Question: need to learn how to do this ACCOUNTING 2030 CHAPTER 8 HANDOUT Calculating Bad Debt Expense/Allowance for Doubtful Accounts December 31, 2018, ABC Company prepared

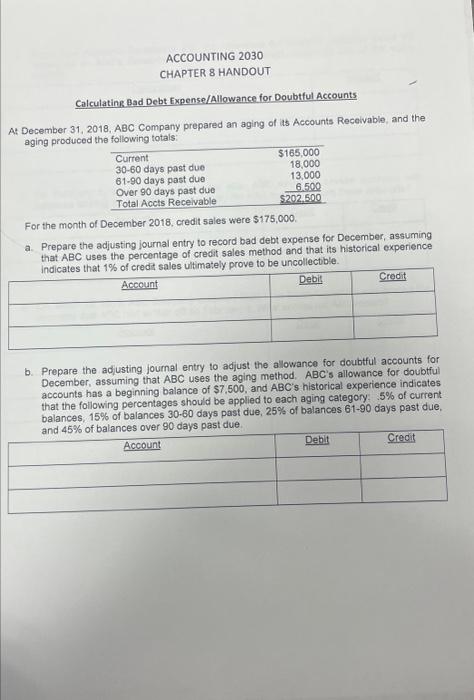

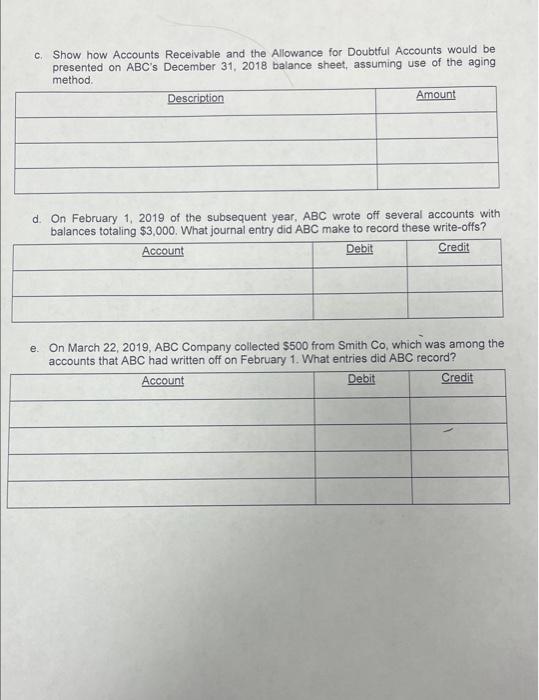

ACCOUNTING 2030 CHAPTER 8 HANDOUT Calculating Bad Debt Expense/Allowance for Doubtful Accounts December 31, 2018, ABC Company prepared an aging of its Accounts Receivable, and the aging produced the following totals: For the month of December 2018, credit sales were $175,000. a. Prepare the adjusting journal entry to record bad debt expense for December, assuming that ABC uses the percentage of credit sales method and that its historical experience tawamiae that 10of eradit sales ultimately prove to be uncollectble. b. Prepare the adjusting joumal entry to adjust the allowance for doubtful accounts for December, assuming that ABC uses the aging method. ABC's allowance for doubtful accounts has a beginning balance of $7,500, and ABC's historical experience indicates that the following percentages should be applied to each aging category. 5% of current balances, 15% of balances 3060 days past due, 25% of balances 6190 days past due, c. Show how Accounts Receivable and the Allowance for Doubtful Accounts would be presented on ABC's December 31, 2018 balance sheet, assuming use of the aging method. d. On February 1, 2019 of the subsequent year, ABC wrote off several accounts with balances totaling $3,000. What journal entry did ABC make to record these write-offs? e. On March 22, 2019, ABC Company collected $500 from Smith Co, which was among the accounts that ABC had written off on February 1. What entries did ABC record

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts