Question: need the answer to a,b and c in excel 5. (20 Points) Consider the following European call option on the Brazilian real: The current dollar

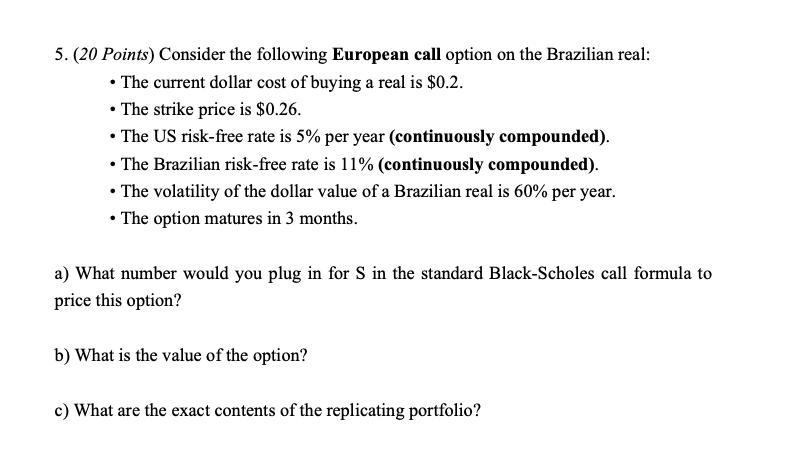

5. (20 Points) Consider the following European call option on the Brazilian real: The current dollar cost of buying a real is $0.2. The strike price is $0.26. The US risk-free rate is 5% per year (continuously compounded). The Brazilian risk-free rate is 11% (continuously compounded). The volatility of the dollar value of a Brazilian real is 60% per year. The option matures in 3 months. a) What number would you plug in for S in the standard Black-Scholes call formula to price this option? b) What is the value of the option? c) What are the exact contents of the replicating portfolio?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts