Question: need these all multiple choises answer fast please 26. Say you placed an at- market order to buy a quantity of futures contracts. The counterparty

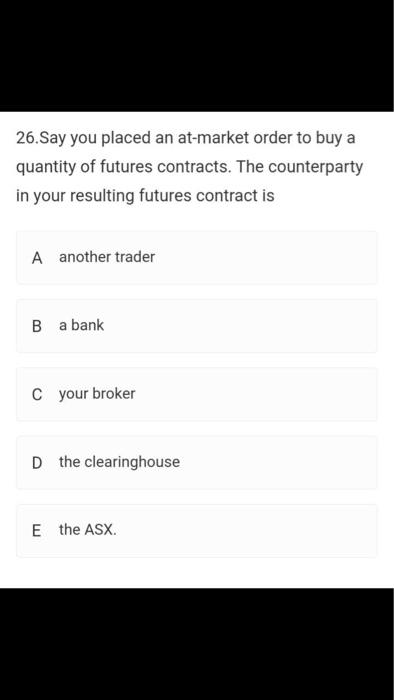

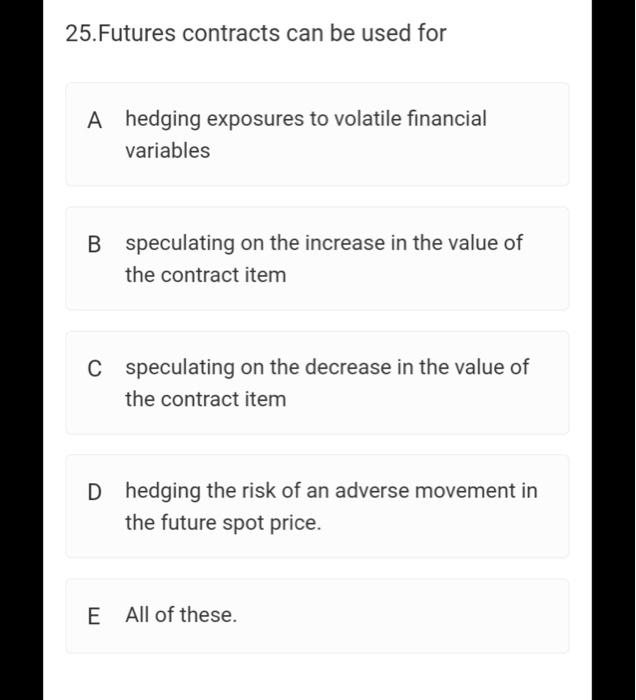

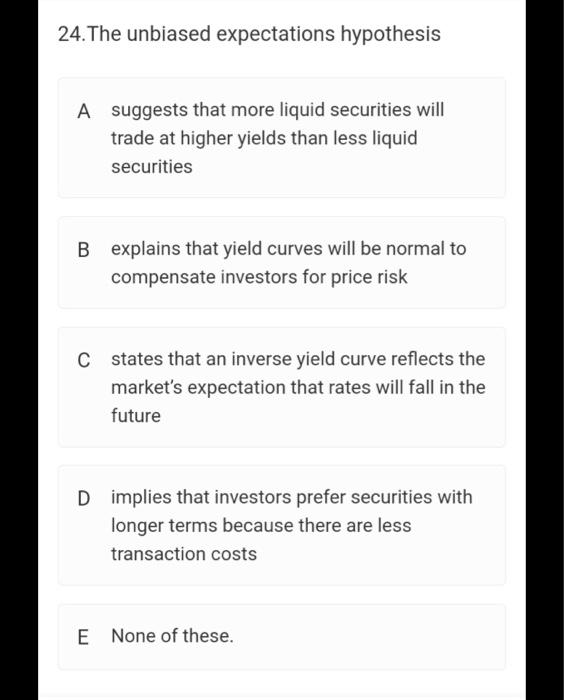

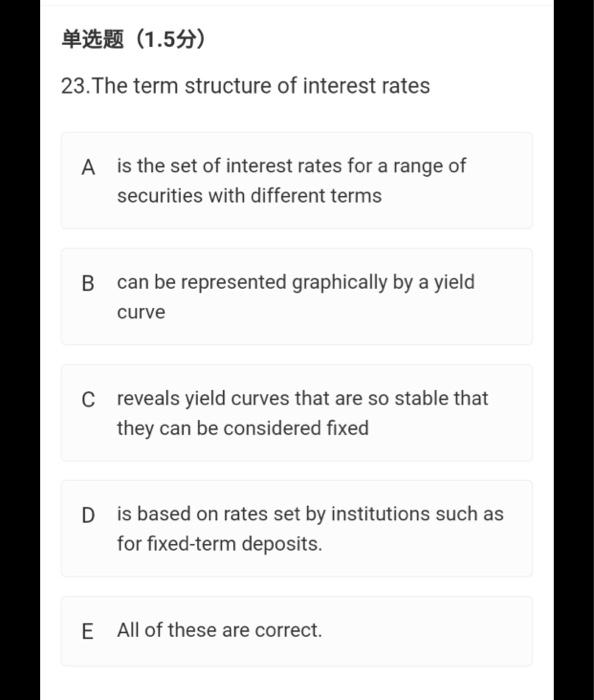

26. Say you placed an at- market order to buy a quantity of futures contracts. The counterparty in your resulting futures contract is A another trader B a bank C your broker D the clearinghouse E the ASX. 25. Futures contracts can be used for A hedging exposures to volatile financial variables B speculating on the increase in the value of the contract item C speculating on the decrease in the value of the contract item D hedging the risk of an adverse movement in the future spot price. E All of these. 24. The unbiased expectations hypothesis A suggests that more liquid securities will trade at higher yields than less liquid securities B explains that yield curves will be normal to compensate investors for price risk C states that an inverse yield curve reflects the market's expectation that rates will fall in the future D implies that investors prefer securities with longer terms because there are less transaction costs E None of these. (1.547) 23. The term structure of interest rates A is the set of interest rates for a range of securities with different terms B can be represented graphically by a yield curve C reveals yield curves that are so stable that they can be considered fixed D is based on rates set by institutions such as for fixed-term deposits. E All of these are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts