Question: Need the solution for E. Thank you. A newly issued bond pays its coupons once a year. Its coupon rate is 5.4%, its maturity is

Need the solution for E. Thank you.

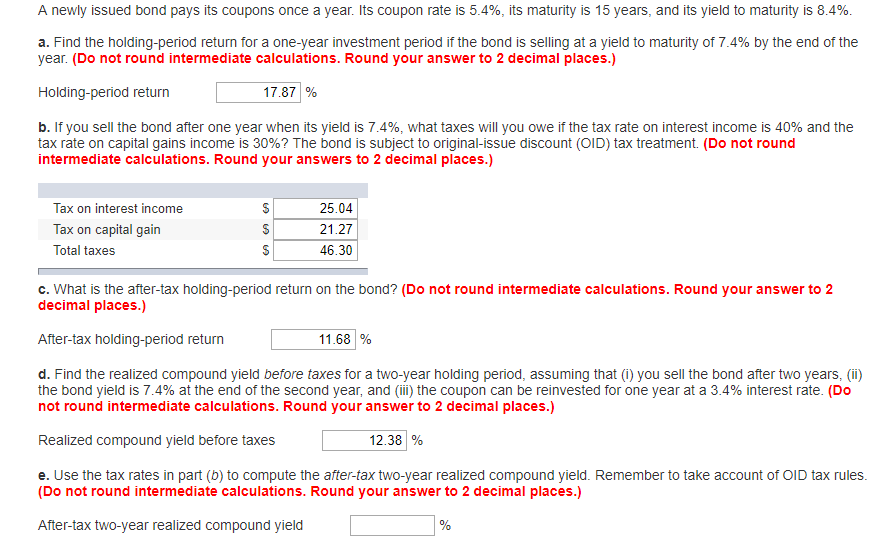

A newly issued bond pays its coupons once a year. Its coupon rate is 5.4%, its maturity is 15 years, and its yield to maturity is 8.4% a. Find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 7.4% by the end of the year. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Holding-period return 17.87 % b. If you sell the bond after one year when its yield is 7.4%, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? The bond is subject to original-issue discount (OID) tax treatment (Do not round intermediate calculations. Round your answers to 2 decimal places.) Tax on interest income Tax on capital gain Total taxes 25.04 21.27 46.30 c. What is the after-tax holding-period return on the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) After-tax holding-period return 11.68 % d. Find the realized compound yield before taxes for a two-year holding period, assuming that (i) you sell the bond after two years, (i) the bond yield is 7.4% at the end of the second year, and (iii) the coupon can be reinvested for one year at a 3.4% interest rate. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Realized compound yield before taxes 12.38 % e. Use the tax rates in part (b) to compute the after-tax two-year realized compound yield. Remember to take account of OID tax rules (Do not round intermediate calculations. Round your answer to 2 decimal places.) After-tax two-year realized compound yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts