Question: Need the answer for A C and D. And please explain how you got the answer so I can understand going forward! Thank you! Problem

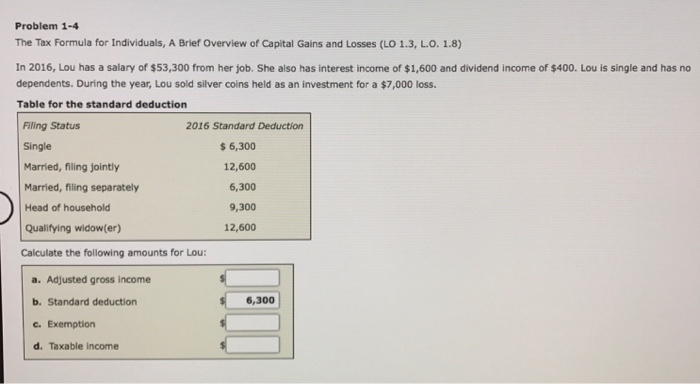

Problem 1-4 The Tax Formula for Individuals, A Brief overview of Capital Gains and Losses (LO 1.3, LO. 1.8) In 2016, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Table for the standard deduction Filing Status 2016 Standard Deduction Single 6,300 Married, filing jointly 12,600 Married, filing separately 6,300 Head of household 9,300 12,600 Qualifying widow(er) Calculate the following amounts for Lou: a. Adjusted gross income 6,300 lb. Standard deduction c. Exemption d. Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts