Question: Need the Required: portion and financial statement completed. The Lazy Boys, Inc. is a small chain of home entertainment stores located throughout the Midwest. As

Need the "Required:" portion and financial statement completed.

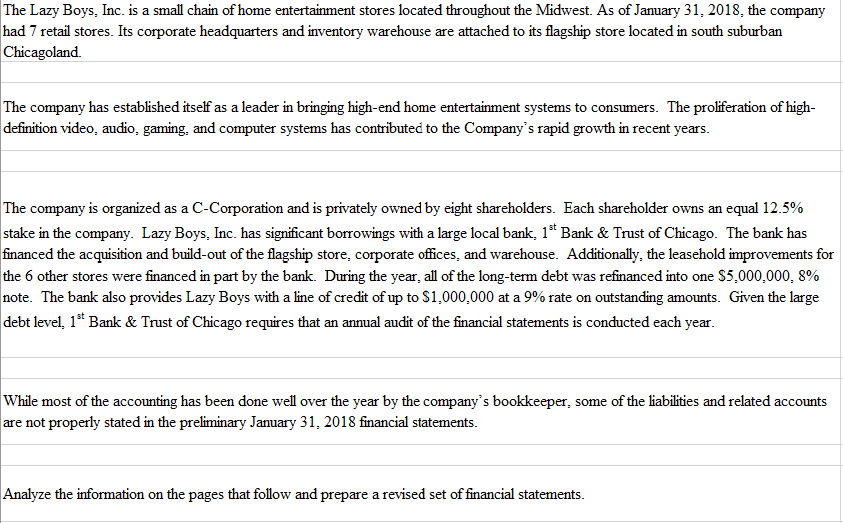

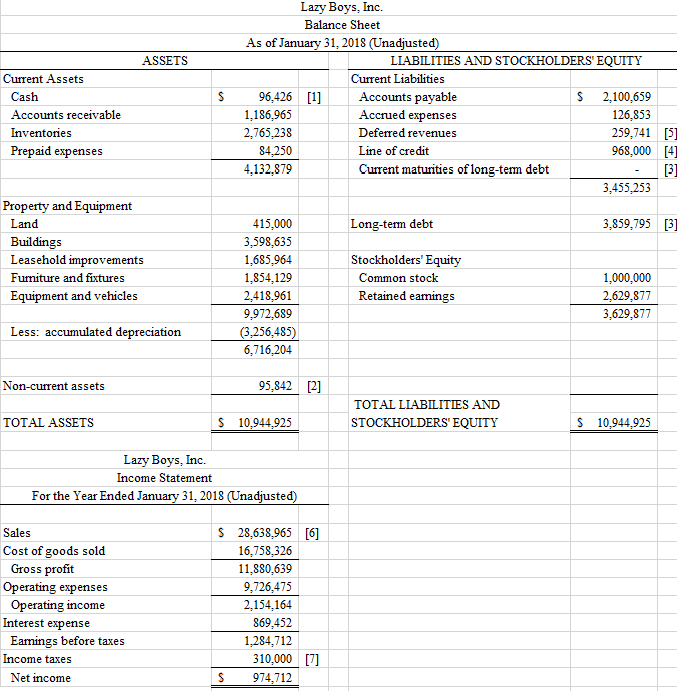

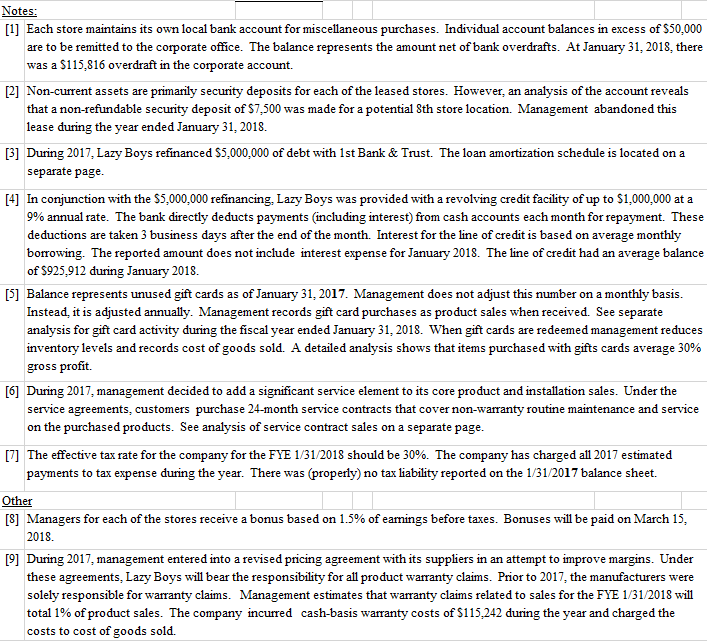

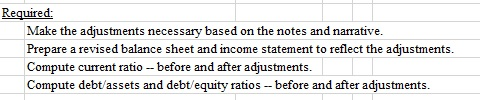

The Lazy Boys, Inc. is a small chain of home entertainment stores located throughout the Midwest. As of January 31, 2018, the company had 7 retail stores. Its corporate headquarters and inventory warehouse are attached to its flagship store located in south suburban Chicagoland The company has established itself as a leader in bringing high-end home entertainment systems to consumers. The proliferation of high- definition video, audio, gaming, and computer systems has contributed to the Company's rapid growth in recent years. The company is organized as a C-Corporation and is privately owned by eight shareholders. Each shareholder owns an equal 12.5% stake in the company. Lazy Boys. Inc. has significant borrowings with a large local bank. 1" Bank & Trust of Chicago. The bank has financed the acquisition and build-out of the flagship store, corporate offices, and warehouse. Additionally, the leasehold improvements for the 6 other stores were financed in part by the bank. During the year, all of the long-term debt was refinanced into one $5,000,000.8% note. The bank also provides Lazy Boys with a line of credit of up to $1.000.000 at a 9% rate on outstanding amounts. Given the large debt level. 19 Bank & Trust of Chicago requires that an annual audit of the financial statements is conducted each year. While most of the accounting has been done well over the year by the company's bookkeeper, some of the liabilities and related accounts are not properly stated in the preliminary January 31, 2018 financial statements. Analyze the information on the pages that follow and prepare a revised set of financial statements. ASSETS Current Assets Cash Accounts receivable Inventories Prepaid expenses Lazy Boys, Inc. Balance Sheet As of January 31, 2018 (Unadjusted) LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities 96,426 [1] Accounts payable S 2,100,659 1,186,965 Accrued expenses 126,853 2,765,238 Deferred revenues 259,741 [5] 84.250 Line of credit 968.000 [4] 4,132,879 Current maturities of long-term debt 3,455.253 Long-term debt 3,859,795 [3] Property and Equipment Land Buildings Leasehold improvements Furniture and fixtures Equipment and vehicles 415,000 3,598,635 1,685,964 1,854,129 2,418,961 9,972,689 (3.256,485) 6,716,204 Stockholders' Equity Common stock Retained earnings 1,000,000 2,629,877 3,629,877 Less: accumulated depreciation Non-current assets 95,842 [2] TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY TOTAL ASSETS $ 10.944.925 $ 10,944,925 Lazy Boys, Inc. Income Statement For the Year Ended January 31, 2018 (Unadjusted) $ [6] Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense Earnings before taxes Income taxes Net income 28,638,965 16,758,326 11.880.639 9,726,475 2,154,164 869,452 1,284,712 310,000 974,712 [7] S Notes: [1] Each store maintains its own local bank account for miscellaneous purchases. Individual account balances in excess of $50,000 are to be remitted to the corporate office. The balance represents the amount net of bank overdrafts. At January 31, 2018, there was a $115,816 overdraft in the corporate account. [2] Non-current assets are primarily security deposits for each of the leased stores. However, an analysis of the account reveals that a non-refundable security deposit of $7,500 was made for a potential Sth store location. Management abandoned this lease during the year ended January 31, 2018 [3] During 2017, Lazy Boys refinanced $5,000,000 of debt with 1st Bank & Trust. The loan amortization schedule is located on a separate page. [4] In conjunction with the $5,000,000 refinancing, Lazy Boys was provided with a revolving credit facility of up to $1,000,000 at a 9% annual rate. The bank directly deducts payments including interest) from cash accounts each month for repayment. I deductions are taken 3 business days after the end of the month. Interest for the line of credit is based on average monthly borrowing. The reported amount does not include interest expense for January 2018. The line of credit had an average balance of $925,912 during January 2018. [5] Balance represents unused gift cards as of January 31, 2017. Management does not adjust this number on a monthly basis. Instead, it is adjusted annually. Management records gift card purchases as product sales when received. See separate analysis for gift card activity during the fiscal year ended January 31, 2018. When gift cards are redeemed management reduces inventory levels and records cost of goods sold. A detailed analysis shows that items purchased with gifts cards average 30% gross profit. [6] During 2017, management decided to add a significant service element to its core product and installation sales. Under the service agreements, customers purchase 24-month service contracts that cover non-warranty routine maintenance and service on the purchased products. See analysis of service contract sales on a separate page. [7) The effective tax rate for the company for the FYE 1/31/2018 should be 30%. The company has charged all 2017 estimated payments to tax expense during the year. There was (properly) no tax liability reported on the 1/31/2017 balance sheet. Other [8] Managers for each of the stores receive a bonus based on 1.5% of earnings before taxes. Bonuses will be paid on March 15, 2018. [9] During 2017, management entered into a revised pricing agreement with its suppliers in an attempt to improve margins. Under these agreements, Lazy Boys will bear the responsibility for all product warranty claims. Prior to 2017, the manufacturers were solely responsible for warranty claims. Management estimates that warranty claims related to sales for the FYE 1/31/2018 will total 1% of product sales. The company incurred cash-basis warranty costs of $115,242 during the year and charged the costs to cost of goods sold. Required: Make the adjustments necessary based on the notes and narrative. Prepare a revised balance sheet and income statement to reflect the adjustments. Compute current ratio -- before and after adjustments. Compute debt/assets and debt/equity ratios -- before and after adjustments. Lazy Boys, Inc. Financial Statements and Other Information January 31, 2018 (Adjusted) Cash 2.100.659 1.186.965 Accounts receivable Inventories Prepaid expenses Accounts payable Accrued expenses Deferred revenues Line of credit Current maturities of long-term debt Long-term debt Property and Equipment Land Buildings Leasehold improvements Furniture and fixtures Equipment and vehicles 1,000,000 415,000 3,598,635 1,685,964 1,854,129 2,418,961 9,972,689 (3.256,485) 6,716,204 Common stock Retained earings Less: accumulated depreciation Non-current assets Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense Earnings before taxes and bonus Bonus Earnings before taxes and bonus Income taxes Net income The Lazy Boys, Inc. is a small chain of home entertainment stores located throughout the Midwest. As of January 31, 2018, the company had 7 retail stores. Its corporate headquarters and inventory warehouse are attached to its flagship store located in south suburban Chicagoland The company has established itself as a leader in bringing high-end home entertainment systems to consumers. The proliferation of high- definition video, audio, gaming, and computer systems has contributed to the Company's rapid growth in recent years. The company is organized as a C-Corporation and is privately owned by eight shareholders. Each shareholder owns an equal 12.5% stake in the company. Lazy Boys. Inc. has significant borrowings with a large local bank. 1" Bank & Trust of Chicago. The bank has financed the acquisition and build-out of the flagship store, corporate offices, and warehouse. Additionally, the leasehold improvements for the 6 other stores were financed in part by the bank. During the year, all of the long-term debt was refinanced into one $5,000,000.8% note. The bank also provides Lazy Boys with a line of credit of up to $1.000.000 at a 9% rate on outstanding amounts. Given the large debt level. 19 Bank & Trust of Chicago requires that an annual audit of the financial statements is conducted each year. While most of the accounting has been done well over the year by the company's bookkeeper, some of the liabilities and related accounts are not properly stated in the preliminary January 31, 2018 financial statements. Analyze the information on the pages that follow and prepare a revised set of financial statements. ASSETS Current Assets Cash Accounts receivable Inventories Prepaid expenses Lazy Boys, Inc. Balance Sheet As of January 31, 2018 (Unadjusted) LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities 96,426 [1] Accounts payable S 2,100,659 1,186,965 Accrued expenses 126,853 2,765,238 Deferred revenues 259,741 [5] 84.250 Line of credit 968.000 [4] 4,132,879 Current maturities of long-term debt 3,455.253 Long-term debt 3,859,795 [3] Property and Equipment Land Buildings Leasehold improvements Furniture and fixtures Equipment and vehicles 415,000 3,598,635 1,685,964 1,854,129 2,418,961 9,972,689 (3.256,485) 6,716,204 Stockholders' Equity Common stock Retained earnings 1,000,000 2,629,877 3,629,877 Less: accumulated depreciation Non-current assets 95,842 [2] TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY TOTAL ASSETS $ 10.944.925 $ 10,944,925 Lazy Boys, Inc. Income Statement For the Year Ended January 31, 2018 (Unadjusted) $ [6] Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense Earnings before taxes Income taxes Net income 28,638,965 16,758,326 11.880.639 9,726,475 2,154,164 869,452 1,284,712 310,000 974,712 [7] S Notes: [1] Each store maintains its own local bank account for miscellaneous purchases. Individual account balances in excess of $50,000 are to be remitted to the corporate office. The balance represents the amount net of bank overdrafts. At January 31, 2018, there was a $115,816 overdraft in the corporate account. [2] Non-current assets are primarily security deposits for each of the leased stores. However, an analysis of the account reveals that a non-refundable security deposit of $7,500 was made for a potential Sth store location. Management abandoned this lease during the year ended January 31, 2018 [3] During 2017, Lazy Boys refinanced $5,000,000 of debt with 1st Bank & Trust. The loan amortization schedule is located on a separate page. [4] In conjunction with the $5,000,000 refinancing, Lazy Boys was provided with a revolving credit facility of up to $1,000,000 at a 9% annual rate. The bank directly deducts payments including interest) from cash accounts each month for repayment. I deductions are taken 3 business days after the end of the month. Interest for the line of credit is based on average monthly borrowing. The reported amount does not include interest expense for January 2018. The line of credit had an average balance of $925,912 during January 2018. [5] Balance represents unused gift cards as of January 31, 2017. Management does not adjust this number on a monthly basis. Instead, it is adjusted annually. Management records gift card purchases as product sales when received. See separate analysis for gift card activity during the fiscal year ended January 31, 2018. When gift cards are redeemed management reduces inventory levels and records cost of goods sold. A detailed analysis shows that items purchased with gifts cards average 30% gross profit. [6] During 2017, management decided to add a significant service element to its core product and installation sales. Under the service agreements, customers purchase 24-month service contracts that cover non-warranty routine maintenance and service on the purchased products. See analysis of service contract sales on a separate page. [7) The effective tax rate for the company for the FYE 1/31/2018 should be 30%. The company has charged all 2017 estimated payments to tax expense during the year. There was (properly) no tax liability reported on the 1/31/2017 balance sheet. Other [8] Managers for each of the stores receive a bonus based on 1.5% of earnings before taxes. Bonuses will be paid on March 15, 2018. [9] During 2017, management entered into a revised pricing agreement with its suppliers in an attempt to improve margins. Under these agreements, Lazy Boys will bear the responsibility for all product warranty claims. Prior to 2017, the manufacturers were solely responsible for warranty claims. Management estimates that warranty claims related to sales for the FYE 1/31/2018 will total 1% of product sales. The company incurred cash-basis warranty costs of $115,242 during the year and charged the costs to cost of goods sold. Required: Make the adjustments necessary based on the notes and narrative. Prepare a revised balance sheet and income statement to reflect the adjustments. Compute current ratio -- before and after adjustments. Compute debt/assets and debt/equity ratios -- before and after adjustments. Lazy Boys, Inc. Financial Statements and Other Information January 31, 2018 (Adjusted) Cash 2.100.659 1.186.965 Accounts receivable Inventories Prepaid expenses Accounts payable Accrued expenses Deferred revenues Line of credit Current maturities of long-term debt Long-term debt Property and Equipment Land Buildings Leasehold improvements Furniture and fixtures Equipment and vehicles 1,000,000 415,000 3,598,635 1,685,964 1,854,129 2,418,961 9,972,689 (3.256,485) 6,716,204 Common stock Retained earings Less: accumulated depreciation Non-current assets Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense Earnings before taxes and bonus Bonus Earnings before taxes and bonus Income taxes Net income

Step by Step Solution

There are 3 Steps involved in it

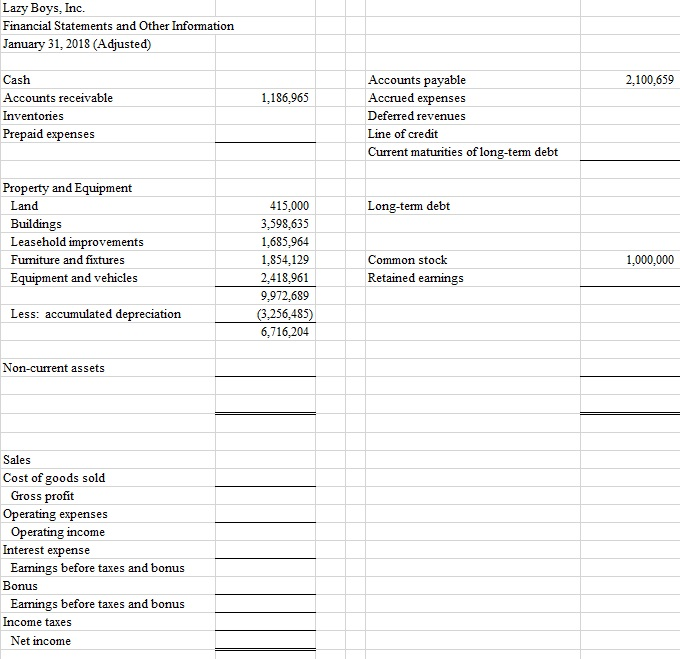

Get step-by-step solutions from verified subject matter experts