Question: NEED THE WORK IN EXCEL ALONG WITH THE FORMULAS VIEW 4. NPV of machine replacement Mighty may replace an old machine with a new, more

NEED THE WORK IN EXCEL ALONG WITH THE FORMULAS VIEW

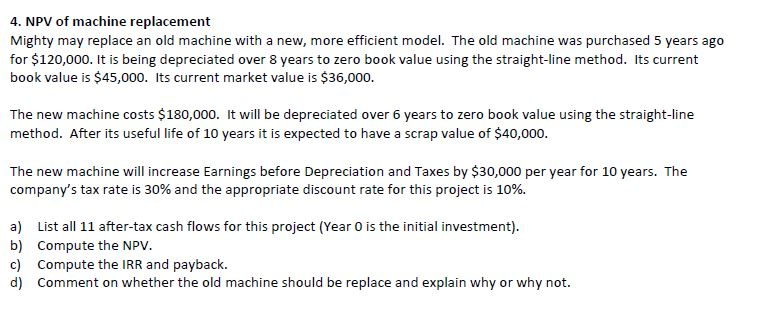

4. NPV of machine replacement Mighty may replace an old machine with a new, more efficient model. The old machine was purchased 5 years ago for $120,000. It is being depreciated over 8 years to zero book value using the straight-line method. Its current book value is $45,000. Its current market value is $36,000. The new machine costs $180,000. It will be depreciated over 6 years to zero book value using the straight-line method. After its useful life of 10 years it is expected to have a scrap value of $40,000 The new machine will increase Earnings before Depreciation and Taxes by $30,000 per year for 10 years. The company's tax rate is 30% and the appropriate discount rate for this project is 10%. a) List all 11 after-tax cash flows for this project (Year O is the initial investment) b) Compute the NPV. c) Compute the IRR and payback d) Comment on whether the old machine should be replace and explain why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts