Question: Need the manufacturing overhead component (row under Direct Labor row) explained please. Rensing Groomers is in the dog-grooming business. Its operating costs are described by

Need the manufacturing overhead component (row under "Direct Labor" row) explained please.

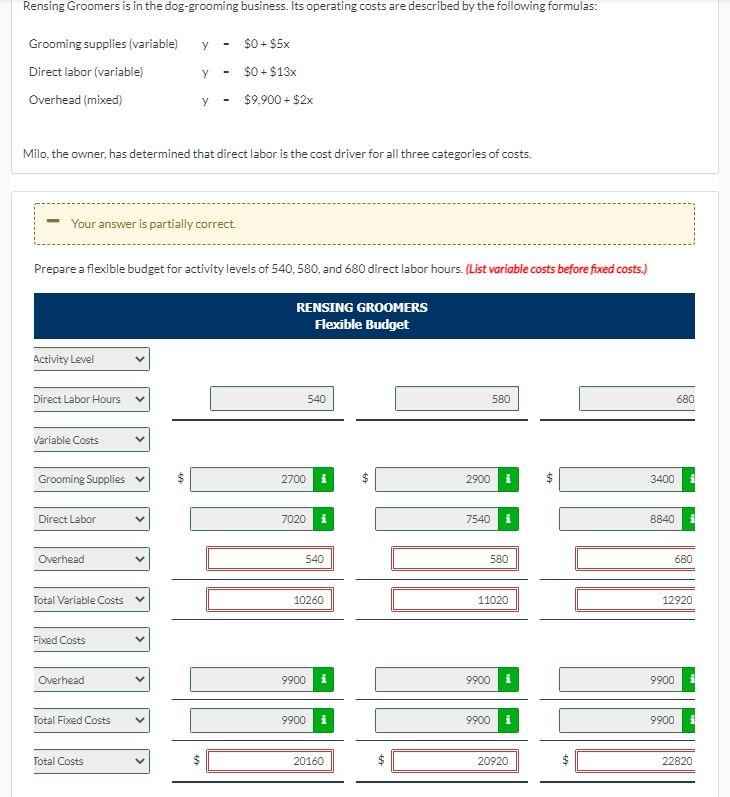

Rensing Groomers is in the dog-grooming business. Its operating costs are described by the following formulas: $0+ $5x Grooming supplies (variable) Direct labor (variable) Overhead (mixed) - $0+ $13x $9.900 + $2x Milo. the owner, has determined that direct labor is the cost driver for all three categories of costs. - Your answer is partially correct Prepare a flexible budget for activity levels of 540,580, and 680 direct labor hours. (List variable costs before fixed costs.) RENSING GROOMERS Flexible Budget Activity Level Direct Labor Hours 540 580 680 Variable Costs Grooming Supplies $ 2700 i $ 2900 $ 3400 Direct Labor 7020 7540 8840 Overhead 540 580 680 Total Variable Costs 10260 11020 12920 Fixed Costs Overhead 9900 9900 9900 Total Fixed Costs 9900 9900 9900 i * Total Costs 20160 $ 20920 22820

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts