Question: Need the right answer dont use AI Holding all else equal (i.e., investment strategy 1 and the rates on the first two bonds in strategy

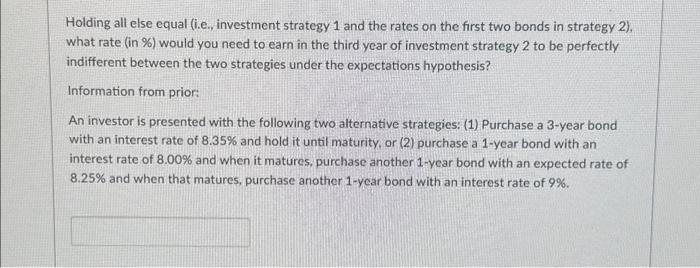

Holding all else equal (i.e., investment strategy 1 and the rates on the first two bonds in strategy 2 ). what rate (in \%) would you need to earn in the third year of investment strategy 2 to be perfectly indifferent between the two strategies under the expectations hypothesis? Information from prior: An investor is presented with the following two alternative strategies: (1) Purchase a 3-year bond with an interest rate of 8.35% and hold it until maturity, or (2) purchase a 1-year bond with an interest rate of 8.00% and when it matures, purchase another 1 -year bond with an expected rate of 8.25% and when that matures, purchase another 1 -year bond with an interest rate of 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts