Question: Need the process Question 1 (40 points) FIRE 481 Exam 1 Questions (please write the answers and steps on paper, take photo of it and

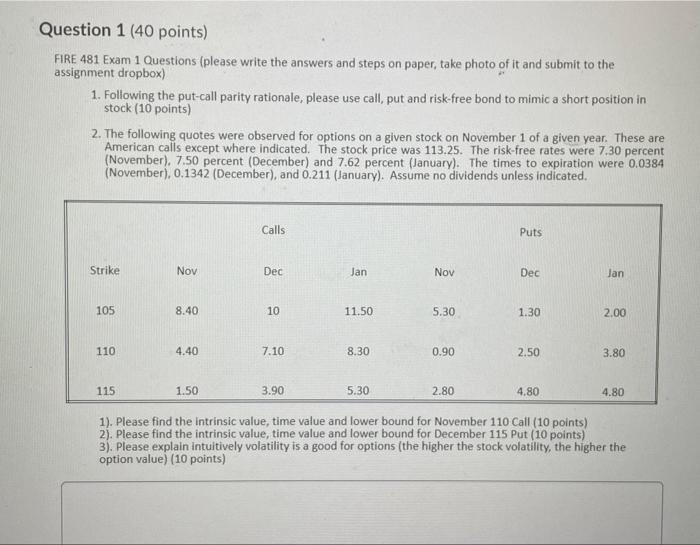

Question 1 (40 points) FIRE 481 Exam 1 Questions (please write the answers and steps on paper, take photo of it and submit to the assignment dropbox) 1. Following the put-call parity rationale, please use call, put and risk-free bond to mimic a short position in stock (10 points) 2. The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. The stock price was 113.25. The risk-free rates were 7.30 percent (November), 7.50 percent (December) and 7.62 percent (January). The times to expiration were 0.0384 (November), 0.1342 (December), and 0.211 (January). Assume no dividends unless indicated. Calls Puts Strike Nov Dec Jan Nov Dec Jan 105 8.40 10 11.50 5.30 1.30 2.00 110 4.40 7.10 8.30 0.90 2.50 3.80 115 1.50 3.90 5.30 2.80 4.80 4.80 1). Please find the intrinsic value, time value and lower bound for November 110 Call (10 points) 2). Please find the intrinsic value, time value and lower bound for December 115 Put (10 points) 3). Please explain intuitively volatility is a good for options (the higher the stock volatility, the higher the option value) (10 points) Question 1 (40 points) FIRE 481 Exam 1 Questions (please write the answers and steps on paper, take photo of it and submit to the assignment dropbox) 1. Following the put-call parity rationale, please use call, put and risk-free bond to mimic a short position in stock (10 points) 2. The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. The stock price was 113.25. The risk-free rates were 7.30 percent (November), 7.50 percent (December) and 7.62 percent (January). The times to expiration were 0.0384 (November), 0.1342 (December), and 0.211 (January). Assume no dividends unless indicated. Calls Puts Strike Nov Dec Jan Nov Dec Jan 105 8.40 10 11.50 5.30 1.30 2.00 110 4.40 7.10 8.30 0.90 2.50 3.80 115 1.50 3.90 5.30 2.80 4.80 4.80 1). Please find the intrinsic value, time value and lower bound for November 110 Call (10 points) 2). Please find the intrinsic value, time value and lower bound for December 115 Put (10 points) 3). Please explain intuitively volatility is a good for options (the higher the stock volatility, the higher the option value) (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts