Question: NEED THIS SOLUTION ASAP I WILL UPVOTE U A four-year-old truck has a present net realizable value of $5,500 and is now expected to have

NEED THIS SOLUTION ASAP I WILL UPVOTE U

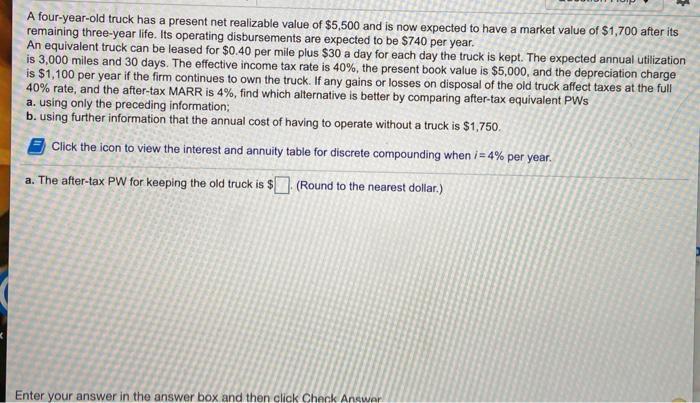

A four-year-old truck has a present net realizable value of $5,500 and is now expected to have a market value of $1,700 after its remaining three-year life. Its operating disbursements are expected to be $740 per year. An equivalent truck can be leased for $0.40 per mile plus $30 a day for each day the truck is kept. The expected annual utilization is 3,000 miles and 30 days. The effective income tax rate is 40%, the present book value is $5,000, and the depreciation charge is $1,100 per year if the firm continues to own the truck. If any gains or losses on disposal of the old truck affect taxes at the full 40% rate, and the after-tax MARR is 4%, find which alternative is better by comparing after-tax equivalent PWs a. using only the preceding information: b. using further information that the annual cost of having to operate without a truck is $1,750. Click the icon to view the interest and annuity table for discrete compounding when i = 4% per year. a. The after-tax PW for keeping the old truck is $(Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer A four-year-old truck has a present net realizable value of $5,500 and is now expected to have a market value of $1,700 after its remaining three-year life. Its operating disbursements are expected to be $740 per year. An equivalent truck can be leased for $0.40 per mile plus $30 a day for each day the truck is kept. The expected annual utilization is 3,000 miles and 30 days. The effective income tax rate is 40%, the present book value is $5,000, and the depreciation charge is $1,100 per year if the firm continues to own the truck. If any gains or losses on disposal of the old truck affect taxes at the full 40% rate, and the after-tax MARR is 4%, find which alternative is better by comparing after-tax equivalent PWs a. using only the preceding information: b. using further information that the annual cost of having to operate without a truck is $1,750. Click the icon to view the interest and annuity table for discrete compounding when i = 4% per year. a. The after-tax PW for keeping the old truck is $(Round to the nearest dollar.) Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts