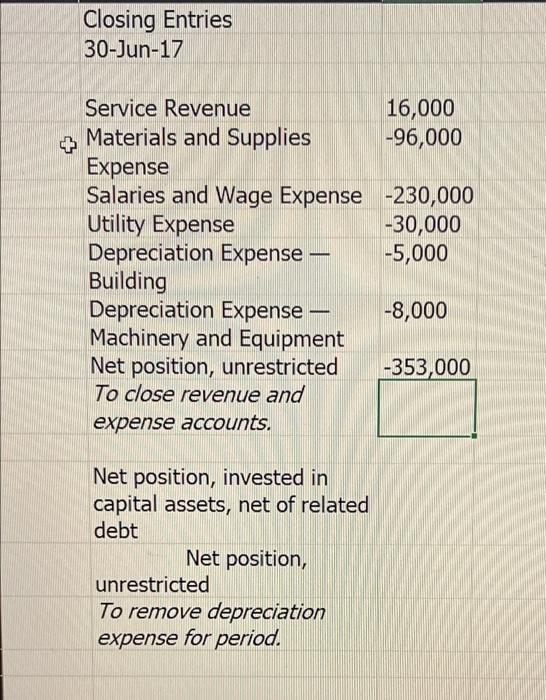

Question: need the format like this for closing entries. im not sure if my numbers are correct please follow format of closing entries Closing Entries 30-Jun-17

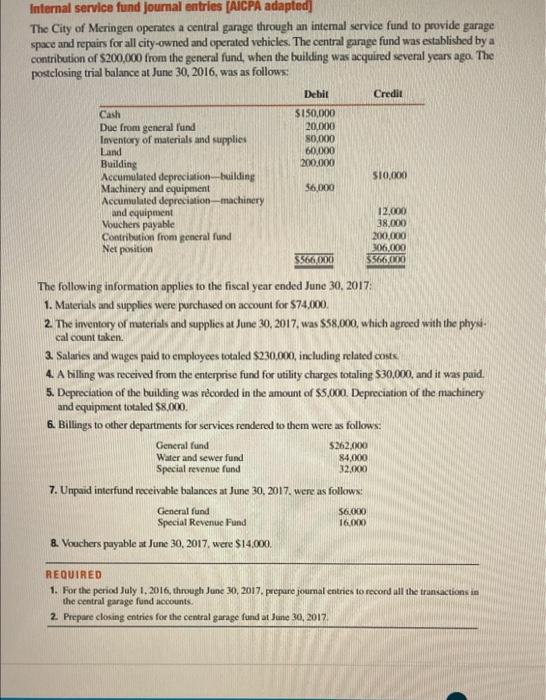

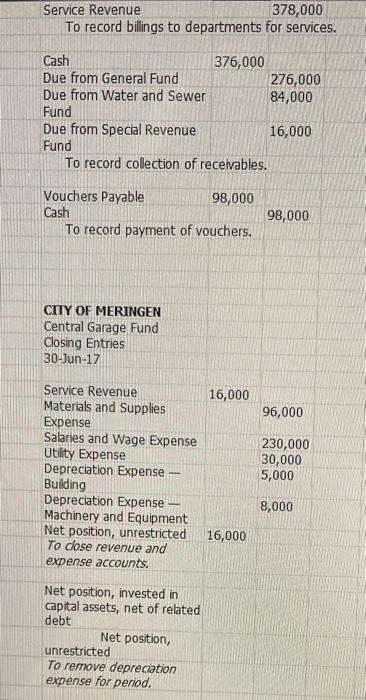

Closing Entries 30-Jun-17 - Service Revenue 16,000 Materials and Supplies -96,000 Expense Salaries and Wage Expense -230,000 Utility Expense -30,000 Depreciation Expense -5,000 Building Depreciation Expense -8,000 Machinery and Equipment Net position, unrestricted -353,000 To close revenue and expense accounts. Net position, invested in capital assets, net of related debt Net position, unrestricted To remove depreciation expense for period. Internal service fund journal entries (AICPA adapted] The City of Meringen operates a central garage through an internal service fund to provide garage space and repairs for all city-owned and operated vehicles. The central garage fund was established by a contribution of $200,000 from the general fund, when the building was acquired several years ago. The postclosing trial balance at June 30, 2016, was as follows: Debit Credit Cash $150,000 Due from general fund 20.000 Inventory of materials and supplies 50,000 Land 60.000 Building 200,000 Accumulated depreciation--building 510,000 Machinery and equipment 56,000 Accumulated depreciation --machinery and equipment 12.000 Vouchers payable 38,000 Contribution from general fund 200.000 Net position 106,000 $566,00 $566,000 The following information applies to the fiscal year ended June 30, 2017 1. Materials and supplies were purchased on account for $74,000. 2. The inventory of materials and supplies at June 30, 2017, was $58.000, which agreed with the phys. cal count taken. 3. Salaries and wages paid to employees totaled $230,000, including related costs. 4. A billing was received from the enterprise fund for utility charges totaling $30,000, and it was paid. 5. Depreciation of the building was recorded in the amount of $5,000 Depreciation of the machinery and equipment totaled $8.000. 6. Billings to other departments for services rendered to them were as follows: General fund Water and sewer fund Special revenue fund $262.000 84,000 32.000 7. Unpaid interfund receivable balances at June 30, 2017. were as follows: General fund $6.000 Special Revenue Fund 16.00 & Vouchers payable at June 30, 2017, were $14.000, REQUIRED 1. For the period July 1, 2016, through June 30, 2017. prepare journal entries to record all the transactions in the central garage fund accounts. 2. Prepare closing entries for the central garage fund at June 30, 2017 Service Revenue 378,000 To record billings to departments for services. Cash 376,000 Due from General Fund 276,000 Due from Water and Sewer 84,000 Fund Due from Special Revenue 16,000 Fund To record colection of receivables. Vouchers Payable 98,000 Cash To record payment of vouchers. 98,000 CITY OF MERINGEN Central Garage Fund Closing Entries 30-Jun-17 16,000 96,000 Service Revenue Materials and Supplies Expense Salaries and Wage Expense Utility Expense Depreciation Expense - Building Depreciation Expense Machinery and Equipment Net position, unrestricted To close revenue and expense accounts. 230,000 30,000 5,000 8,000 16,000 Net position, invested in capital assets, net of related debt Net position, unrestricted To remove depreciation expense for period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts