double? A. 14.39 B. 15.15 C. 15.95 D. 17.67 (D. NPER(4%,01-2500,5000); 72/4-18) 9, Wendy has $5,000 invested in a bank that pays 3.8% annually. How long will it take for her funds to triple? A. 29.46 B. 25.26 C. 26.58 D. 27.98 (A. NPER(3.8%,0-5000, 15000) ) 10. Five years ago, Greenery Inc. earned S1.50 per share. Its earnings this year were S3.20. What was the growth rate in earnings per share (EPS) over the 5-year period? A. 15.54% B. 16.36% C. 17.18% D. 18.04% (B. RATE(5,0,-1.5,3.2))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts