Question: need to be down with python coding, should inlcude: Simulating the Stock Prices Path Asian options : Arithmetic and geometric averages Lookback options (exotic option)

need to be down with python coding, should inlcude:

Simulating the Stock Prices Path

Asian options : Arithmetic and geometric averages Lookback options (exotic option)

Time to Expiry

Conclusion

Or at least please give me some hints step by step how to solve this question. Thank you

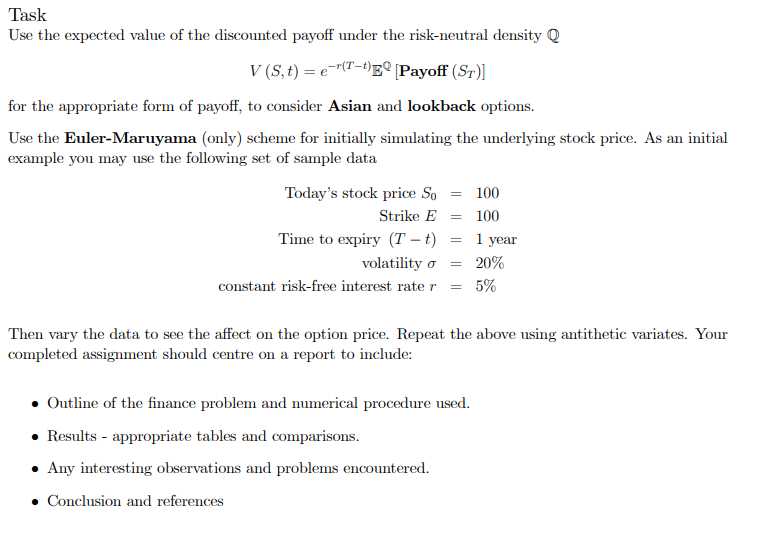

Task Use the expected value of the discounted payoff under the risk-neutral density Q V(S,t)=er(Tt)EQ[Payoff(ST)] for the appropriate form of payoff, to consider Asian and lookback options. Use the Euler-Maruyama (only) scheme for initially simulating the underlying stock price. As an initial example you may use the following set of sample data TodaysstockpriceS0StrikeETimetoexpiry(Tt)volatilityconstantrisk-freeinterestrater=100=100=1year=20%=5% Then vary the data to see the affect on the option price. Repeat the above using antithetic variates. Your completed assignment should centre on a report to include: - Outline of the finance problem and numerical procedure used. - Results - appropriate tables and comparisons. - Any interesting observations and problems encountered. - Conclusion and references Task Use the expected value of the discounted payoff under the risk-neutral density Q V(S,t)=er(Tt)EQ[Payoff(ST)] for the appropriate form of payoff, to consider Asian and lookback options. Use the Euler-Maruyama (only) scheme for initially simulating the underlying stock price. As an initial example you may use the following set of sample data TodaysstockpriceS0StrikeETimetoexpiry(Tt)volatilityconstantrisk-freeinterestrater=100=100=1year=20%=5% Then vary the data to see the affect on the option price. Repeat the above using antithetic variates. Your completed assignment should centre on a report to include: - Outline of the finance problem and numerical procedure used. - Results - appropriate tables and comparisons. - Any interesting observations and problems encountered. - Conclusion and references

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts