Question: need the step by step process and answer. 1. (5 Points) You are given the following information: U.S. Germany Nominal one year interest rate 1%

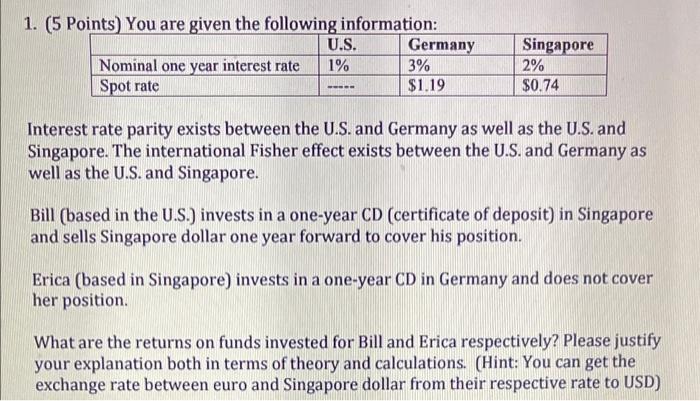

1. (5 Points) You are given the following information: U.S. Germany Nominal one year interest rate 1% 3% Spot rate $1.19 Singapore 2% $0.74 Interest rate parity exists between the U.S. and Germany as well as the U.S. and Singapore. The international Fisher effect exists between the U.S. and Germany as well as the U.S. and Singapore. Bill (based in the U.S.) invests in a one-year CD (certificate of deposit) in Singapore and sells Singapore dollar one year forward to cover his position. Erica (based in Singapore) invests in a one-year CD in Germany and does not cover her position. What are the returns on funds invested for Bill and Erica respectively? Please justify your explanation both in terms of theory and calculations. (Hint: You can get the exchange rate between euro and Singapore dollar from their respective rate to USD) 1. (5 Points) You are given the following information: U.S. Germany Nominal one year interest rate 1% 3% Spot rate $1.19 Singapore 2% $0.74 Interest rate parity exists between the U.S. and Germany as well as the U.S. and Singapore. The international Fisher effect exists between the U.S. and Germany as well as the U.S. and Singapore. Bill (based in the U.S.) invests in a one-year CD (certificate of deposit) in Singapore and sells Singapore dollar one year forward to cover his position. Erica (based in Singapore) invests in a one-year CD in Germany and does not cover her position. What are the returns on funds invested for Bill and Erica respectively? Please justify your explanation both in terms of theory and calculations. (Hint: You can get the exchange rate between euro and Singapore dollar from their respective rate to USD)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts