Question: Need to know how to find the answer for the two incorrect one [The following information applies to the questions displayed below] The accounting records

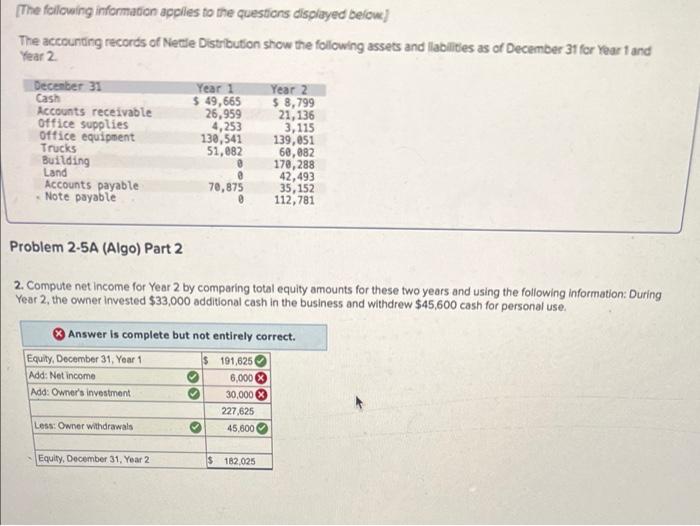

[The following information applies to the questions displayed below] The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and Year 2. December 31 Year 1 Year 2 Cash $49,665 $8,799 Accounts receivable 26,959 21,136 Office supplies 4,253 3,115 130,541 139,051 Office equipment Trucks Building Land 51,082 60,082 170,288 0 42,493 70,875 35,152 Accounts payable -Note payable 112,781 Problem 2-5A (Algo) Part 2 2. Compute net income for Year 2 by comparing total equity amounts for these two years and using the following information: During Year 2, the owner invested $33,000 additional cash in the business and withdrew $45,600 cash for personal use. Answer is complete but not entirely correct. Equity, December 31, Year 1 $ 191,6256 Add: Net income Add: Owner's investment. Less: Owner withdrawals Equity, December 31, Year 201 6,000 X 30,000 227,625 45,600 $ 182,025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts