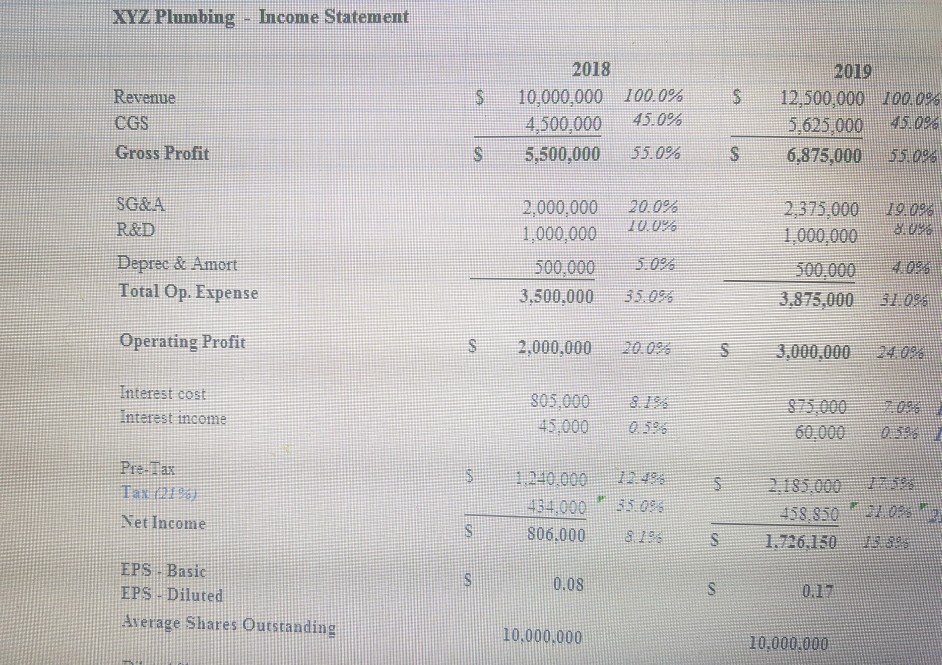

Question: Need to find solutions for sections highlighted in yellow fields. XYZ Plumbing - Income Statement 2018 $ Revenue CGS 10,000,000 4.500.000 5,500,000 100.0% 45.0% 55.0%

Need to find solutions for sections highlighted in yellow fields.

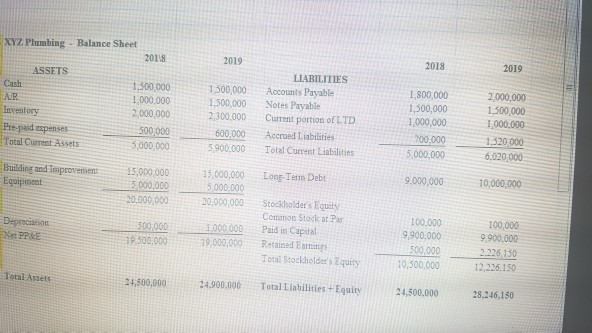

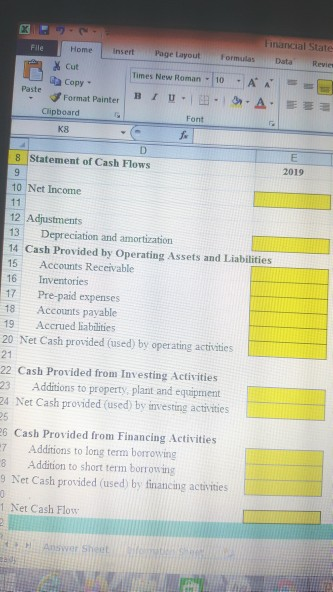

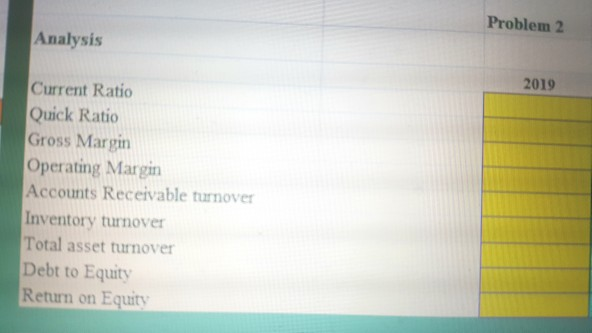

XYZ Plumbing - Income Statement 2018 $ Revenue CGS 10,000,000 4.500.000 5,500,000 100.0% 45.0% 55.0% 2019 12,500,000 100.0% 5.625.000 45.0% 6,875,000 55.096 GA 2,000,000 1.000.000 20.09% 10.0% SG&A R&D Deprec & Amort Total Op. Expense 2,375.000 20.096 1.000.000 = 8095 500.000 4.095 3.875,000 31.095 500,000 3.500.000 35.07 Operating Profit 2,000,000 20.005 S 3 ,000,000 24.096 Interest cost Interest income 305.000 45.000039 60.000039 Premax Tax 5 : 240.000 134.000 806.000 72 3.505 819 Net Income 7185.000 458.950 21.00 1.726,150 $8.5 0.08 EPS - Basic EPS - Dilured Average Shares Outstandin 0.17 10.000.000 10.000.000 XYZ Plumbing - Balance Sheet 2018 2019 2018 2019 ASSETS Cash AR Inventory Pre-paid expenses Total Current Assets 1,500,000 1.000.000 2,000,000 500000 3,000,000 1,500,000 1.500,000 2,300,000 600,000 5 900.000 LIABILITIES Accounts Payable Notes Payable Current portion of LTD Accrued Liabilities Total Current Liabilities 1.800,000 1,500,000 1,000,000 700.000 5.000.000 2.000.000 1.500.000 1.000.000 1.520.000 6.020 000 Building and Improvement Equipment 15,000,000 5.000.000 20.000.000 15.000.000 5.000.000 Long Term Debt 9.000,000 10,000,000 Depreciation APPLE 500.000 19.500.000 1.000.000 19.000.000 Corrion Stock at Par Paid in Capital Retained Earn Total Stockholders Equity 100.000 9.900.000 500.000 10.500.000 100,000 9.900.000 2.226.150 12,226.150 Total Assets 24,500,000 24.900.000 Total Liabilities - Equity 24,500.000 28.246.130 Financial State File Home insert Page Layout Formulas X Cut Times New Roman - 10 - A e Copy RT U- - Paste Format Painter Clipboard 8 Statement of Cash Flows 2019 10 Net Income 11 12 Adjustments Depreciation and amortization 14 Cash Provided by Operating Assets and Liabilities 15 Accounts Receivable 16 Inventories 17 Pre-paid expenses 18 Accounts payable 19 Accrued liabilities 20 Net Cash provided (used) by operating activities 21 22 Cash Provided from Investing Activities 23 Additions to property, plant and equipment 24 Net Cash provided (used) by investing activities 25 16 Cash Provided from Financing Activities 7 Additions to long term borrowing 8 Addition to short term borrowing 9 Net Cash provided (used) by financing activities Net Cash Flow WS PL Problem 2 Analysis 2019 Current Ratio Quick Ratio Gross Margin Operating Margin Accounts Receivable turnover Inventory turnover Total asset turnover Debt to Equity Return on Equity XYZ Plumbing - Income Statement 2018 $ Revenue CGS 10,000,000 4.500.000 5,500,000 100.0% 45.0% 55.0% 2019 12,500,000 100.0% 5.625.000 45.0% 6,875,000 55.096 GA 2,000,000 1.000.000 20.09% 10.0% SG&A R&D Deprec & Amort Total Op. Expense 2,375.000 20.096 1.000.000 = 8095 500.000 4.095 3.875,000 31.095 500,000 3.500.000 35.07 Operating Profit 2,000,000 20.005 S 3 ,000,000 24.096 Interest cost Interest income 305.000 45.000039 60.000039 Premax Tax 5 : 240.000 134.000 806.000 72 3.505 819 Net Income 7185.000 458.950 21.00 1.726,150 $8.5 0.08 EPS - Basic EPS - Dilured Average Shares Outstandin 0.17 10.000.000 10.000.000 XYZ Plumbing - Balance Sheet 2018 2019 2018 2019 ASSETS Cash AR Inventory Pre-paid expenses Total Current Assets 1,500,000 1.000.000 2,000,000 500000 3,000,000 1,500,000 1.500,000 2,300,000 600,000 5 900.000 LIABILITIES Accounts Payable Notes Payable Current portion of LTD Accrued Liabilities Total Current Liabilities 1.800,000 1,500,000 1,000,000 700.000 5.000.000 2.000.000 1.500.000 1.000.000 1.520.000 6.020 000 Building and Improvement Equipment 15,000,000 5.000.000 20.000.000 15.000.000 5.000.000 Long Term Debt 9.000,000 10,000,000 Depreciation APPLE 500.000 19.500.000 1.000.000 19.000.000 Corrion Stock at Par Paid in Capital Retained Earn Total Stockholders Equity 100.000 9.900.000 500.000 10.500.000 100,000 9.900.000 2.226.150 12,226.150 Total Assets 24,500,000 24.900.000 Total Liabilities - Equity 24,500.000 28.246.130 Financial State File Home insert Page Layout Formulas X Cut Times New Roman - 10 - A e Copy RT U- - Paste Format Painter Clipboard 8 Statement of Cash Flows 2019 10 Net Income 11 12 Adjustments Depreciation and amortization 14 Cash Provided by Operating Assets and Liabilities 15 Accounts Receivable 16 Inventories 17 Pre-paid expenses 18 Accounts payable 19 Accrued liabilities 20 Net Cash provided (used) by operating activities 21 22 Cash Provided from Investing Activities 23 Additions to property, plant and equipment 24 Net Cash provided (used) by investing activities 25 16 Cash Provided from Financing Activities 7 Additions to long term borrowing 8 Addition to short term borrowing 9 Net Cash provided (used) by financing activities Net Cash Flow WS PL Problem 2 Analysis 2019 Current Ratio Quick Ratio Gross Margin Operating Margin Accounts Receivable turnover Inventory turnover Total asset turnover Debt to Equity Return on Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts