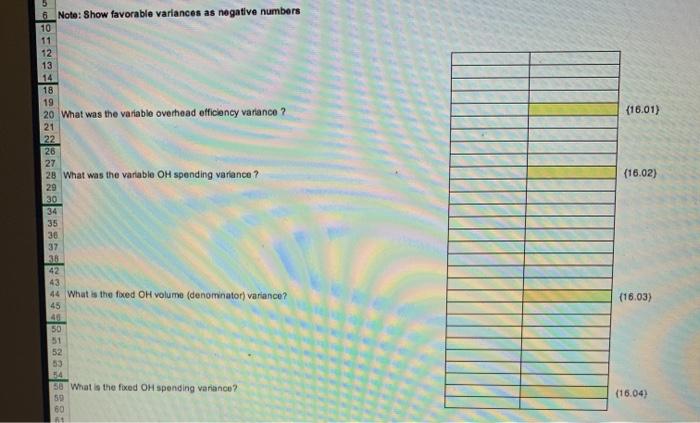

Question: need the formulas for each cell Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 750,000.00 375.000.00 $ Sales 25,000 lamps @

need the formulas for each cell

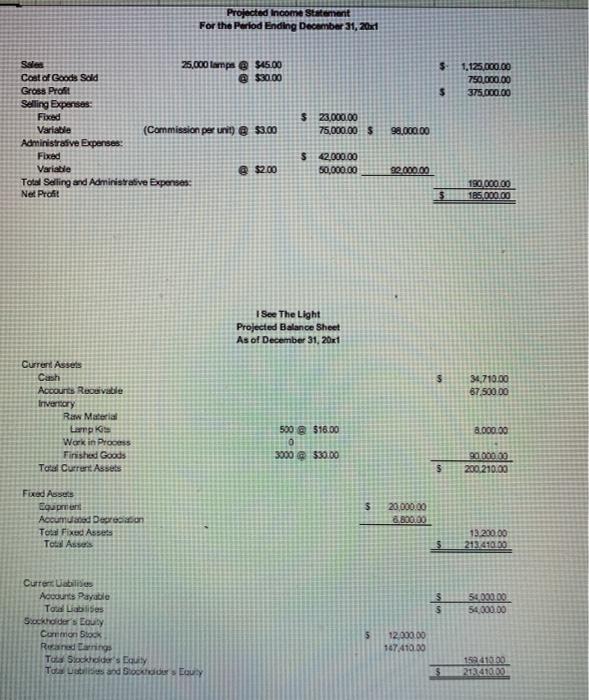

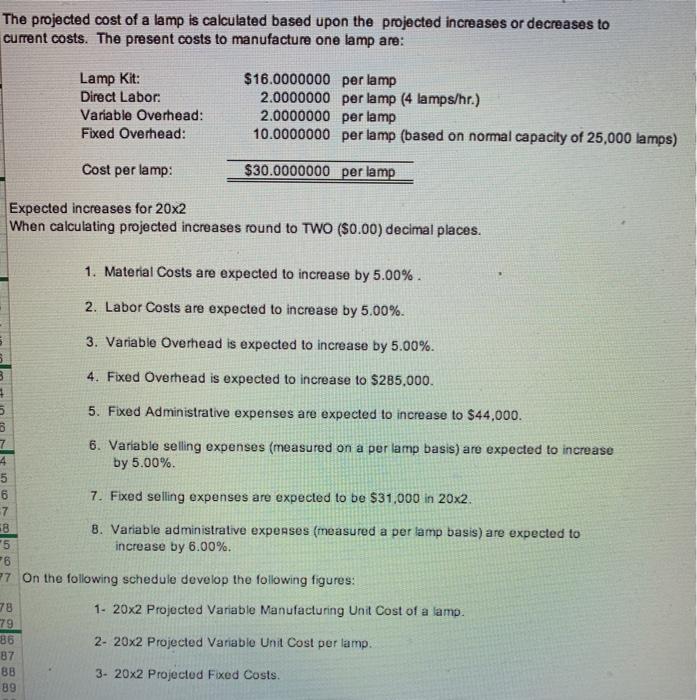

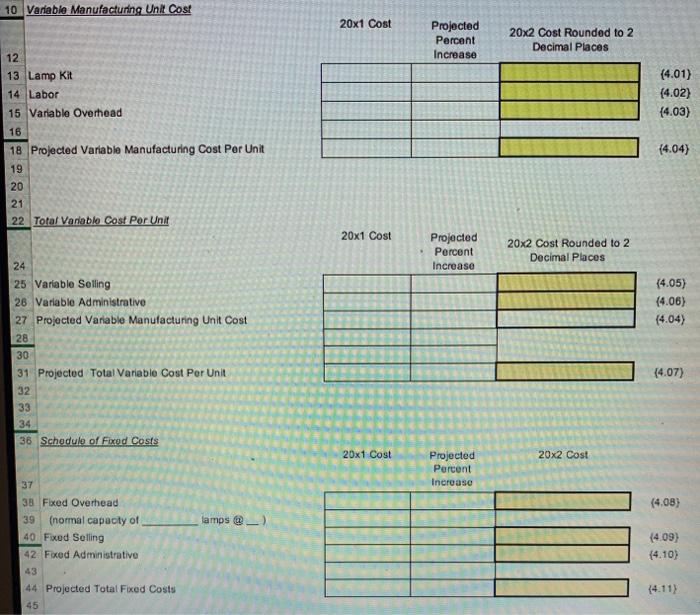

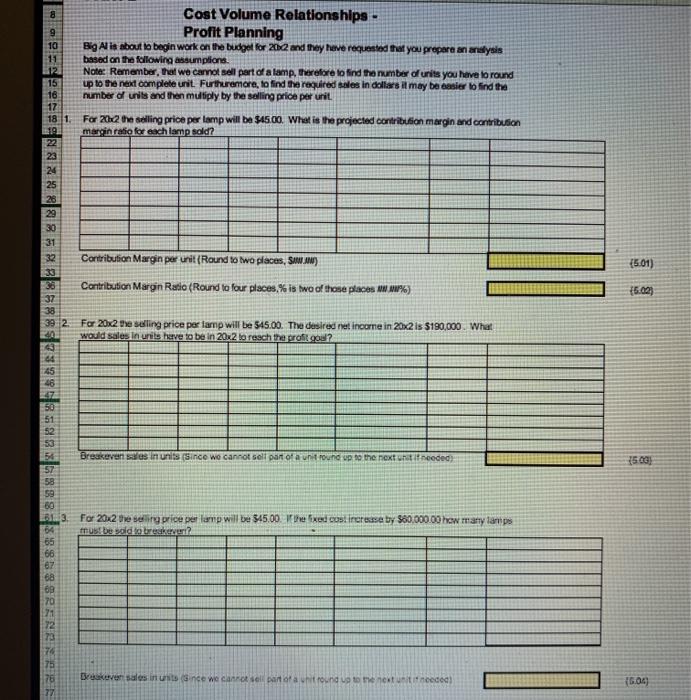

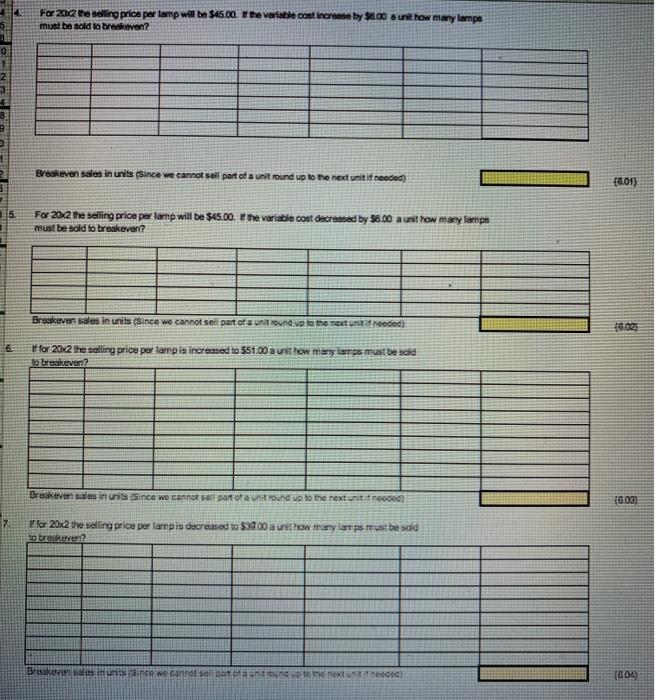

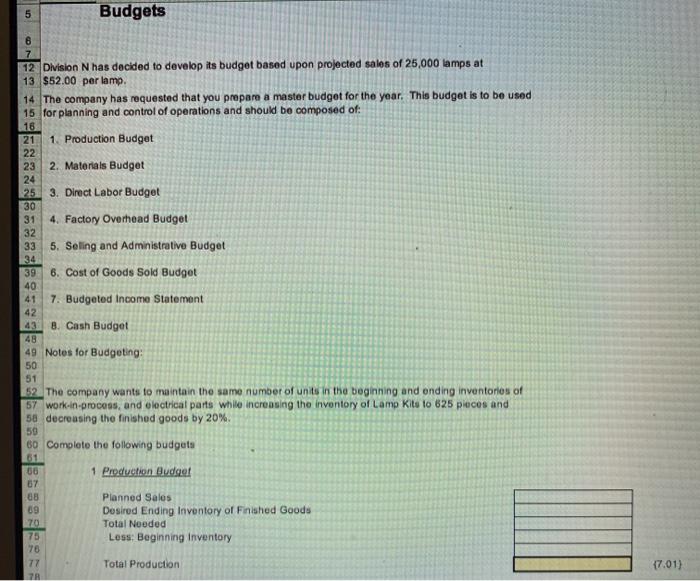

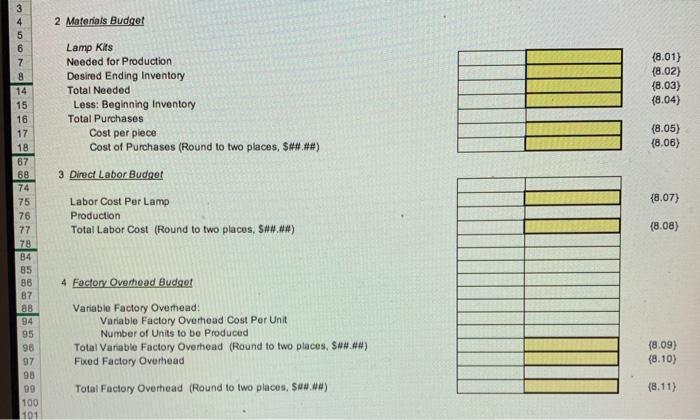

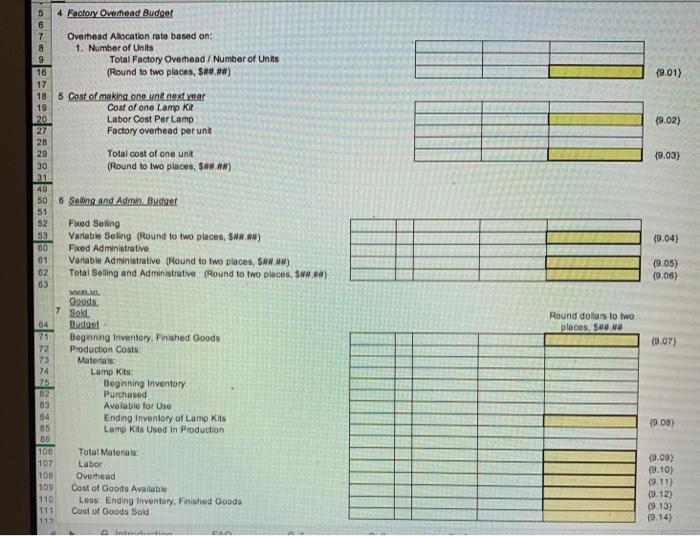

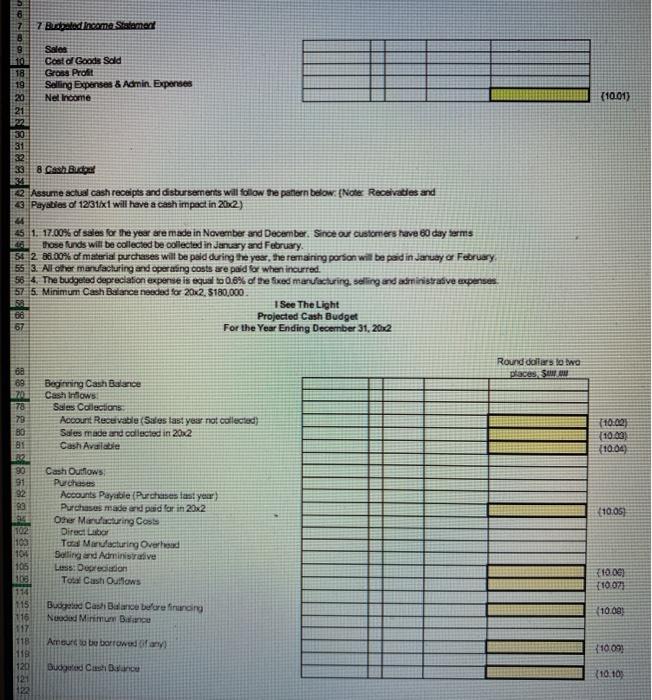

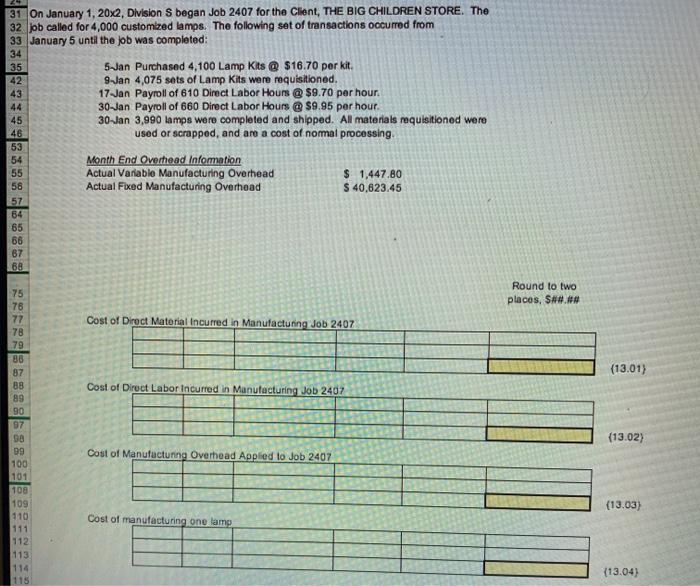

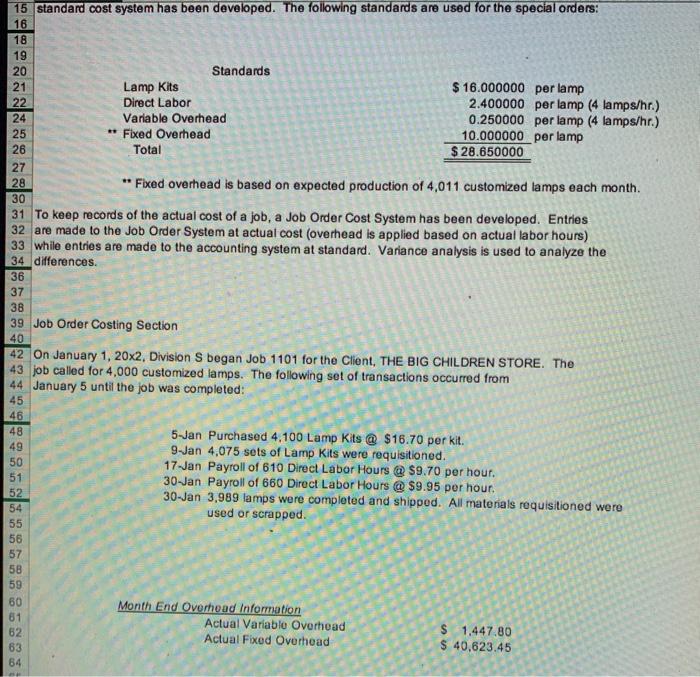

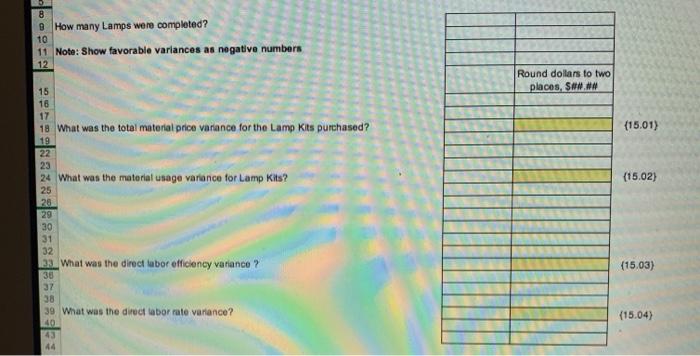

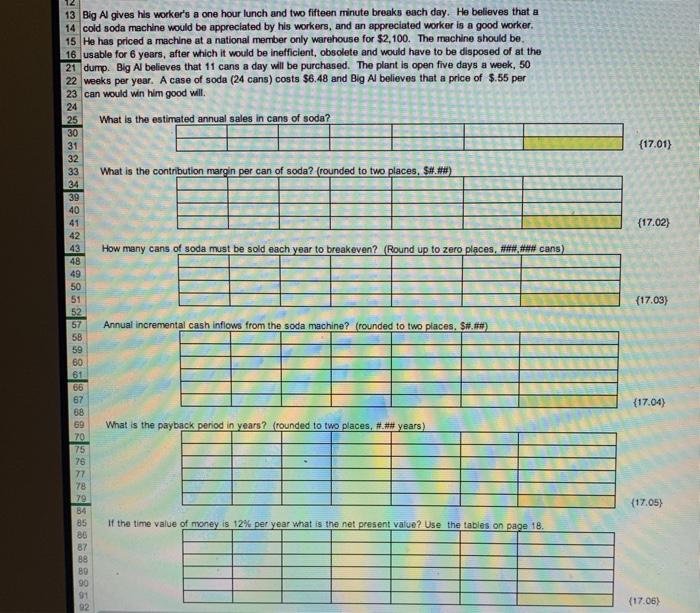

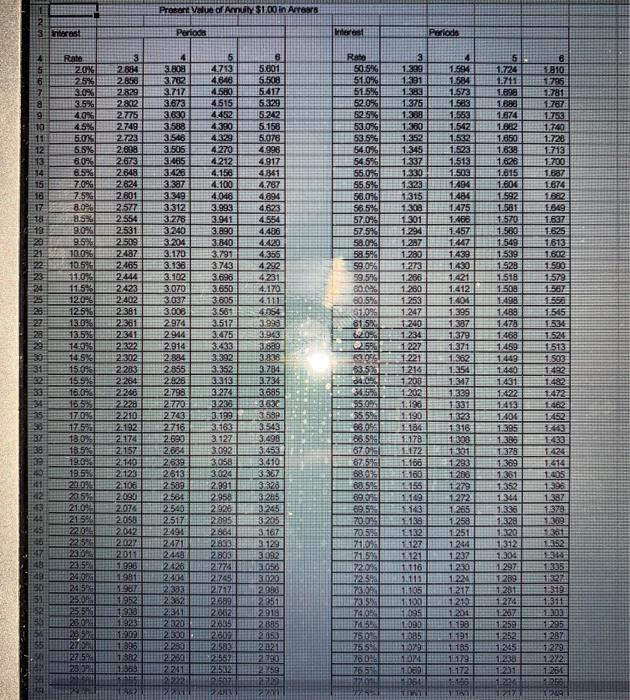

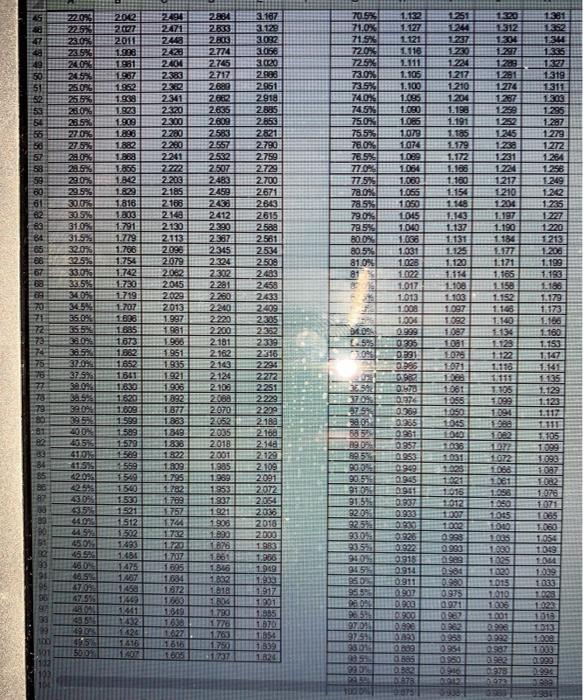

need the formulas for each cell Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 750,000.00 375.000.00 $ Sales 25,000 lamps @ $45.00 Cast of Goods Sold $30.00 Gross Pront Selling Expenses Fixed Variable (Commission per unit) $3.00 Administrative Expenses Fixed Variable $2.00 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 75,000.00 $ 92.000.00 $ 42.000.00 50,000.00 92.000.00 $ 190,000.00 185,000.00 1 See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets 34.710.00 67,500 DO Accounts Receivable Invertory Raw Material LOK Work in Process Tinished Goods To Current Assets 500 $16.00 8.000.00 3000 $30.00 90,000.00 200,210.00 $ 23 000.00 Fixed AS Soup Accumulated Deprown Total Fixed Assets Tots Asses 13.200.00 213.410.00 5 54.000.00 54,000.00 3 Current abilities Accounts Payable To Liables Sockholders Louity Curemon Stock Red Laming To Stockholder's Equity Toutes and Sockhodes Eur 5 12,000.00 167410.00 212 41000 The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Lamp Kit: Direct Labor Variable Overhead: Fixed Overhead: $16.0000000 per lamp 2.0000000 per lamp (4 lamps/hr.) 2.0000000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp: $30.0000000 per lamp Expected increases for 20x2 When calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 5.00%. 2. Labor Costs are expected to increase by 5.00% 3. Variable Overhead is expected to increase by 5.00%. 3 4. Fixed Overhead is expected to increase to $285,000. 5 5. Fixed Administrative expenses are expected to increase to $44,000. 7 6. Variable selling expenses (measured on a per lamp basis) are expected to increase 4 by 5.00% 5 6 7. Fixed selling expenses are expected to be $31,000 in 20x2. 7 8 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.00% 6 7 On the following schedule develop the following figures: 78 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 79 86 2- 20x2 Projected Variable Unit Cost per lamp. 87 BB 3- 20x2 Projected Fixed Costs. 89 10 Variable Manufacturing Unit Cost 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places (4.01) (4.02) (4.03) 12 13 Lamp Kit 14 Labor 15 Variable Overhead 16 18 Projected Variable Manufacturing Cost Per Unit 19 20 21 22 Total Vanablo Cost Per Unit (4.04) 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places (4.05) (4.06) (4.04) 24 25 Variable Selling 26 Variable Administrative 27 Projected Variable Manufacturing Unit Cost 28 30 31 Projected Total Variable Cost Per Unit 32 33 34 36 Schedule of Fixed Costs (4.07) 20x1 Cost 20x2 Cost Projected Percent Increase 37 (4.08) lamps @_) 38 Fixed Overhead 39 (normal capacly of 40 Fixed Selling 42 Fixed Administrative (4.09) {4.10) 14.11) 44 Projected Total Fixed Costs 45 8 on 10 11 312 15 16 17 18.11 Cost Volume Relationships - Profit Planning Big Al is about to begin work on the budget for 2012 and they have requested that you prepara analysis based on the following assumptions Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required we in dollars it may be easier to find the number of units and then multiply by the selling price per unit. For 2012 selling price per lamp will be $45.00. What is the projected contribution marginand contribution margin ratio for exchlamp sold? 22 22 24 25 28 29 30 31 Contribution Margin per unit (Round to two places, SAW.JAN) {5.01) 33 Contribution Margin Ratio (Round to four places.% is two of those places w21%) $5.02) 38 39 2. For 20x2 the selling price per lamp will be 545.00. The desired reincorne in 20X2 is $190,000. What would sales in units trave to be in 20x2 to reach the profit goal? 44 45 46 15.00) 50 51 52 53 Breakeven we in units Since we cannot sell part of a unit round up to the next untit needed 57 58 59 80 BL 3. For 2012 Deseling price per lamp will be 345.00. The red cost increase by $60,000.00 how many lamps 64 must be sold to breaker 65 66 67 68 89 75 Bakoven sales instince we cannot sell part of a unit round up to the next needed (6.06 For 2002 the selling price per lamp will be $45.00. the variable continere by $8.00 eur how many lampa must be sold to breakeven? 5 0 Breakeven sales in units (Since we cannot sell part of a unit round up to the next unit it needed) 8.01) For 20.2 The selling price per lamp will be $45.00. the variable cost decreased by 3600 a unit row many lamps must be sold to breakeven? Breakuen sales in units (Since we cannot sell part of a unit round up to the next troeded 26.02 W for 20x2 the selling price per lamp is increased to $51.00 a wow many lamps must be sold obreskeven? Breckeve sales in uns Since we cannot be part of it to the next (8.03) for 20x20 selling price per la pis decreased to 539.00 a un how many lapsust be sold Breakoulusihtisince we cannot taland P.Sometro 10:04 5 Budgets 7 12 Division N has decided to develop its budget based upon projected sales of 25,000 lamps at 13 $52.00 per lamp 14 The company has requested that you prepare a master budget for the year. This budget is to be used 15 for planning and control of operations and should be composed of: 16 21 1 Production Budget 22 23 2. Materials Budget 24 25 3. Direct Labor Budget 30 31 4. Factory Overhead Budget 32 33 5. Seling and Administrative Budget 34 39 6. Cost of Goods Sold Budget 40 7. Budgeted Income Statement 42 43 B. Cash Budget 48 49 Notes for Budgeting 50 51 52. The company wants to maintain the same number of units in the beginning and ending inventories of 57 work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 625 pieces and 58 decreasing the finished goods by 20% 59 60 Complete the following budgets 61 06 1 Production Budget 67 88 Planned Sales 09 Desired Ending Inventory of Finished Goods 70 Total Needed 75 Less: Beginning inventory 78 77 Total Production ZA {7.01) 2 Materials Budget (8.01) (8.02) (8.03) (8.04) Lamp Kits Needed for Production Desired Ending Inventory Total Needed Less: Beginning Inventory Total Purchases Cost per piece Cost of Purchases (Round to two places, $##.##) 3 Direct Labor Budget (8.05) (8.06) {8.07) 3 4 5 6 7 8 14 15 16 17 18 67 6B 74 75 76 77 78 84 85 86 87 88 94 95 96 97 98 99 100 101 Labor Cost Per Lamp Production Total Labor Cost (Round to two places. S####) (8.08) 4 Factory Overhead Budget Variable Factory Overhead: Variable Factory Overhead Cost Per Unit Number of Units to be produced Total Variable Factory Overhead (Round to two places, Sww.4) Fixed Factory Overhead {8.09) (8.10) Total Factory Overhead (Round to two places, Sww.) (8.11) 5 * Factory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, $40.) (9.01) 8 9 16 17 18 19 20 27 28 29 30 131 5 Cost of making one vnk next year Cost of one Lamp kr Labor Cost Per Lamp Factory overhead perunt (9.02) Total cost of one unt (Round to two places, SA 19.03) (9.04) 50 6 Seang.and Admin Budget 51 52. Fred Seling 53 Variable Seling (Round to two places, S.) 60 Fixed Administrative 01 Variable Administrative (Round to two places, SAW.) 02 Total Selling and Administrative (Round to two places, s.) 63 Goods (9.05) (9.06) 7 Sold Round dollars to two places, S. (9.07) 04 71 72 73 74 25 62 03 84 85 30 100 107 100 109 110 111 112 Beginning inventory. Finished Goods Production Costs: Materials: Lamp Kits: Beginning Inventory Purchased Avalable for Use Ending Inventory of Lamp Kits Lomp Kits Used In Production Total Materis Labor Overhead Cost of Goods Available Lous Ending Inventory, Fighed Goods Cost of Goods Sold 19.08) (9.09) (9.10) (911) (9.12) (9.13) (9.14) PAN 2 Busbarcame Salamay Sales Cost of Goods Sald Grass Profit Selling Expenses & Admin Expenses Nel Income (10.01) 20 21 8 Cash Budo 22 Assume actual cash receipts and disbursements will follow the pattern below (Note Receivables and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts