Question: need the answer to C approximate yield to maturity Harold Reese must choose between two bonds Bond X pays $76 annual Interest and has a

need the answer to C approximate yield to maturity

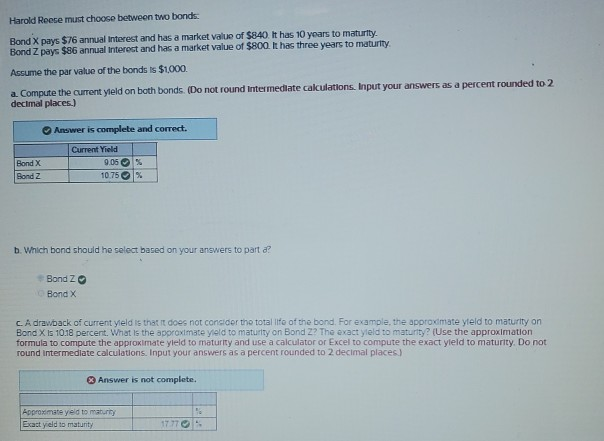

Harold Reese must choose between two bonds Bond X pays $76 annual Interest and has a market value of $840. It has 10 years to maturity. Bond Z pays $86 annual interest and has a market value of $800. It has three years to maturity Assume the par value of the bonds is $1000 a Compute the current yield on both bonds. (Do not round Intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Answer is complete and correct. Current Yield 9.06% 10.75% Bond X Bond 2 b. Which bond should he select based on your answers to part ? Bond zo Bond X CA drawback of current yleld is that it does not consider the total life of the bond. For example, the approxmate yteld to maturity on Bond X is 10.18 percent. What is the approximate yield to maturity on Bond Z? The exact yield to maturity? (Use the approximation formula to compute the approximate yield to maturity and use a calculator or Excel to compute the exact yield to maturity. Do not round Intermediate calculations. Input your answers as a percent rounded to 2 decimal places) Answer is not complete. Approximate yeld to matury Exact yield to maturity 1777

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts