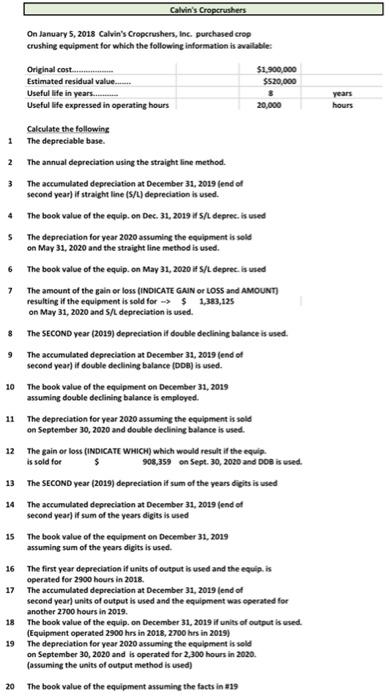

Question: need to solve this problems On lanuary 5, 2018 Calvin's Cropcrushers, lnc. purchased crop crushing equipment for which the following information is available: Calculate the

On lanuary 5, 2018 Calvin's Cropcrushers, lnc. purchased crop crushing equipment for which the following information is available: Calculate the following 1 The depreciable base. 2 The annual depreciation using the straight line method. 3 The accumulated depreciation at December 31, 2019 (ead of second year) if straight line ( 5/h) depreciation is used. 4 The book value of the equip. on Dec. 31, 2019 if 5/ beprec. is used 5 The depreciation for year 2020 assuming the equipment is sold on May 31, 2020 and the straight line method is used. 6 The book value of the equip. on May 31, 2020 if $/L deprec. is used 7 The amount of the gain or loss (INDICATE GAN or LOSS and AMOUNT) resulting if the equipment is sold for $1,383,125 on May 31, 2020 and 5/ depreciation is used. 8 The SECOND year (2019) depreciation if double declining balance is used. 9 The accumulated depreciation at December 31, 2019 (end of second year) if double declining balance (D0s) is used. 10 The book value of the equipment on December 31, 2019 assuming double declining balance is empleyed. 11 The depreciation for year 2020 assuming the equipment is seld on September 30,2020 and double declining balance is used. 12 The gain of loss (iNDICATE WhiCH) which would result if the equip. is sold for $903,359 on 5ept. 30,2020 and Doe ir wed. 13 The SECOND year (2019) depreciation if sum of the years dicits is used 14 The accumulated depreciation at December 31, 2019 (end of second year) if sum of the years digits is used 15 The book value of the equipment on December 31, 2019 assuming sum of the years digits is used. 16 The first year depreciation if units of output is uved and the equip. is operated for 2900 hours in 2018 . 17 The accumulated depreciation at December 31, 2019 (end of second year) units of output is used and the equipment was eperated for another 2700 hours in 2019. 18 The book value of the equip. on December 31,2019 if units of output is used. (Equipment operated 2900 hrs in 2018, 2700 hrs in 2019) 19 The depreciation for year 2020 assuming the equipment is rold on September 30,2020 and is operated for 2,300 hours in 2020. (assuming the units of output method is used) 20 The book value of the equipment assumine the facts in =19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts