Question: Need to know how to do formula for exam! thanks 3. Suppose only four assets exist and the correlation between any two assets is zero.

Need to know how to do formula for exam! thanks

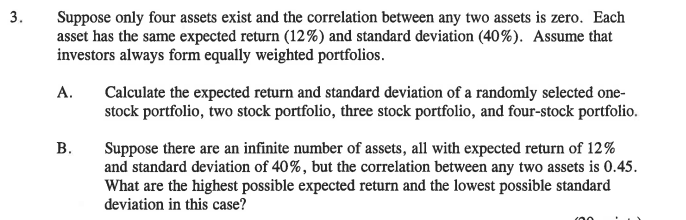

3. Suppose only four assets exist and the correlation between any two assets is zero. Each asset has the same expected return (12%) and standard deviation (40%). Assume that investors always form equally weighted portfolios. A. Calculate the expected return and standard deviation of a randomly selected one- stock portfolio, two stock portfolio, three stock portfolio, and four-stock portfolio. Suppose there are an infinite number of assets, all with expected return of 12% and standard deviation of 40%, but the correlation between any two assets is 0.45. What are the highest possible expected return and the lowest possible standard deviation in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts