Question: Need the info added into these excel sheets. Valuation Project Please use the excel file (attached) for this short project and assume that this is

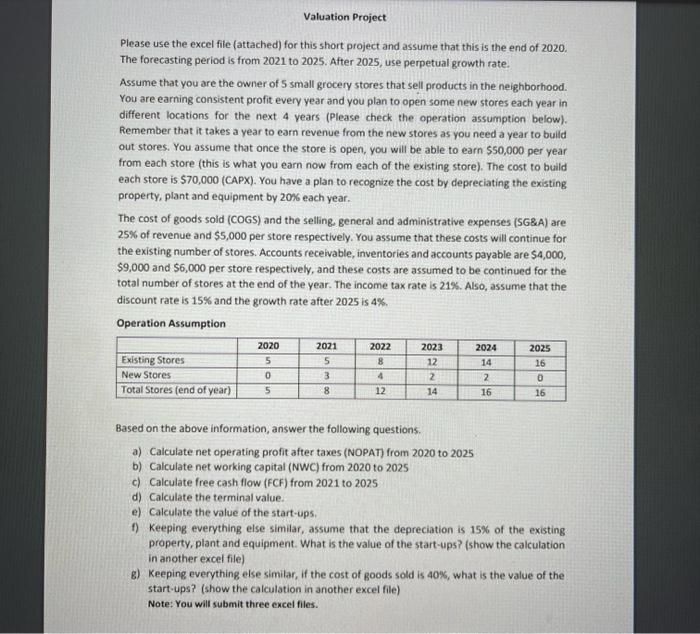

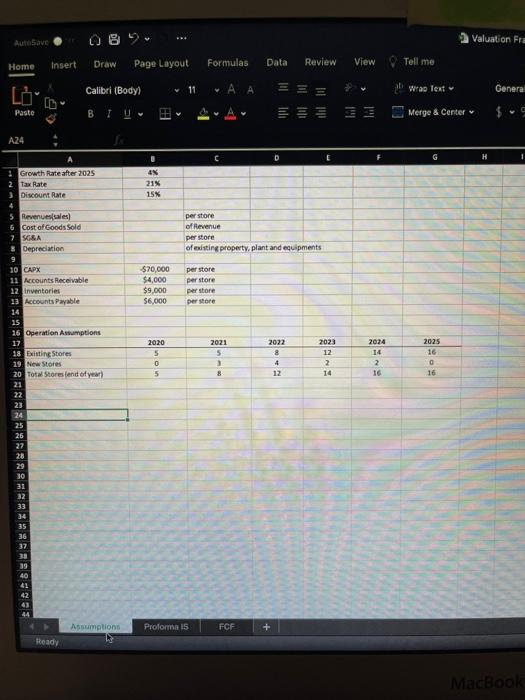

Valuation Project Please use the excel file (attached) for this short project and assume that this is the end of 2020. The forecasting period is from 2021 to 2025. After 2025, use perpetual growth rate. Assume that you are the owner of 5 small grocery stores that sell products in the neighborhood. You are earning consistent profit every year and you plan to open some new stores each year in different locations for the next 4 years (Please check the operation assumption below). Remember that it takes a year to earn revenue from the new stores as you need a year to build out stores. You assume that once the store is open, you will be able to earn $50,000 per year from each store (this is what you earn now from each of the existing store). The cost to build each store is $70,000 (CAPX). You have a plan to recognize the cost by depreciating the existing property, plant and equipment by 20% each year. The cost of goods sold (COGS) and the selling, general and administrative expenses (SG&A) are 25% of revenue and $5,000 per store respectively. You assume that these costs will continue for the existing number of stores. Accounts receivable, inventories and accounts payable are $4,000, $9,000 and $6,000 per store respectively, and these costs are assumed to be continued for the total number of stores at the end of the year. The income tax rate is 21%. Also, assume that the discount rate is 15% and the growth rate after 2025 is 4% Operation Assumption 2022 Existing Stores New Stores Total Stores (end of year) 2020 2024 14 5 2021 5 3 8 8 4 2023 12 2 14 2025 16 0 16 0 5 2 16 12 Based on the above information, answer the following questions. a) Calculate net operating profit after taxes (NOPAT) from 2020 to 2025 b) Calculate net working capital (NWC) from 2020 to 2025 c) Calculate free cash flow (FCF) from 2021 to 2025 d) Calculate the terminal value. e) Calculate the value of the start-ups. 1) Keeping everything else similar, assume that the depreciation is 15% of the existing property, plant and equipment. What is the value of the start-ups? (show the calculation in another excel file) 6) Keeping everything else similar, if the cost of goods sold is 40%, what is the value of the start-ups? (show the calculation in another excel file) Note: You will submit three excel files. AutoSave 8. Valuation Fre Insert Home Draw Page Layout Formulas Data Calibri (Body) 11 Lo Review View Tell me wrap text SEE Merge & Center General Paste BI c 0 > 1 A24 C D E Growth Rate after 2025 Tax Rate Discount Rate AN 21% 15% Revenues ales) Cost of Goods Sold 7 SIA 8 Depreciation per store of Revenue per store of existing property, plant and equipments $70,000 $4,000 $9.000 $6,000 per store per store perstore persore 2021 2020 5 0 5 2021 5 3 8 2022 8 4 12 2 14 2024 14 2 16 2025 16 0 16 12 10 CAPX 11 Accounts Receivable 22 Inventories 13 Accounts Payable 24 15 26 Operation Assumptions 17 18 Existing Stores 19 New Stores 20 Total Storesfend of year) 21 22 23 24 25 25 27 28 29 30 31 32 33 35 36 37 38 19 40 42 44 Assumptions Proforma is FCF + Ready MacBook Income Statement 1 2 3 2020 2021 2022 2023 2024 2025 4 Revenues 5 Cost of Goods Sold (COGS) 6 Gross Profit 7 SG&A 8 EBITDA 9 Depreciation 10 EBIT 11 Tax 12 NOPAT 13 14 15 Other Calculations 16 Property, Plant and Equipment 17 CAPX 18 Net Working Capital Calculations 19 20 Accounts Receivable 21 Inventories 22 Current Assets 23 Current Liabilities 24 Net Working Capital 25 26 27 28 2020 2021 2022 2023 2024 2025 1 Income Statement 2 3 4 Revenues 5 Cost of Goods Sold (COGS) 6 Gross Profit 7 SG&A 8 EBITDA 9 Depreciation 10 EBIT 11 Tax 12 NOPAT 13 14 15 Other Calculations 16 Property, Plant and Equipment 17 CAPX 18 Net Working Capital Calculations 19 20 Accounts Receivable 21 Inventories 22 Current Assets 23 Current Liabilities 24 Net Working Capital 25 26 27 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts