Question: Need step by step solution for both questions. Thank you. Attempts: 14. Equivalent annual annuities Aa Aa Another method to deal with the unequal life

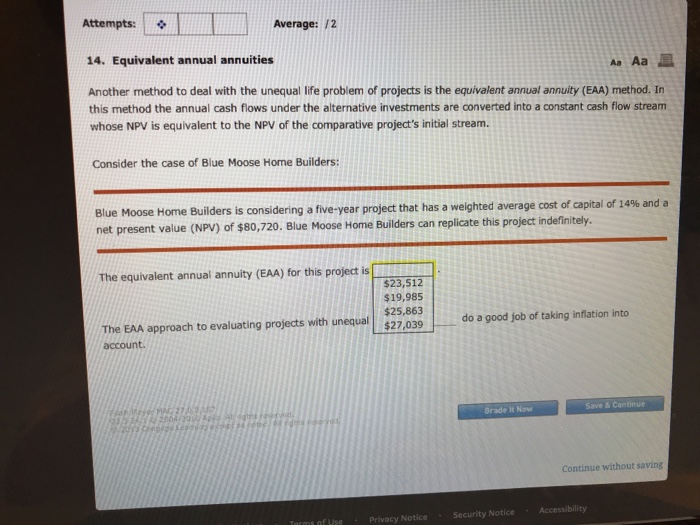

Attempts: 14. Equivalent annual annuities Aa Aa Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative project's initial stream Consider the case of Blue Moose Home Builders Blue Moose Home Builders is considering a five-year project that has a weighted average cost of capital of 14% and a net present value (NPV) of $80,720. Blue Moose Home Builders can replicate this project indefinitely The equivalent annual annuity (EAA) for this project is $23,512 $19,985 $25,863 $27,039 The EAA approach to evaluating projects with unequal$27 039 do a good job of taking inflation into account. Grade It Now Save & Centinue Continue without saving Tarms nf vee Privacy Notice Security NoticeAccessibility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts