Question: need this with work shown please 4. You observe the yields of the following Treasury securities (all yields are shown on a bond-equivalent basis): Year

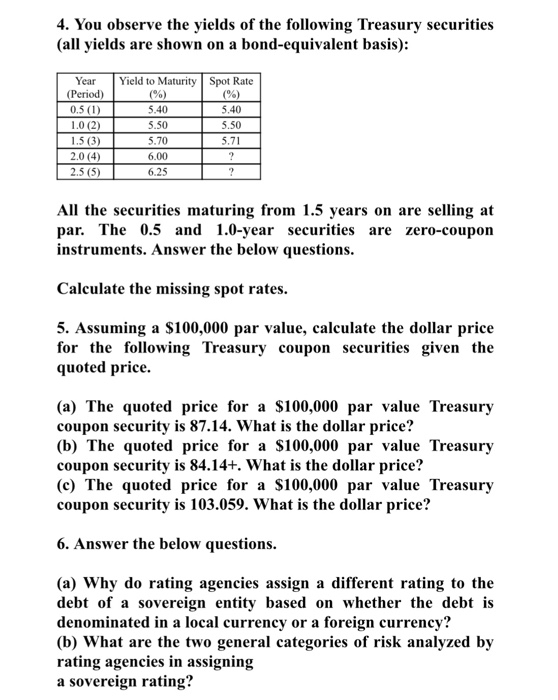

4. You observe the yields of the following Treasury securities (all yields are shown on a bond-equivalent basis): Year Yield to Maturity Spot Rate Period) 1.0 (2) 1.5 (3) 2.0 (4) 2.5 (5) 5.40 5.50 5.70 6.00 6.25 5.40 5.50 5.71 All the securities maturing from 1.5 years on are selling at par. The 0.5 and 1.0-year securities are zero-coupon instruments. Answer the below questions Calculate the missing spot rates 5. Assuming a S100,000 par value, calculate the dollar price for the following Treasury coupon securities given the quoted price. (a) The quoted price for a $100,000 par value Treasury coupon security is 87.14. What is the dollar price? (b) The quoted price for a $100,000 par value Treasury coupon security is 84.14+. What is the dollar price? (c) The quoted price for a S100,000 par value Treasury coupon security is 103.059. What is the dollar price? 6. Answer the below questions. (a) Why do rating agencies assign a different rating to the debt of a sovereign entity based on whether the debt is denominated in a local currency or a foreign currency? (b) What are the two general categories of risk analyzed by rating agencies in assigning a sovereign rating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts