Question: Need the answer to number 1 ONLY All Take-home problems worth 10 points. In-class test will be 30 multiple choice worth 2 points each.. ABC

Need the answer to number 1 ONLY

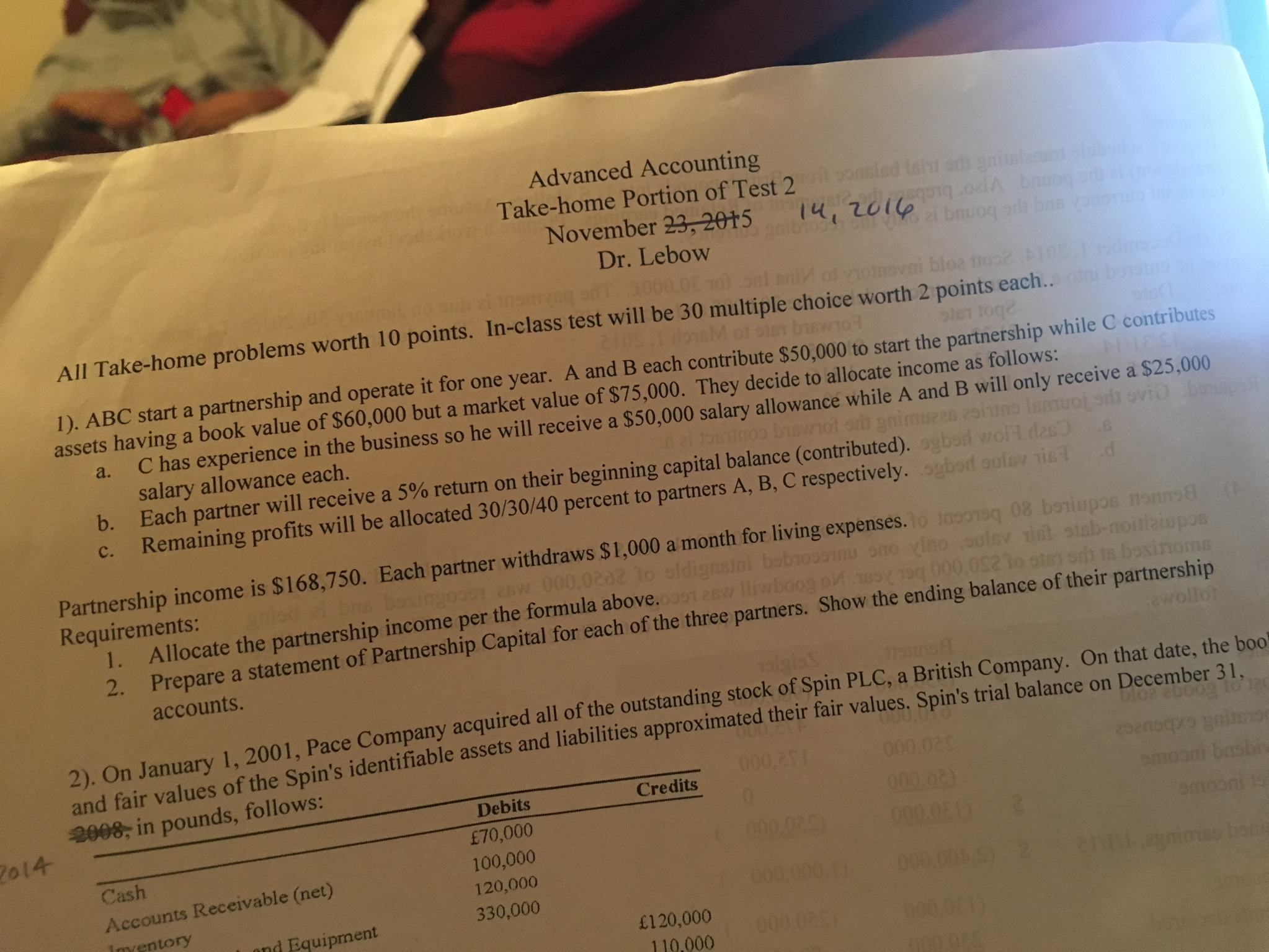

All Take-home problems worth 10 points. In-class test will be 30 multiple choice worth 2 points each.. ABC start a partnership and operate it for one year. A and B each contribute $50,000 to start the partnership while C assets having a book value of $60,000 but a market value of $75,000. They decide to allocate income as follows: C has experience in the business so he will receive a $50,000 salary allowance while A and B will only receive a $25,000 salary allowance each. Each partner will receive a 5% return on their beginning capital balance (contributed). Remaining profits will be allocated 30/30/40 percent to partners A, B, C respectively. Partnership income is $168, 750. Each partner withdraws $1,000 a month for living expenses. Requirements: Allocate the partnership income per the formula above. Prepare a statement of Partnership Capital for each of the three partners. Show the ending balance of their partnership accounts. On January 1, 2001, Pace company acquired all of the outstanding stock of Spin PLC, a British Company. On that date, the boo' On January 1, 2001, Pace Company acquired all of the outstanding stock of Spin PLC, a British Company. On that date, the and fair values of the Spin's Identifiable assets and liabilities approximated their fair values. Spin's trial balance on December 31, 2008 in pound, follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts