Question: need to design a real case study including all steps of the accounting process (Journal, General Ledger, Trial Balance, Adjusting entries, closing entries, the income

need to design a real case study including all steps of the accounting process (Journal, General Ledger, Trial Balance, Adjusting entries, closing entries, the income statement, and the Balance sheet).

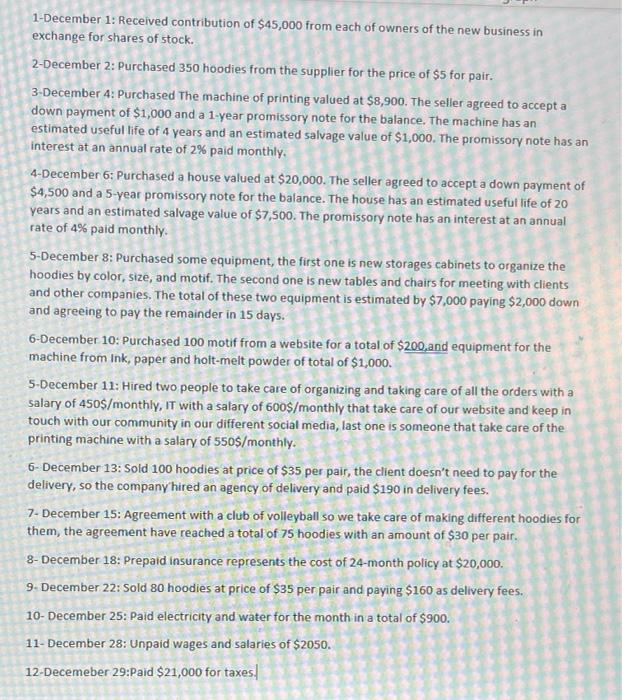

1-December 1: Received contribution of $45,000 from each of owners of the new business in exchange for shares of stock. 2-December 2: Purchased 350 hoodies from the supplier for the price of $5 for pair. 3-December 4: Purchased the machine of printing valued at $8,900. The seller agreed to accept a down payment of $1,000 and a 1-year promissory note for the balance. The machine has an estimated useful life of 4 years and an estimated salvage value of $1,000. The promissory note has an interest at an annual rate of 2% paid monthly 4-December 6: Purchased a house valued at $20,000. The seller agreed to accept a down payment of $4,500 and a 5-year promissory note for the balance. The house has an estimated useful life of 20 years and an estimated salvage value of $7,500. The promissory note has an interest at an annual rate of 4% paid monthly 5-December 8: Purchased some equipment, the first one is new storages cabinets to organize the hoodies by color, size, and motif. The second one is new tables and chairs for meeting with clients and other companies. The total of these two equipment is estimated by $7,000 paying $2,000 down and agreeing to pay the remainder in 15 days. 6-December 10: Purchased 100 motif from a website for a total of $200 and equipment for the machine from Ink, paper and holt-melt powder of total of $1,000 5-December 11: Hired two people to take care of organizing and taking care of all the orders with a salary of 450$/monthly, it with a salary of 600$/monthly that take care of our website and keep in touch with our community in our different social media, last one is someone that take care of the printing machine with a salary of 550$/monthly. 6- December 13: Sold 100 hoodies at price of $35 per pair, the client doesn't need to pay for the delivery, so the company hired an agency of delivery and paid $190 in delivery fees. 7- December 15: Agreement with a club of volleyball so we take care of making different hoodies for them, the agreement have reached a total of 75 hoodies with an amount of $30 per pair. 8- December 18: Prepaid Insurance represents the cost of 24-month policy at $20,000 9. December 22: Sold 80 hoodies at price of $35 per pair and paying $160 as delivery fees. 10- December 25: Paid electricity and water for the month in a total of $900. 11- December 28: Unpaid wages and salaries of $2050. 12-Decemeber 29:Paid $21,000 for taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts