Question: need this all answered (its all one question) For example, if you know that the real rate of interest is 5% and it is expected

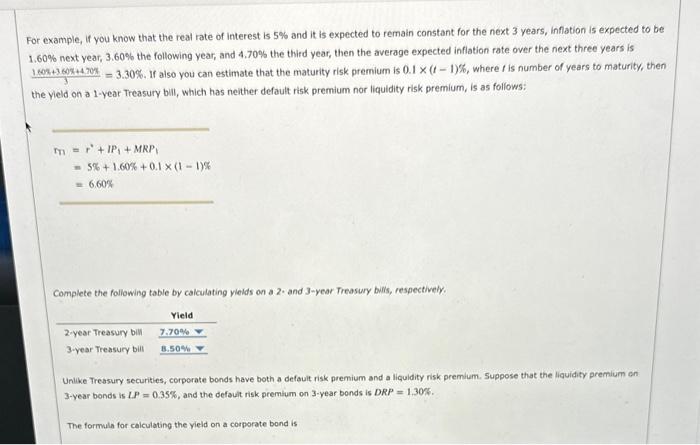

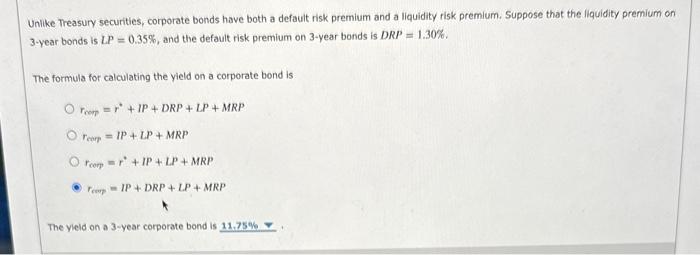

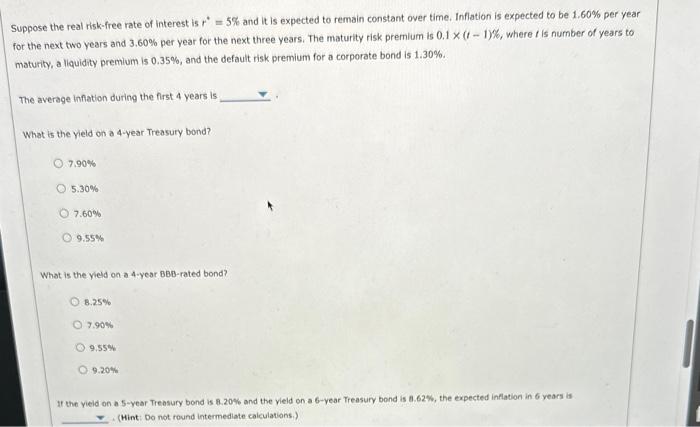

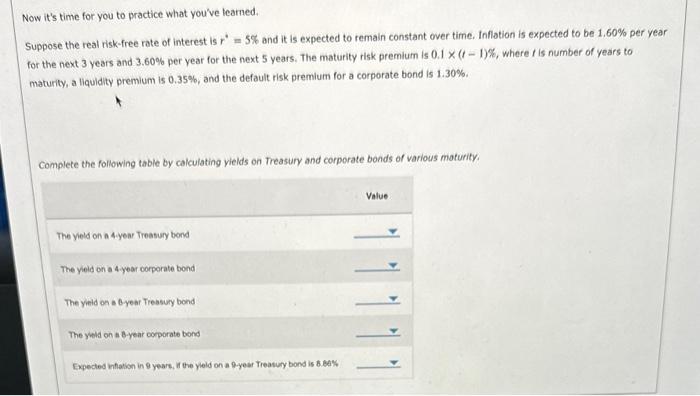

For example, if you know that the real rate of interest is 5% and it is expected to remain constant for the next 3 years, inflation is expected to be 1.60% next year, 3.60% the following year, and 4.70% the third year, then the average expected inflation rate over the next three years is 3160x+3cosx+470x=3.30%. If also you can estimate that the maturity risk premium is 0.1(t1)%, where t is number of years to maturity, then the yield on a 1-year Treasury bill, which has neither default risk premium nor liquidity risk premium, is as follows: m=r2+IP1+MRP1=5%+1.60%+0.1(11)%=6.60% Complete the following table by calculating vields on a 2- and 3-year Treasury bilis, respectively. Unike Treasury securities, corporate bonds have both a defoult risk premium and a liquidity risk premium. Suppose that the liquidity premium on 3-year bonds is LP=0.35%, and the defouit risk premlum on 3-year bonds is DRP=1.30%. The formula for calculating the yield on a corporate bond is Unlike Treasury securities, corporate bonds have both a default risk premium and a liquidity risk premlum. Suppose that the liquidity premium on 3-year bonds is LP=0.35%, and the default risk premium on 3 -year bonds is DRP=1.30%. The formula for calculating the yield on a corporate bond is rnop=r+IP+DRP+LP+MRPreop=IP+LP+MRPrcop=r+IP+LP+MRPrceop=IP+DRP+LP+MRP The yleid on a 3-year corporate bond is Suppose the real risk-free rate of interest is r=5% and it is expected to remain constant over time. Inflation is expected to be 1.60% per year for the next two years and 3.60% per year for the next three years. The maturity risk premlum is 0.1(t1)%, where t is number of years to maturity, a liquidity premium is 0.35%, and the default risk premium for a corporate bond is 1.30%. The average inflation during the first 4 years is What is the yield on a 4-year Treasury bond? 7.90%5.30%7.60%9.55% What is the yield on a 4-year BBB-rated bond? 8.25% 7.90% 9.55% 9.204 It the vieid on a 5 -year Treasury bond is 8.20% and the yield on a 6 -year Treasury bond is 8.62%, the expected inflation in 6 years is (Hint: Do not round intermediate calculations.) Now it's time for you to practice what you've leamed. Suppose the real risk-free rate of interest is r=5% and it is expected to remain constant over time. Inflotion is expected to be 1,60% per year for the next 3 years and 3.60% per year for the next 5 years, The maturity risk premium is 0.1(t1)%, where t is number of years to maturity, a liquidity premium is 0.35%, and the default risk premium for a corporate bond is 1.30%. Complete the following table by calculating yields on Treasury and corporate bonds of various moturity

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we will calculate the yields for the various Treasury and corporate bonds using the given formulas Lets break down the solution ... View full answer

Get step-by-step solutions from verified subject matter experts