Question: NEED TO DO ONLY QUESTION 1 AND QUESTION 2 12:31 Project Timing 1. Analysis Start: 12/31/22 2. Predevelopment: 12 months 3. Construction: 24 months 4.

NEED TO DO ONLY QUESTION 1 AND QUESTION 2

NEED TO DO ONLY QUESTION 1 AND QUESTION 2

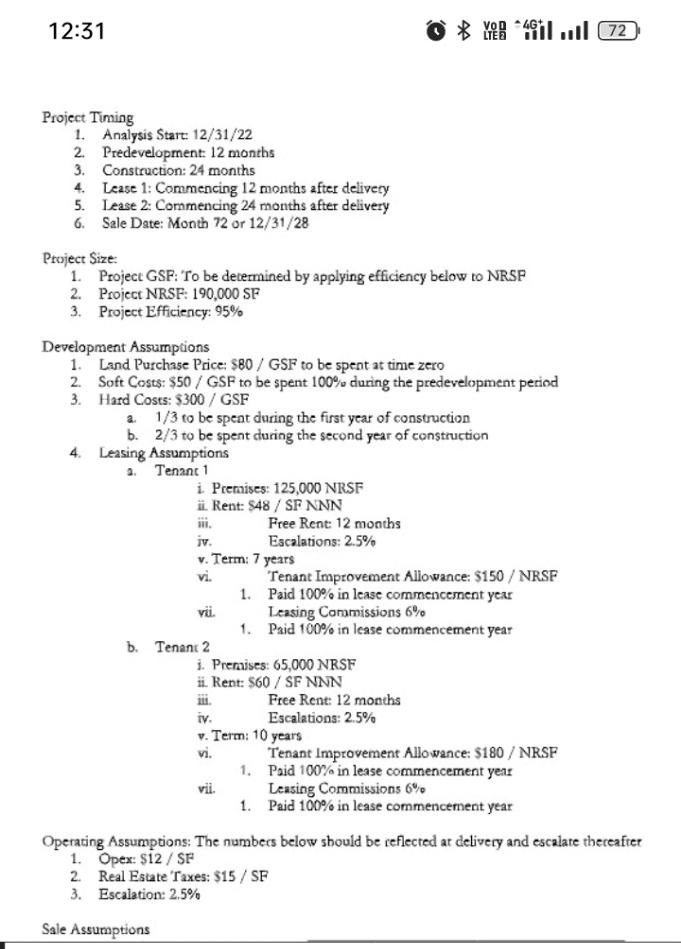

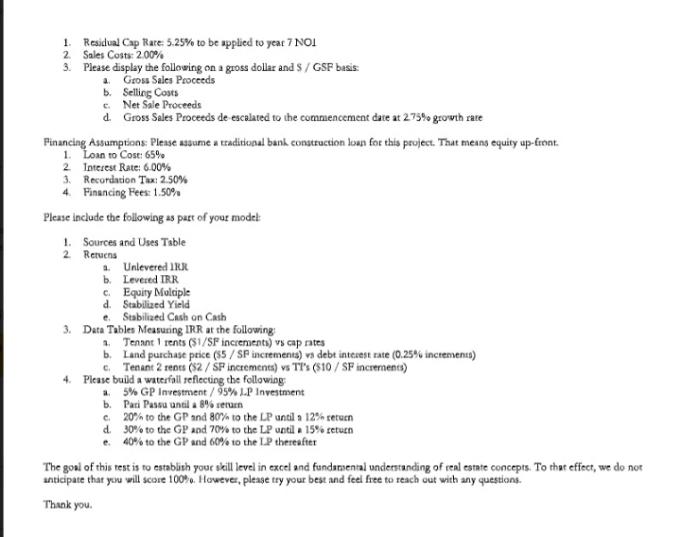

12:31 Project Timing 1. Analysis Start: 12/31/22 2. Predevelopment: 12 months 3. Construction: 24 months 4. Lease 1: Commencing 12 months after delivery 5. Lease 2: Commencing 24 months after delivery 6. Sale Date: Month 72 or 12/31/28 Project Size: 1. Project GSF: To be determined by applying efficiency below to NRSP 2. Project NRSF: 190,000 SP 3. Project Efficiency: 95% Development Assumptions 1. Land Purchase Price: $80/GSF to be spent at time zero 2. Soft Costs: $50/ GSF to be spent 100% during the predevelopment period 3. Hard Costs: $300/ GSF 2. 1/3 to be speat during the first year of construction b. 2/3 to be spent during the second year of construction 4. Leasing Assumptions 2. Tenanc 1 i. Premises: 125,000 NRSF ii. Rent: $48 / SF NNN iii. Free Rent: 12 months iv. Escalations: 2.5% v. Term: 7 years vi. Tenant Improvement Allowance: \$150 / NRSF 1. Paid 100% in lease commencement year vii. Leasing Commissions 6% 1. Paid 100% in lease commencement year b. Tenant 2 i. Premises: 65,000 NRSF ii. Rent: $60/ SF NNN iii. Free Rent: 12 monchs iv. Escalations: 2.5% v. Term: 10 years vi. Tenant Improvement Allowance: $180 / NRSF 1. Paid 100% in lease commencement year vii. Leasing Commissions 6% 1. Paid 100% in lease commencement year Operating Assumptions: The numbers below sbould be reflected ar delivery and escalate thereafter 1. Opex: $12/SF 2. Real Estate 'raxes: $15 / SF 3. Escalation: 2.5% 1. Residual Cap Rare: 5.25% to be applied to yeac 7NO 2. Sales Costs: 2.00% 3. Please display the following on a gross dollar and S / GSF basis: a. Gross Sales Proceeds b. Selling Costs c. Net Sale Proceeds d. Gross Sales Proceeds de escalated to the commencement date at 275% growth rate Pinancing Assumptions: Please assume a traditional bank construction loun fot this peoject. That means equity up-ftnat. 1. Loan to Cost: 65% 2. Interest Rate: 6.00% 3. Recordation Tax: 250% 4. Financing Fees 1.50% Please include the following as part of your modet: 1. Sources and Uses Table 2. Retuens a. Unlevered 1Rk b. Levered IRR. c. Equity Molciple d. Stabiliaed Yield e. Stabilized Cash on Cath 3. Data Tables Measuring IRR at the following: 3. Tense 1 rents ( 1/SF inciements) ws cap rates b. Land purchase ptice ( 55/SF increments) ws debt interest rate ( 0.25% increments) c. Tenant 2 rens ( $2/SP increments) vs TP's ($10/SF increments) 4. Please build a waterfall reflecting the following a. 5% GP Investment / 95% L.P Investment b. Pari Passu anell a 8% return c. 20% to the GP and 80% to the LP antil a 12% return d. 30% to the GP and 70% to the LP until a 15% retuen e. 40% to the GP and 60% to the L.P thereafter The goal of this rest is to establith your skill level in excel and fundamental undentanding of real estate concepts. To that effect, we do nor anticipate that you will score 100\%. However, please try your best and feel free to reach out with any questions. Thank you. Please include the following as part of your model: 1. Sources and Uses Table 2. Retuens a. Unlevered IRR b. Levered IRR c. Equity Muldiple d. Stabilized Yield e. Stabilized Cash on Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts