Question: need the solution Q2. On 1 July 2022, Yard Ltd paid $264,770 for 75% of the share capital of Bi the equity of Birds Ltd

need the solution

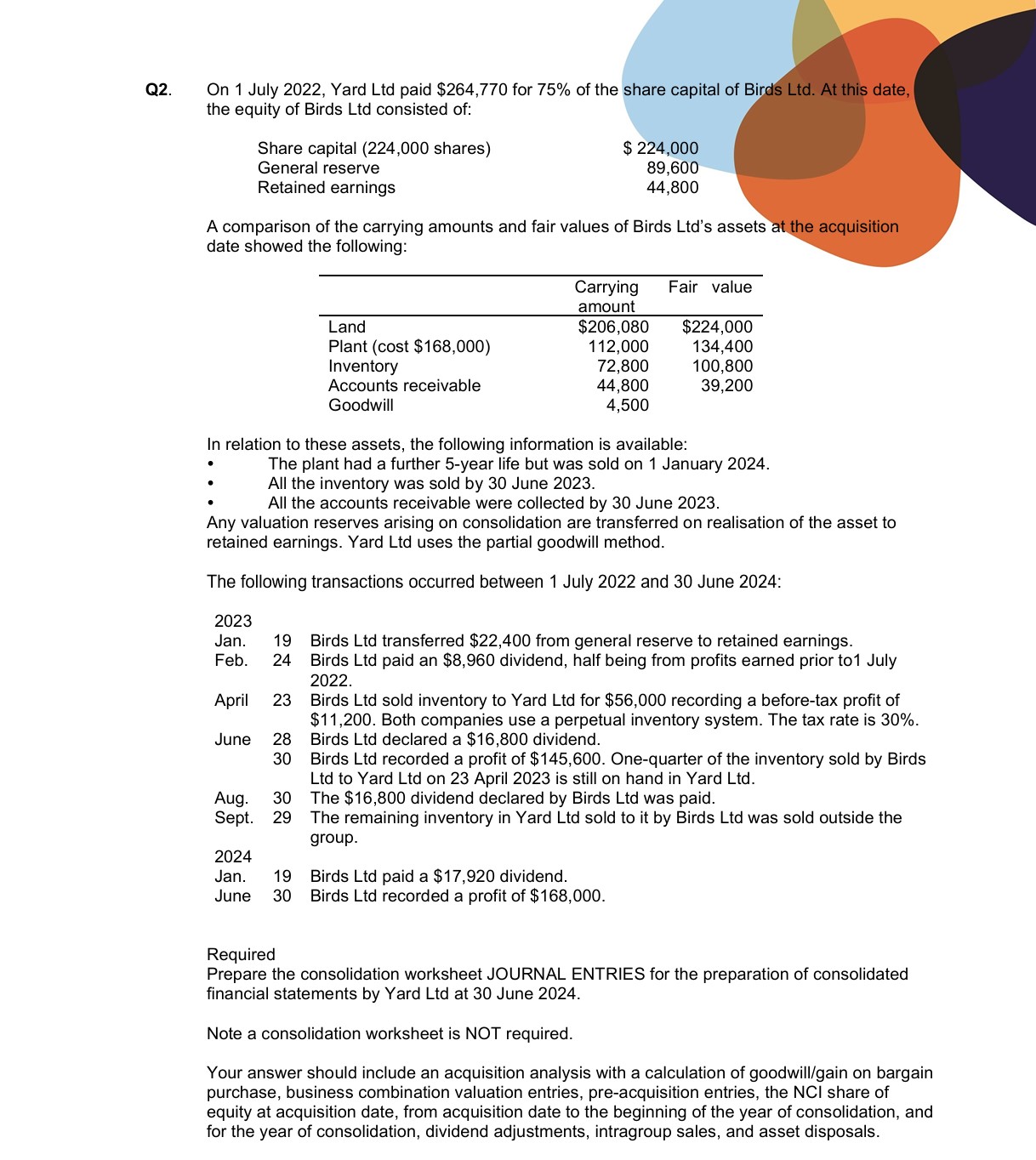

Q2. On 1 July 2022, Yard Ltd paid $264,770 for 75% of the share capital of Bi the equity of Birds Ltd consisted of: Share capital (224,000 shares) $ 224,000 General reserve 89,600 Retained earnings 44 800 A comparison of the carrying amounts and fair values of Birds Ltd's assets date showed the following: Carrying Fair value amount Land $206,080 $224,000 Plant (cost $168,000) 112,000 134,400 Inventory 72,800 100,800 Accounts receivable 44 800 39,200 Goodwill 4,500 In relation to these assets, the following information is available: . The plant had a further 5-year life but was sold on 1 January 2024. . All the inventory was sold by 30 June 2023. . All the accounts receivable were collected by 30 June 2023. Any valuation reserves arising on consolidation are transferred on realisation of the asset to retained earnings. Yard Ltd uses the partial goodwill method. The following transactions occurred between 1 July 2022 and 30 June 2024: 2023 Jan. 19 Birds Ltd transferred $22,400 from general reserve to retained earnings. Feb. 24 Birds Ltd paid an $8,960 dividend, half being from profits earned prior to1 July 2022. April 23 Birds Ltd sold inventory to Yard Ltd for $56,000 recording a before-tax profit of $11,200. Both companies use a perpetual inventory system. The tax rate is 30%. June 28 Birds Ltd declared a $16,800 dividend. 30 Birds Ltd recorded a profit of $145,600. One-quarter of the inventory sold by Birds Ltd to Yard Ltd on 23 April 2023 is still on hand in Yard Lid. Aug. 30 The $16,800 dividend declared by Birds Ltd was paid. Sept. 29 The remaining inventory in Yard Ltd sold to it by Birds Ltd was sold outside the group. 2024 Jan. 19 Birds Ltd paid a $17,920 dividend. June 30 Birds Ltd recorded a profit of $168,000. Required Prepare the consolidation worksheet JOURNAL ENTRIES for the preparation of consolidated financial statements by Yard Ltd at 30 June 2024. Note a consolidation worksheet is NOT required. Your answer should include an acquisition analysis with a calculation of goodwill/gain on bargain purchase, business combination valuation entries, pre-acquisition entries, the NCI share of equity at acquisition date, from acquisition date to the beginning of the year of consolidation, and for the year of consolidation, dividend adjustments, intragroup sales, and asset disposals

Q2. On 1 July 2022, Yard Ltd paid $264,770 for 75% of the share capital of Bi the equity of Birds Ltd consisted of: Share capital (224,000 shares) $ 224,000 General reserve 89,600 Retained earnings 44 800 A comparison of the carrying amounts and fair values of Birds Ltd's assets date showed the following: Carrying Fair value amount Land $206,080 $224,000 Plant (cost $168,000) 112,000 134,400 Inventory 72,800 100,800 Accounts receivable 44 800 39,200 Goodwill 4,500 In relation to these assets, the following information is available: . The plant had a further 5-year life but was sold on 1 January 2024. . All the inventory was sold by 30 June 2023. . All the accounts receivable were collected by 30 June 2023. Any valuation reserves arising on consolidation are transferred on realisation of the asset to retained earnings. Yard Ltd uses the partial goodwill method. The following transactions occurred between 1 July 2022 and 30 June 2024: 2023 Jan. 19 Birds Ltd transferred $22,400 from general reserve to retained earnings. Feb. 24 Birds Ltd paid an $8,960 dividend, half being from profits earned prior to1 July 2022. April 23 Birds Ltd sold inventory to Yard Ltd for $56,000 recording a before-tax profit of $11,200. Both companies use a perpetual inventory system. The tax rate is 30%. June 28 Birds Ltd declared a $16,800 dividend. 30 Birds Ltd recorded a profit of $145,600. One-quarter of the inventory sold by Birds Ltd to Yard Ltd on 23 April 2023 is still on hand in Yard Lid. Aug. 30 The $16,800 dividend declared by Birds Ltd was paid. Sept. 29 The remaining inventory in Yard Ltd sold to it by Birds Ltd was sold outside the group. 2024 Jan. 19 Birds Ltd paid a $17,920 dividend. June 30 Birds Ltd recorded a profit of $168,000. Required Prepare the consolidation worksheet JOURNAL ENTRIES for the preparation of consolidated financial statements by Yard Ltd at 30 June 2024. Note a consolidation worksheet is NOT required. Your answer should include an acquisition analysis with a calculation of goodwill/gain on bargain purchase, business combination valuation entries, pre-acquisition entries, the NCI share of equity at acquisition date, from acquisition date to the beginning of the year of consolidation, and for the year of consolidation, dividend adjustments, intragroup sales, and asset disposals

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock