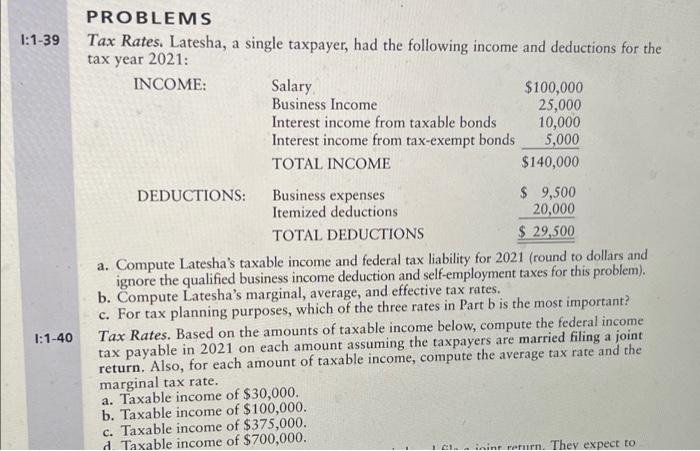

Question: Need this problems answer in this excel format. 1:1-39 PROBLEMS Tax Rates. Latesha, a single taxpayer, had the following income and deductions for the tax

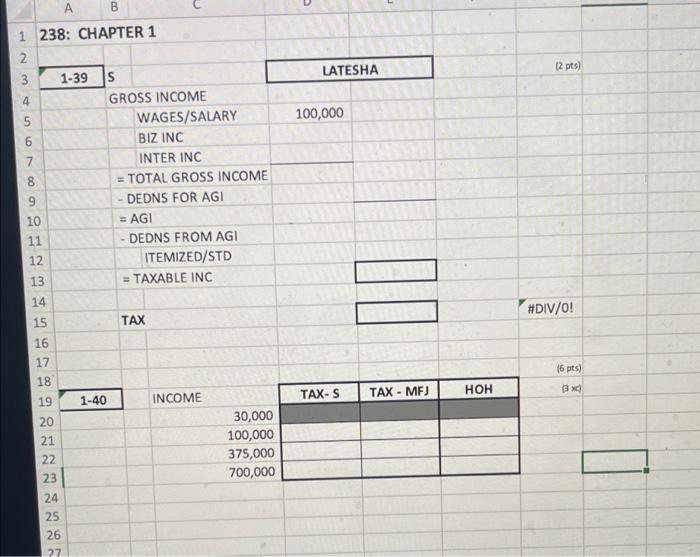

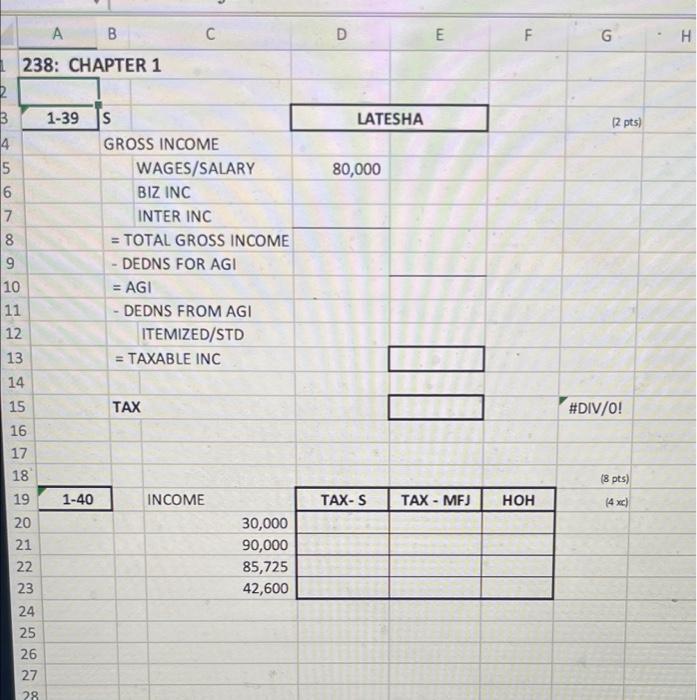

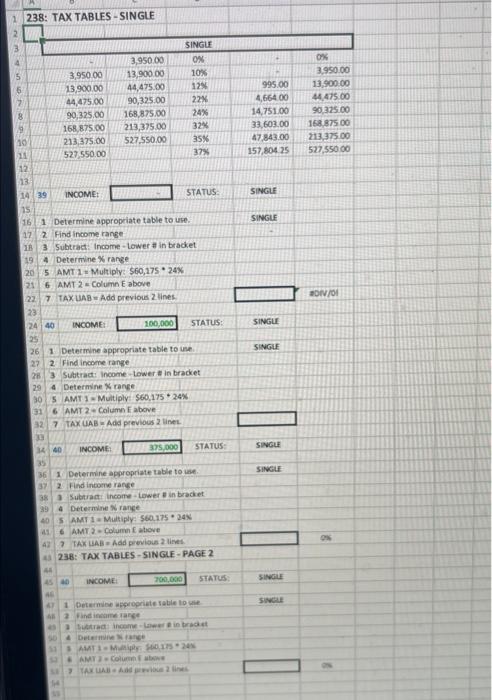

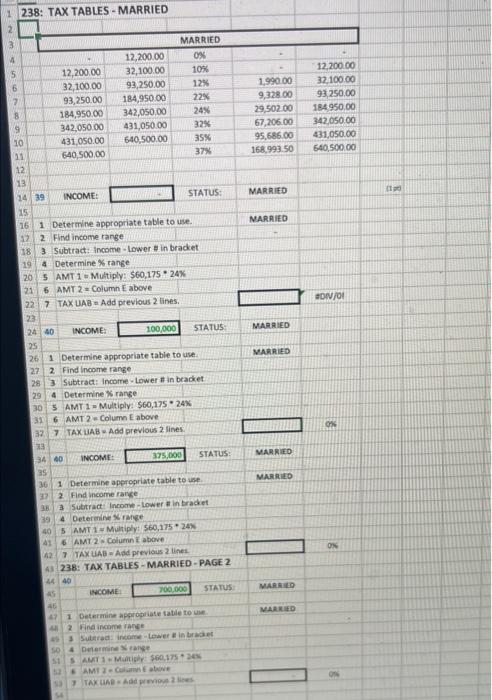

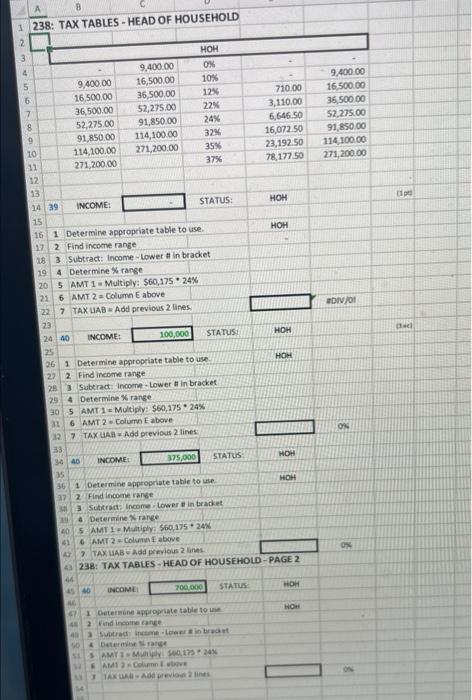

1:1-39 PROBLEMS Tax Rates. Latesha, a single taxpayer, had the following income and deductions for the tax year 2021: INCOME: Salary $100,000 Business Income 25,000 Interest income from taxable bonds 10,000 Interest income from tax-exempt bonds 5,000 TOTAL INCOME $140,000 DEDUCTIONS: Business expenses $ 9,500 Itemized deductions 20,000 TOTAL DEDUCTIONS $ 29,500 a. Compute Latesha's taxable income and federal tax liability for 2021 (round to dollars and ignore the qualified business income deduction and self-employment taxes for this problem). b. Compute Latesha's marginal, average, and effective tax rates. c. For tax planning purposes, which of the three rates in Part b is the most important? Tax Rates. Based on the amounts of taxable income below, compute the federal income tax payable in 2021 on each amount assuming the taxpayers are married filing a joint return. Also, for each amount of taxable income, compute the average tax rate and the marginal tax rate. a. Taxable income of $30,000. b. Taxable income of $100,000. c. Taxable income of $375,000. d Taxable income of $700,000. 10. ininn maturn. They expect to 1:1-40 a B B 1 238: CHAPTER 1 2 1-39 12 pts) S LATESHA 4 100,000 5 6 7 00 8 GROSS INCOME WAGES/SALARY BIZ INC INTER INC = TOTAL GROSS INCOME - DEDNS FOR AGI = AGI DEDNS FROM AGI ITEMIZED/STD = TAXABLE INC 9 1 10 11 12 HO 13 14 #DIV/0! TAX 15 16 17 18 19 (6 pts) DO TAX - MF) TAX-S HOH 3) INCOME 1-40 20 30,000 100,000 375,000 700,000 21 22 23 24 25 26 27 B C D m F F G H 238: CHAPTER 1 1-39 S LATESHA 12 pts) 4 5 16 7 80,000 00 9 GROSS INCOME WAGES/SALARY BIZ INC INTER INC = TOTAL GROSS INCOME - DEDNS FOR AGI = AGI - DEDNS FROM AGI ITEMIZED/STD = TAXABLE INC 9 10 11 12 13 II G TAX #DIV/0! (8 pts) 1-40 INCOME TAX-S TAX - MFJ HOH (4x) 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 30,000 90,000 85,725 42,600 995.00 4,664 00 14,751.00 33,603.00 47,843.00 157,80425 OX 3.950.00 13 900.00 44.475.00 90.325.00 168.875.00 213.375.00 527,550.00 SINGLE 1 238: TAX TABLES - SINGLE 2 SINGLE 4 3.950.00 ON 5 3.950.00 13,900.00 10% 6 13,900.00 44,475.00 128 2 44,475.00 90,325.00 22 90,325.00 168.875.00 24% 9 168.875.00 213,375.00 32% 00 213,375.00 527,550.00 35% 11 527,550.00 37% 12 13 1439 INCOME STATUS 15 1611 Determine appropriate table to use 12 2 Find income range 13 Subtract: Income - Lower in bracket 19 4 DetermineX range 20 5 AMT 1 Multiply: $60,275 24% 21 6 AMT 2 Column E above 22 7 TAX UAB Add previous 2 lines 23 2440 INCOME 100,000 STATUS: 25 26 1 Determine appropriate table to 27 2 Find income range 253 Subtract: Income Lower in bracket 29 4 Determine range 30 SAMT 1 Multiply: $60,175.24% 31 6 AMT 2 Column above 327 TAX UAB Add previous 2 line SINGLE ON/01 SINGLE SINGLE SINGU SINGLE 14 40 INCOME 375.000 STATUS: 35 36 1 Determine appropriate table to use 37 2 Find income range 38 Subtract: income Lower in bracket 29 4 Determine range 405 AMT 1 Multiply: $60.175.24 6 AMT 2 Column Eatove 42 7 TAK LAB Add previous 2 lines 238: TAX TABLES - SINGLE - PAGE 2 INCOME 200,000 STATUS SINGLE SINGLE 1 Detare proprietatile 2 indemerance tra income in Dean AMTI MS1720 AM Coluwe TAXA is 1.990.00 9,328.00 29,502.00 67,206,00 95,686.00 168.993.50 12,200.00 32,100.00 93,250.00 184 950.00 342.050.00 431,050.00 640,500.00 MARRIED 10 MARRIED #DIV/OI 1 238: TAX TABLES - MARRIED 2 3 MARRIED 4 12,200.00 ON 5 12,200.00 32,100.00 10% 6 32,100.00 93,250.00 12% 2 93,250.00 184,950.00 22% 8 184,950.00 342,050.00 24% 19 342,050.00 431,050.00 325 10 431,050.00 640,500.00 35% 21 640, 500,00 37% 12 13 14 39 INCOME: STATUS: 15 16 1 Determine appropriate table to use. 12 2 Find income range 18 3 Subtract: Income Lower in bracket 19 4 DetermineX range 20 SAMT 1 Multiply: $60,175 24% 21 6 AMT 2 Column E above 227 TAX LIAB Add previous 2 lines. 23 2440 INCOME 100,000 STATUS 25 26 1 Determine appropriate table to use 27 2 Find income range 283 Subtract: Income - Lower # in bracket 29 4 DetermineX range 30 5 AMT 1 = Multiply: $60,175.24% 36 AMT 2 Column E above 32 7 TAX UAB Add previous 2 Sines 13 34 40 INCOME: 375.000 STATUS 35 36 1 Determine appropriate table to use 22 2 Find income range 33 Subtract: Income - Lower in bracket 394 Determine range 40 5 AMT 1 Multiply: 560,175 24 41 6 AMY 2 Column above 42 7 TAX UAB - Add previous 2 lines 4238: TAX TABLES - MARRIED - PAGE 2 44 40 INCOME 700.000 STATUS MARRIED MARRIED ON MARRIED MARRIED ON MARRIED MARKED 17 1 Determine appropriate table to use 2 Hind income range 3 Sutra income Lower in brace Determine tage SAMT 1 Multiply $60,1753 AM Combo STAX AB Adrs 2lines ON B 1 238: TAX TABLES - HEAD OF HOUSEHOLD 9,400.00 16,500.00 36,500.00 52,275.00 91,850.00 114,100.00 271,200.00 9,400.00 16,500.00 36,500.00 52,275.00 91,850.00 114,100.00 271,200.00 HOH OX 10% 12 22 24% 32 35% 37% 710.00 3,110,00 6,646.50 16,072,50 23,192.50 78 177.50 9.400.00 16.500.00 36,500.00 52.275.00 91.850.00 114,100.00 271,200.00 8. DO 10 11 12 HOH DIV/0 14 39 INCOME: STATUS: 15 16 1 Determine appropriate table to use 17 2 Find income range 18 3 Subtract: Income - Lower # in bracket 19 4 Determine range 20 5 AMT 1 Multiply: $60,175.24% 23 6 AMT 2 Column E above 22 7 TAX UAB - Add previous 2 lines. 23 2440 INCOME: 100,000 STATUS: 25 26 1 Determine appropriate table to use 27 2 Find income range 28 Subtract: Income-Lower in bracket 29 4 Determine range 30 5 AMT 1 Multiply: $60,175 24% 3 6 AMT 2 Column E above 112 7 TAX UAB Add previous 2 lines HOH HOH os 34 40 INCOME 375,000 STATUS HOH 35 36 1 Determine appropriate table to use HOH 37 2 Find income range 3 Suttrad income Lower in bracket 4 Determine range 405 AMTL Multiply: 560, 175 24 6 AMT 2 Column above 7 TAX UAB Add previous 2 lines 4 238: TAX TABLES - HEAD OF HOUSEHOLD - PAGE 2 44 INCOME 700.000 STATUS HOW OX No 1 Determine appropriate table to 2 Wind income tange Sincelerinde & Den SAMTIM S0017324 AMI Column 1 TAXA previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts