Question: Need the answer for this question and an explanation at how you came up with the calculation. Phillip and Naydeen Rivers are married with two

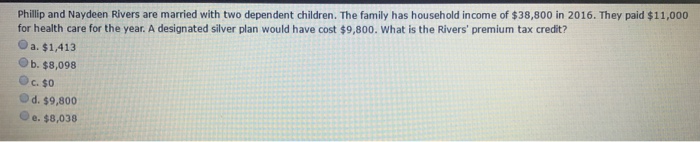

Phillip and Naydeen Rivers are married with two dependent children. The family has household income of $38,800 in 2016. They paid $11,000 for health care for the year. A designated silver plan would have cost $9,800. What is the Rivers' premium tax credit? a. $1,413 b. $8,098 C. $0 0 d. $9,800 O e. $8,038

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts