Question: need the answer before 9 please or i will fail my exam suck my big co*k i fuc*ing failed The 2004 room vant and comparative

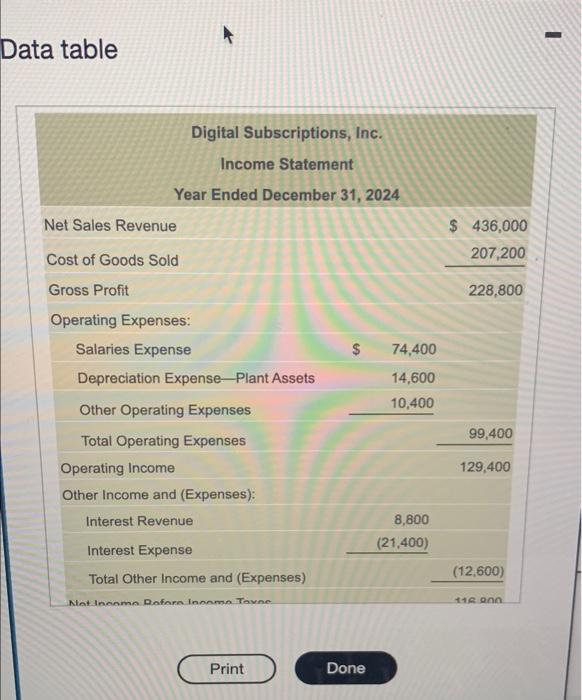

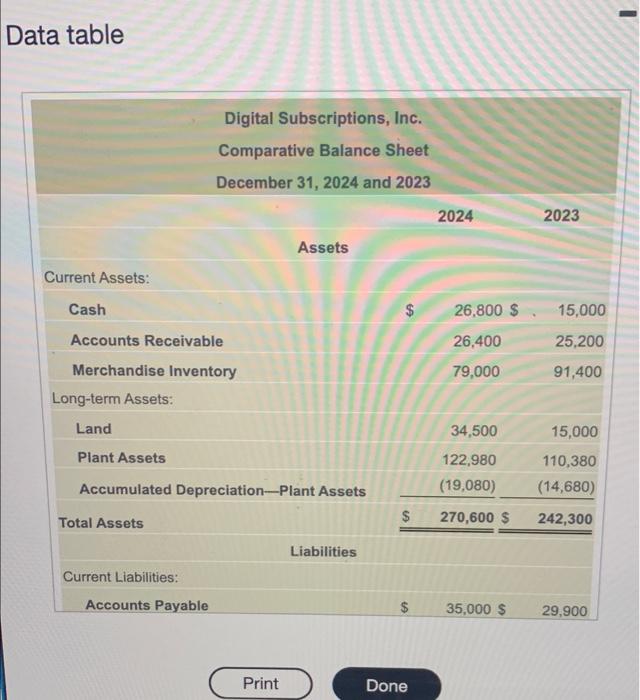

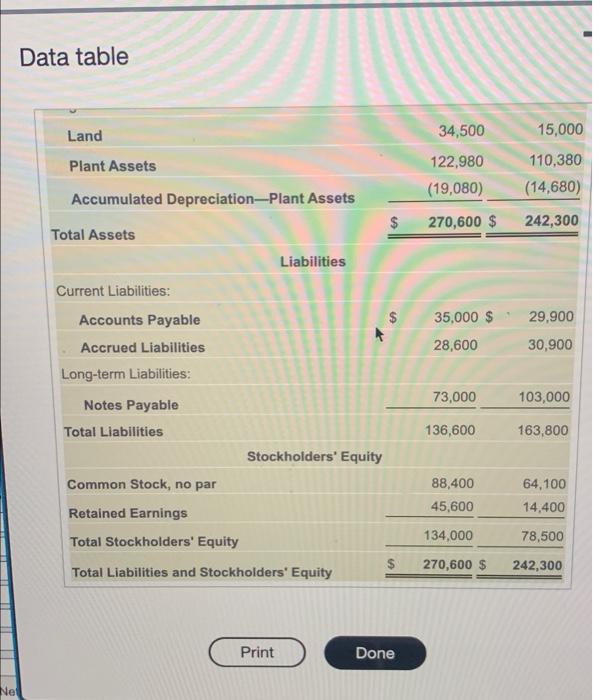

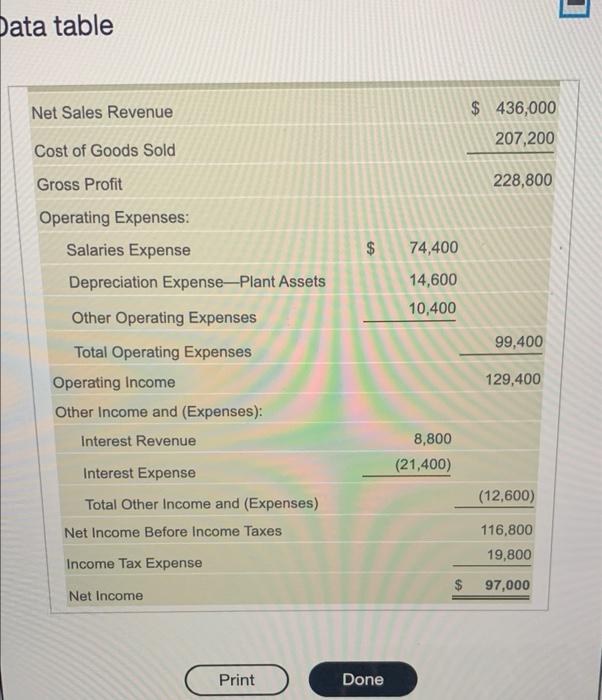

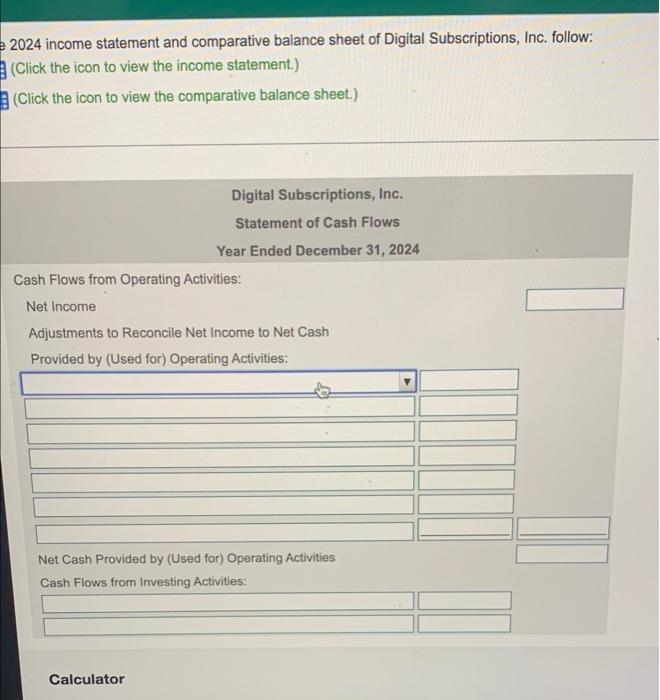

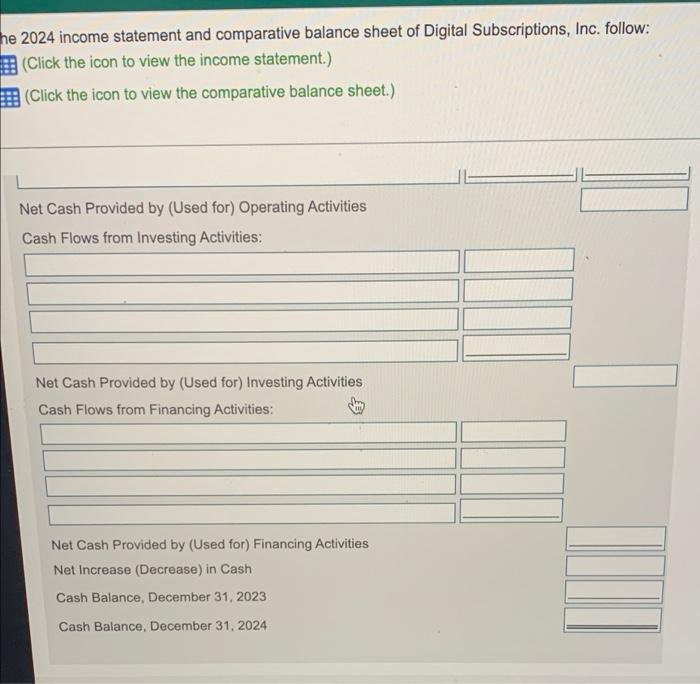

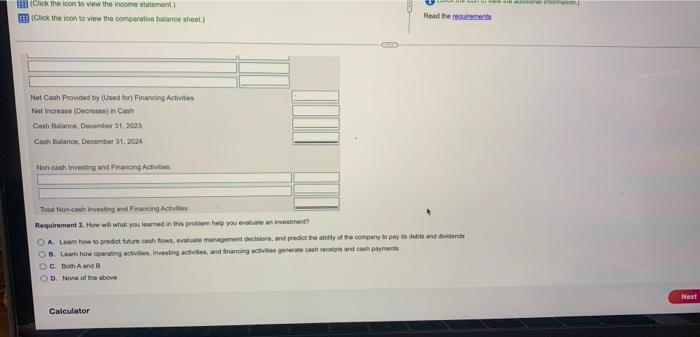

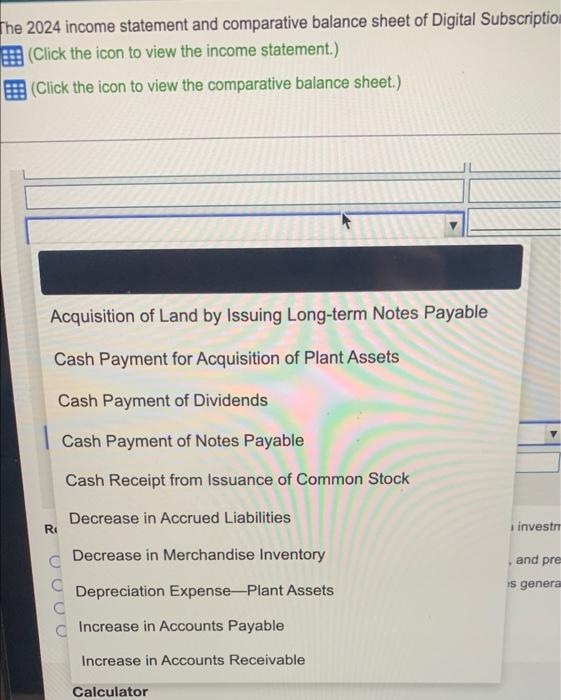

The 2004 room vant and comparative in rotor, resto Chicone nome Click the loan to recognita Goose) Complete the went on schon wie beim wm the anh tow trom neering Big Scre Busca Requirements 2004 og Carom Oper Natcome como Prototy do Pri Done Cash Pro Next Calculator - X Requirements 1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment? Print Done Data table Digital Subscriptions, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue $ 436,000 207,200 Cost of Goods Sold Gross Profit 228,800 $ 74,400 14,600 10,400 Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue 99,400 129,400 8,800 (21,400) Interest Expense Total Other Income and (Expenses) (12,600) Notinomo Rafara inname Tavne 110 000 Print Done Data table Digital Subscriptions, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 Assets Current Assets: Cash $ 26,800 $ 15,000 Accounts Receivable 26,400 25,200 79,000 91,400 Merchandise Inventory Long-term Assets: Land 34,500 15,000 Plant Assets 122,980 (19.080) 110,380 (14,680) Accumulated Depreciation--Plant Assets Total Assets $ 270,600 $ 242,300 Liabilities Current Liabilities: Accounts Payable $ 35,000 $ 29,900 Print Done Data table Land 34,500 15,000 Plant Assets 122,980 (19,080) 110,380 (14,680) Accumulated Depreciation-Plant Assets $ 270,600 $ 242,300 Total Assets Liabilities Current Liabilities: $ 35,000 $ 29.900 Accounts Payable Accrued Liabilities Long-term Liabilities: 28,600 30,900 73,000 103,000 Notes Payable Total Liabilities 136,600 163,800 Stockholders' Equity Common Stock, no par 88,400 45,600 64,100 14,400 Retained Earnings Total Stockholders' Equity 134,000 78,500 270,600 $ 242,300 Total Liabilities and Stockholders' Equity Print Done Net Data table Net Sales Revenue $ 436,000 207,200 Cost of Goods Sold Gross Profit 228,800 Operating Expenses: Salaries Expense Depreciation ExpensePlant Assets $ 74,400 14,600 10,400 Other Operating Expenses 99,400 129,400 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense 8,800 (21,400) (12,600) 116,800 19,800 $ 97,000 Net Income Print Done 2024 income statement and comparative balance sheet of Digital Subscriptions, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Digital Subscriptions, Inc. Statement of Cash Flows Year Ended December 31, 2024 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Calculator he 2024 income statement and comparative balance sheet of Digital Subscriptions, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2023 Cash Balance, December 31, 2024 Click the loon to view the income statement Click the icon to view the comparative shoot) Read the rements GTD Net Cash Provided by (Used for Financing Activities Nations (Decrease in a Cash Bulane Dember 21, 2003 Cash Balance, December 11.2024 Non cash investing and Financing Activities Total Non-cashing and Firen Achim Requirement 2. How will what you learned in this problem help you eveniment? OA Learn how to predict the cash flows, el management decision, and predict the ability of the company to pay debits and dividende OB Learn how our wing the investing activities and branding the generate cash and payment G. Both and D. Nor of the above Next Calculator The 2024 income statement and comparative balance sheet of Digital Subscription (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Acquisition of Land by Issuing Long-term Notes Payable Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Decrease in Accrued Liabilities RI investn and pre Decrease in Merchandise Inventory Depreciation Expense-Plant Assets is genera Increase in Accounts Payable Increase in Accounts Receivable Calculator The 2004 room vant and comparative in rotor, resto Chicone nome Click the loan to recognita Goose) Complete the went on schon wie beim wm the anh tow trom neering Big Scre Busca Requirements 2004 og Carom Oper Natcome como Prototy do Pri Done Cash Pro Next Calculator - X Requirements 1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment? Print Done Data table Digital Subscriptions, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue $ 436,000 207,200 Cost of Goods Sold Gross Profit 228,800 $ 74,400 14,600 10,400 Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue 99,400 129,400 8,800 (21,400) Interest Expense Total Other Income and (Expenses) (12,600) Notinomo Rafara inname Tavne 110 000 Print Done Data table Digital Subscriptions, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 Assets Current Assets: Cash $ 26,800 $ 15,000 Accounts Receivable 26,400 25,200 79,000 91,400 Merchandise Inventory Long-term Assets: Land 34,500 15,000 Plant Assets 122,980 (19.080) 110,380 (14,680) Accumulated Depreciation--Plant Assets Total Assets $ 270,600 $ 242,300 Liabilities Current Liabilities: Accounts Payable $ 35,000 $ 29,900 Print Done Data table Land 34,500 15,000 Plant Assets 122,980 (19,080) 110,380 (14,680) Accumulated Depreciation-Plant Assets $ 270,600 $ 242,300 Total Assets Liabilities Current Liabilities: $ 35,000 $ 29.900 Accounts Payable Accrued Liabilities Long-term Liabilities: 28,600 30,900 73,000 103,000 Notes Payable Total Liabilities 136,600 163,800 Stockholders' Equity Common Stock, no par 88,400 45,600 64,100 14,400 Retained Earnings Total Stockholders' Equity 134,000 78,500 270,600 $ 242,300 Total Liabilities and Stockholders' Equity Print Done Net Data table Net Sales Revenue $ 436,000 207,200 Cost of Goods Sold Gross Profit 228,800 Operating Expenses: Salaries Expense Depreciation ExpensePlant Assets $ 74,400 14,600 10,400 Other Operating Expenses 99,400 129,400 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense 8,800 (21,400) (12,600) 116,800 19,800 $ 97,000 Net Income Print Done 2024 income statement and comparative balance sheet of Digital Subscriptions, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Digital Subscriptions, Inc. Statement of Cash Flows Year Ended December 31, 2024 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Calculator he 2024 income statement and comparative balance sheet of Digital Subscriptions, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2023 Cash Balance, December 31, 2024 Click the loon to view the income statement Click the icon to view the comparative shoot) Read the rements GTD Net Cash Provided by (Used for Financing Activities Nations (Decrease in a Cash Bulane Dember 21, 2003 Cash Balance, December 11.2024 Non cash investing and Financing Activities Total Non-cashing and Firen Achim Requirement 2. How will what you learned in this problem help you eveniment? OA Learn how to predict the cash flows, el management decision, and predict the ability of the company to pay debits and dividende OB Learn how our wing the investing activities and branding the generate cash and payment G. Both and D. Nor of the above Next Calculator The 2024 income statement and comparative balance sheet of Digital Subscription (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Acquisition of Land by Issuing Long-term Notes Payable Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Decrease in Accrued Liabilities RI investn and pre Decrease in Merchandise Inventory Depreciation Expense-Plant Assets is genera Increase in Accounts Payable Increase in Accounts Receivable Calculator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts