Question: Need to know the values A. Inventory turnover B. Day's sales outstanding C. Total asset turnover D. Fixed asset turnover E. Total debt ratio F.

Need to know the values

A. Inventory turnover

B. Day's sales outstanding

C. Total asset turnover

D. Fixed asset turnover

E. Total debt ratio

F. Debt-to-equity ratio

G. Times-interest-earned

H. Cash coverage

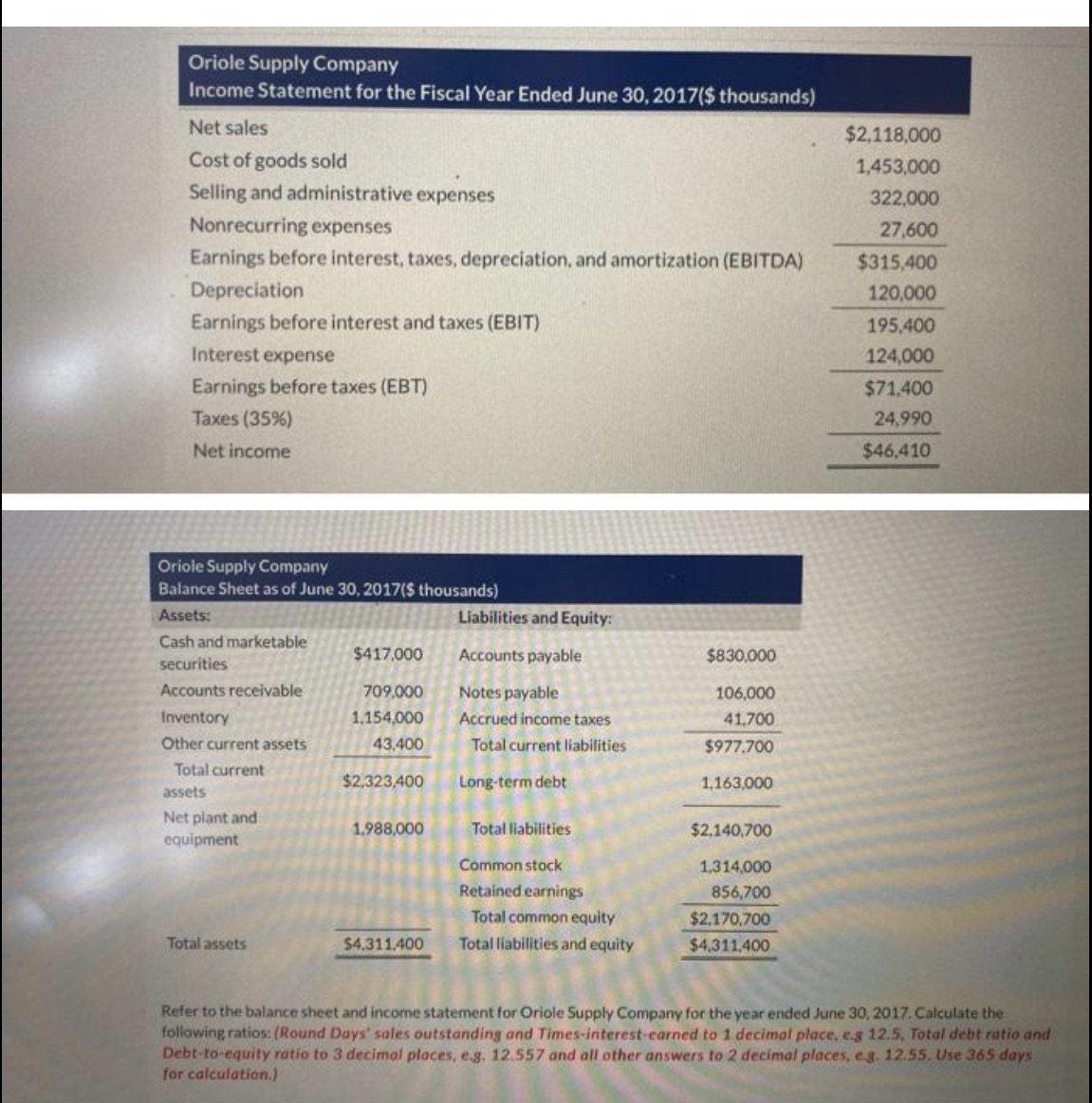

Oriole Supply Company Income Statement for the Fiscal Year Ended June 30, 2017($ thousands) Net sales $2,118,000 Cost of goods sold 1,453,000 Selling and administrative expenses 322,000 Nonrecurring expenses 27,600 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $315,400 Depreciation 120,000 Earnings before interest and taxes (EBIT) 195.400 Interest expense 124,000 Earnings before taxes (EBT) $71,400 Taxes (35%) 24,990 Net income $46,410 Oriole Supply Company Balance Sheet as of June 30, 2017($ thousands) Assets: Liabilities and Equity: Cash and marketable $417,000 Accounts payable $830,000 securities Accounts receivable 709,000 Notes payable 106,000 Inventory 1,154,000 Accrued income taxes 41,700 Other current assets 43,400 Total current liabilities $977.700 Total current $2,323,400 Long-term debt 1,163,000 assets Net plant and 1,988,000 Total liabilities $2,140,700 equipment Common stock 1,314,000 Retained earnings 856,700 Total common equity $2,170.700 Total assets $4,311,400 Total liabilities and equity $4,311,400 Refer to the balance sheet and income statement for Oriole Supply Company for the year ended June 30, 2017. Calculate the following ratios: (Round Days' sales outstanding and Times-interest-earned to 1 decimal place. e.g 12.5, Total debt ratio and Debt-to-equity ratio to 3 decimal places, e.g. 12.557 and all other answers to 2 decimal places, e g. 12.55. Use 365 days for calculation.)

Oriole Supply Company Income Statement for the Fiscal Year Ended June 30, 2017($ thousands) Net sales $2,118,000 Cost of goods sold 1,453,000 Selling and administrative expenses 322,000 Nonrecurring expenses 27,600 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $315,400 Depreciation 120,000 Earnings before interest and taxes (EBIT) 195.400 Interest expense 124,000 Earnings before taxes (EBT) $71,400 Taxes (35%) 24,990 Net income $46,410 Oriole Supply Company Balance Sheet as of June 30, 2017($ thousands) Assets: Liabilities and Equity: Cash and marketable $417,000 Accounts payable $830,000 securities Accounts receivable 709,000 Notes payable 106,000 Inventory 1,154,000 Accrued income taxes 41,700 Other current assets 43,400 Total current liabilities $977.700 Total current $2,323,400 Long-term debt 1,163,000 assets Net plant and 1,988,000 Total liabilities $2,140,700 equipment Common stock 1,314,000 Retained earnings 856,700 Total common equity $2,170.700 Total assets $4,311,400 Total liabilities and equity $4,311,400 Refer to the balance sheet and income statement for Oriole Supply Company for the year ended June 30, 2017. Calculate the following ratios: (Round Days' sales outstanding and Times-interest-earned to 1 decimal place. e.g 12.5, Total debt ratio and Debt-to-equity ratio to 3 decimal places, e.g. 12.557 and all other answers to 2 decimal places, e g. 12.55. Use 365 days for calculation.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts