Question: need the solution to this problem. thanks. Problem 3: Breaking Point You are evaluating an investment project with initial cost $120,000 that can be depreciated

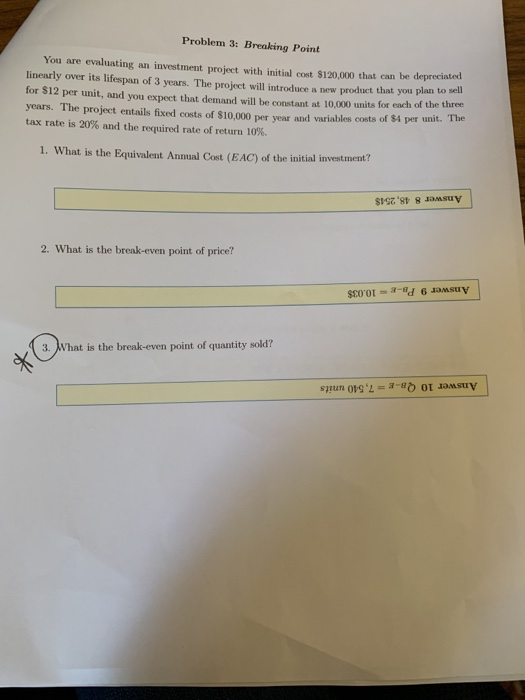

Problem 3: Breaking Point You are evaluating an investment project with initial cost $120,000 that can be depreciated linearly over its lifespan of 3 years. The project will introduce a new product that you plan for 512 per unit, and you expect that demand will be constant at 10.000 units for each of the can years. The project entails fixed costs of $10,000 per year and variables costs of $4 per unit. tax rate is 20% and the required rate of return 10%. 1. What is the Equivalent Annual Cost (EAC) of the initial investment? SIST'S 8 OSUV 2. What is the break-even point of price? SCOOT = -d 6 JOSUV 3. What is the break-even point of quantity sold? Sun OPSL = -8 OT JOSUV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts