Question: Need This Answer ASAP. ( emergency) Q1. (a) Explain the relationship among interest rates on bonds of different maturities reflected in yield curve patterns by

Need This Answer ASAP. ( emergency)

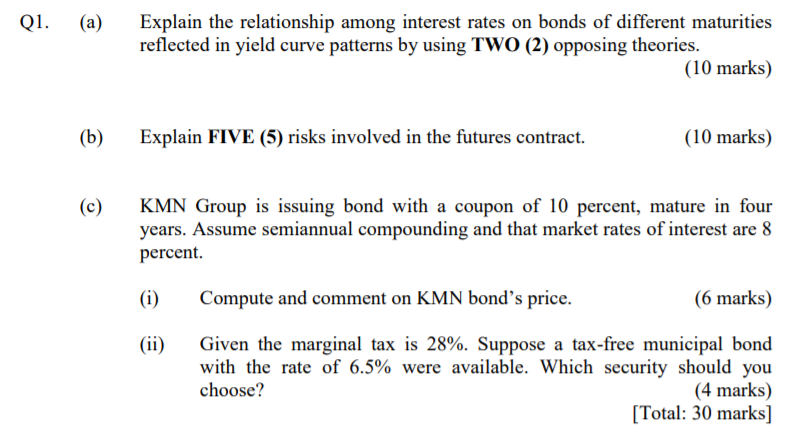

Q1. (a) Explain the relationship among interest rates on bonds of different maturities reflected in yield curve patterns by using TWO (2) opposing theories. (10 marks) (b) Explain FIVE (5) risks involved in the futures contract. (10 marks) (c) KMN Group is issuing bond with a coupon of 10 percent, mature in four years. Assume semiannual compounding and that market rates of interest are 8 percent (i) Compute and comment on KMN bond's price. (6 marks) (ii) Given the marginal tax is 28%. Suppose a tax-free municipal bond with the rate of 6.5% were available. Which security should you choose? (4 marks) [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts