Question: need this asap please please note this one question i. calculate the following ratios using the Financial Statements attached. - Profitability (Return on equity; Operating

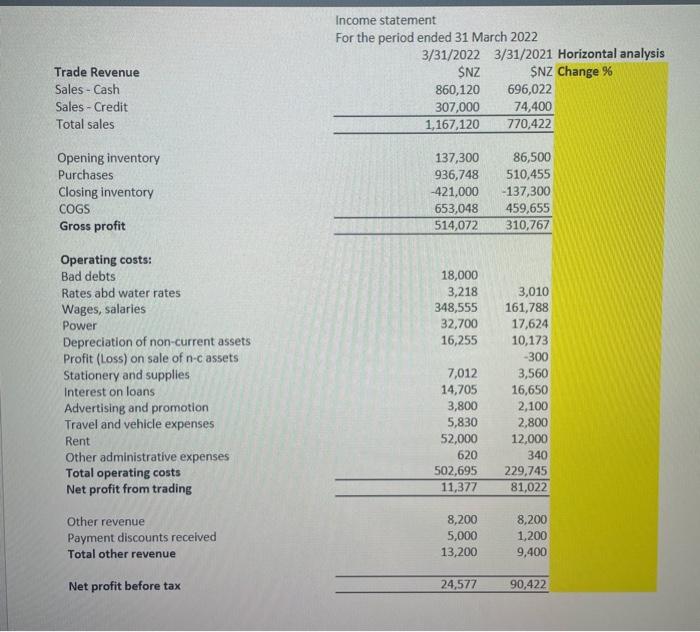

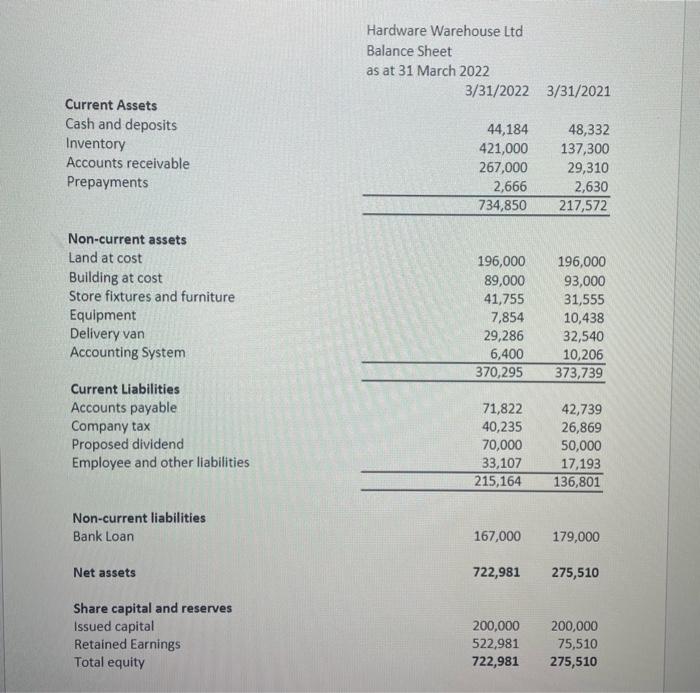

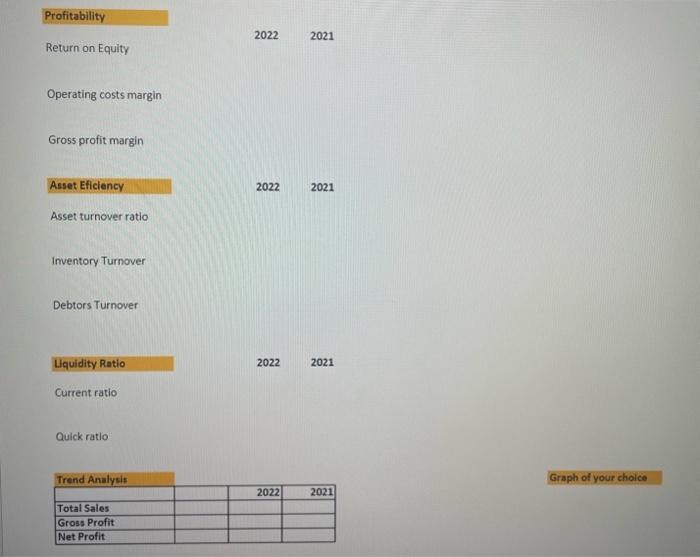

i. calculate the following ratios using the Financial Statements attached. - Profitability (Return on equity; Operating costs margin; Gross profit margin) - Asset efficiency (Asset turnover ratio; Inventory Tumover; Debtors Turnover) - Liquidity (Current ratio; Quick ratio) ii. perform trend analysis for Total Sales, Gross Profit, Net Profit before tax with a graph of your choice. iii. Perform horizontal analysis for the Income Statement. Income statement For the period ended 31 March 2022 Trade Revenue 3/31/20223/31/2021 Horizontal analysis Sales-Cash Sales-Credit Total sales Opening invento Purchases Closing invent COGS Gross profit Operating costs: Bad debts Rates abd water rates Wages, salaries Power Depreciation of non-current assets Profit (Loss) on sale of nc assets Stationery and supplies Interest on loans Advertising and promotion Travel and vehicle expenses Rent Other administrative expenses Total operating costs Net profit from trading Other revenue Payment discounts receh Total other revenue Net profit before tax Hardware Warehouse Ltd Balance Sheet as at 31 March 2022 Current Assets Cash and deposits Inventory 3/31/20223/31/2021 Accounts receivable Prepayments Current Liabilities Accounts payable Company tax Proposed dividend Employee and other liabilities Non-current liabilities Bank Loan 167,000179,000 Net assets 722,981275,510 Share capital and reserves Issued capital Retained Earnings Total equity \begin{tabular}{rr} 196,000 & 196,000 \\ 89,000 & 93,000 \\ 41,755 & 31,555 \\ 7,854 & 10,438 \\ 29,286 & 32,540 \\ 6,400 & 10,206 \\ \hline 370,295 & 373,739 \\ \hline & \\ \hline 11,822 & 42,739 \\ 40,235 & 26,869 \\ 70,000 & 50,000 \\ 33,107 & 17,193 \\ \hline 215,164 & 136,801 \\ \hline \end{tabular} Profitability Return on Equity 20222021 Operating costs margin Gross profit margin Asset Eficiency 20222021 Asset turnover ratio Inventory Turnover Debtors Turnover Liquidity Ratio 20222021 Current ratio Quick ratio Trend Analysis \begin{tabular}{|l|l|l|l|} \hline & & 2022 & 2021 \\ \hline Total Sales & & & \\ \hline Gross Profit & & & \\ \hline Net Profit & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts