Question: Need the answer please ASAP (canada) Marvin Moving has begun to prepare his 2020 tax return and has already computed the following amounts correctly: Income

Need the answer please ASAP (canada)

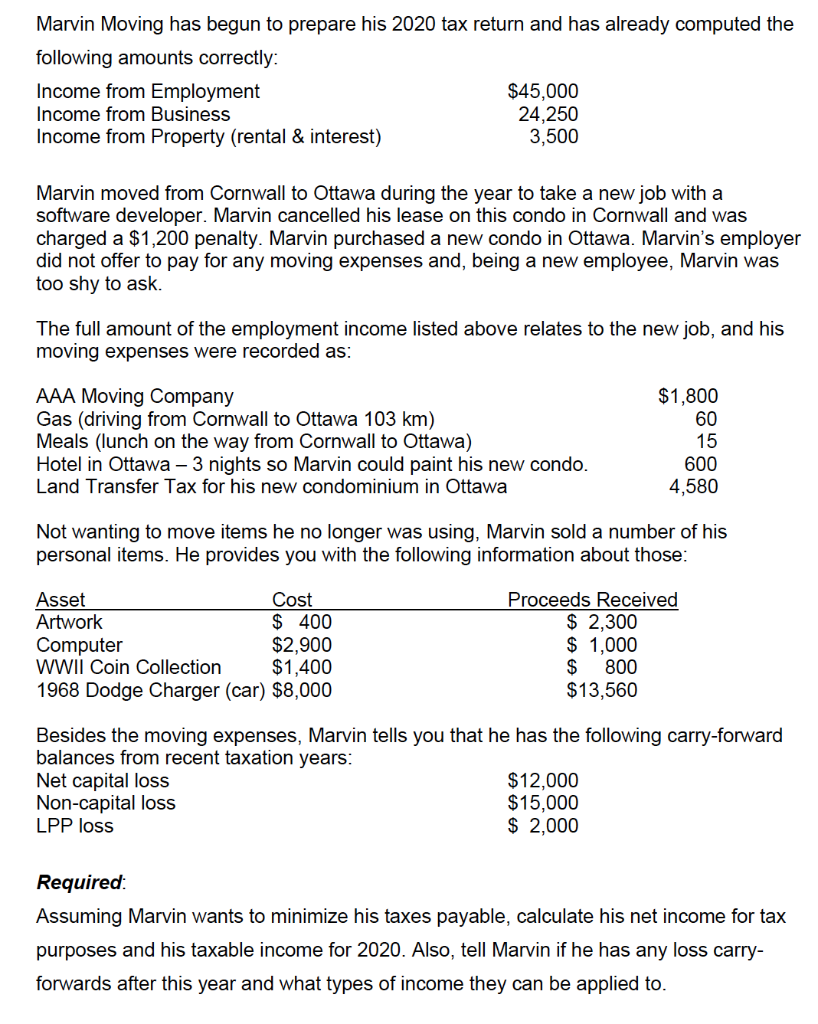

Marvin Moving has begun to prepare his 2020 tax return and has already computed the following amounts correctly: Income from Employment $45,000 Income from Business 24,250 Income from Property (rental & interest) 3,500 Marvin moved from Cornwall to Ottawa during the year to take a new job with a software developer. Marvin cancelled his lease on this condo in Cornwall and was charged a $1,200 penalty. Marvin purchased a new condo in Ottawa. Marvin's employer did not offer to pay for any moving expenses and, being a new employee, Marvin was too shy to ask. The full amount of the employment income listed above relates to the new job, and his moving expenses were recorded as: AAA Moving Company Gas (driving from Cornwall to Ottawa 103 km) Meals (lunch on the way from Cornwall to Ottawa) Hotel in Ottawa - 3 nights so Marvin could paint his new condo. Land Transfer Tax for his new condominium in Ottawa $1,800 60 15 600 4,580 Not wanting to move items he no longer was using, Marvin sold a number of his personal items. He provides you with the following information about those: Asset Cost Artwork $ 400 Computer $2,900 WWII Coin Collection $1,400 1968 Dodge Charger (car) $8,000 Proceeds Received $ 2,300 $ 1,000 $ 800 $13,560 Besides the moving expenses, Marvin tells you that he has the following carry-forward balances from recent taxation years: Net capital loss $12,000 Non-capital loss $15,000 LPP loss $ 2,000 Required: Assuming Marvin wants to minimize his taxes payable, calculate his net income for tax purposes and his taxable income for 2020. Also, tell Marvin if he has any loss carry- forwards after this year and what types of income they can be applied to. Marvin Moving has begun to prepare his 2020 tax return and has already computed the following amounts correctly: Income from Employment $45,000 Income from Business 24,250 Income from Property (rental & interest) 3,500 Marvin moved from Cornwall to Ottawa during the year to take a new job with a software developer. Marvin cancelled his lease on this condo in Cornwall and was charged a $1,200 penalty. Marvin purchased a new condo in Ottawa. Marvin's employer did not offer to pay for any moving expenses and, being a new employee, Marvin was too shy to ask. The full amount of the employment income listed above relates to the new job, and his moving expenses were recorded as: AAA Moving Company Gas (driving from Cornwall to Ottawa 103 km) Meals (lunch on the way from Cornwall to Ottawa) Hotel in Ottawa - 3 nights so Marvin could paint his new condo. Land Transfer Tax for his new condominium in Ottawa $1,800 60 15 600 4,580 Not wanting to move items he no longer was using, Marvin sold a number of his personal items. He provides you with the following information about those: Asset Cost Artwork $ 400 Computer $2,900 WWII Coin Collection $1,400 1968 Dodge Charger (car) $8,000 Proceeds Received $ 2,300 $ 1,000 $ 800 $13,560 Besides the moving expenses, Marvin tells you that he has the following carry-forward balances from recent taxation years: Net capital loss $12,000 Non-capital loss $15,000 LPP loss $ 2,000 Required: Assuming Marvin wants to minimize his taxes payable, calculate his net income for tax purposes and his taxable income for 2020. Also, tell Marvin if he has any loss carry- forwards after this year and what types of income they can be applied to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts