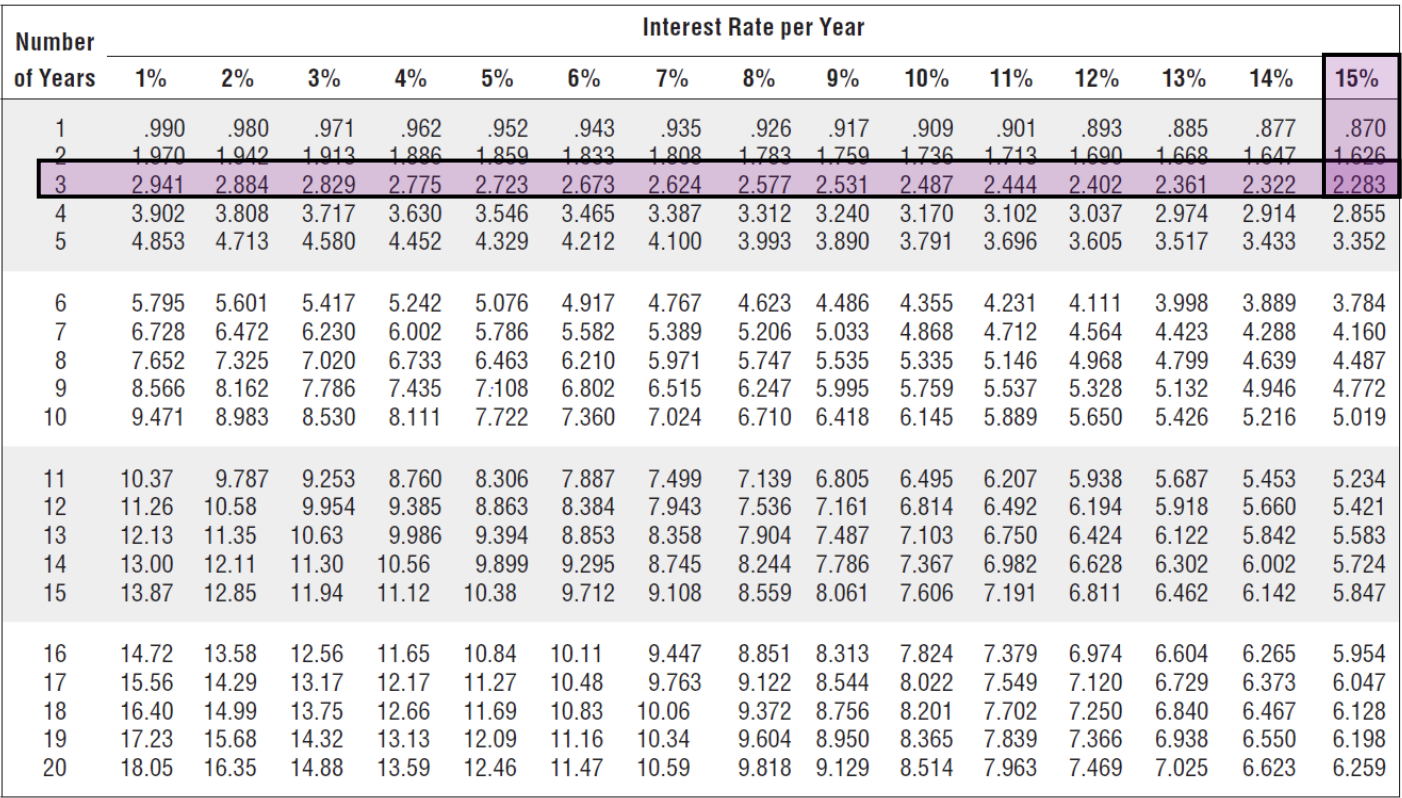

Question: *need to use general repayment loan formula A (equal regular payment) = L (amount borrowed)/Btr Btr can be interpreted from annuity table: Jason wants to

*need to use general repayment loan formula

A (equal regular payment) = L (amount borrowed)/Btr

Btr can be interpreted from annuity table:

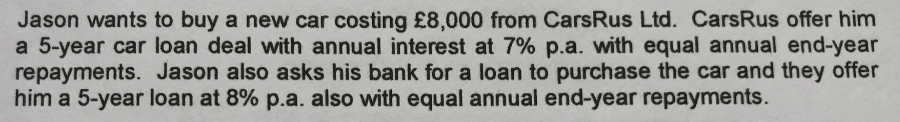

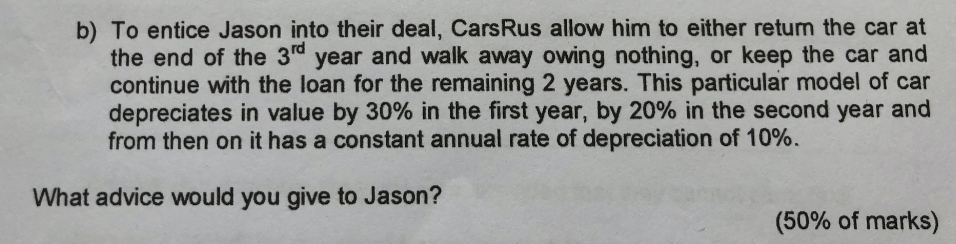

Jason wants to buy a new car costing 8,000 from CarsRus Ltd. CarsRus offer him a 5-year car loan deal with annual interest at 7% p.a. with equal annual end-year repayments. Jason also asks his bank for a loan to purchase the car and they offer him a 5-year loan at 8% p.a. also with equal annual end-year repayments. b) To entice Jason into their deal, CarsRus allow him to either return the car at the end of the 3rd year and walk away owing nothing, or keep the car and continue with the loan for the remaining 2 years. This particular model of car depreciates in value by 30% in the first year, by 20% in the second year and from then on it has a constant annual rate of depreciation of 10%. What advice would you give to Jason? (50% of marks) Interest Rate per Year Number of Years 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% .971 1 2 3 4 5 .990 1970 2.941 3.902 4.853 .980 1010 2.884 3.808 4.713 1912 2.829 3.717 4.580 1962 1986 2.775 3.630 4.452 .952 1959 2.723 3.546 4.329 .943 1 222 2.673 3.465 4.212 .935 1 208 2.624 3.387 4.100 .926 .917 1.792 1 759 2.577 2.531 3.312 3.240 3.993 3.890 .909 1726 2.487 3.170 3.791 .901 1 72 2.444 3.102 3.696 .893 169 2.402 3.037 3.605 .885 1668 2.361 2.974 3.517 .877 1647 2.322 2.914 3.433 .870 1626 2.283 2.855 3.352 6 7 8 9 10 5.795 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 8.983 5.417 6.230 7.020 7.786 8.530 5.242 6.002 6.733 7.435 8.111 5.076 5.786 6.463 7:108 7.722 4.917 5.582 6.210 6.802 7.360 4.767 5.389 5.971 6.515 7.024 4.623 4.486 5.206 5.033 5.747 5.535 6.247 5.995 6.710 6.418 4.355 4.231 4.868 4.712 5.335 5.146 5.759 5.537 6.145 5.889 4.111 4.564 4.968 5.328 5.650 3.998 4.423 4.799 5.132 5.426 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 11 12 13 14 15 10.37 11.26 12.13 13.00 13.87 9.787 10.58 11.35 12.11 12.85 9.253 9.954 10.63 11.30 11.94 8.760 9.385 9.986 10.56 11.12 8.306 8.863 9.394 9.899 10.38 7.887 8.384 8.853 9.295 9.712 7.499 7.943 8.358 8.745 9.108 7.139 6.805 7.536 7.161 7.904 7.487 8.244 7.786 8.559 8.061 6.495 6.207 6.814 6.492 7.103 6.750 7.367 6.982 7.606 7.191 5.938 6.194 6.424 6.628 6.811 5.687 5.918 6.122 6.302 6.462 5.453 5.660 5.842 6.002 6.142 5.234 5.421 5.583 5.724 5.847 16 17 18 19 20 14.72 15.56 16.40 17.23 18.05 13.58 14.29 14.99 15.68 16.35 12.56 13.17 13.75 14.32 14.88 11.65 12.17 12.66 13.13 13.59 10.84 11.27 11.69 12.09 12.46 10.11 10.48 10.83 11.16 11.47 9.447 9.763 10.06 10.34 10.59 8.851 8.313 9.122 8.544 9.372 8.756 9.604 8.950 9.818 9.129 7.824 8.022 8.201 8.365 8.514 7.379 7.549 7.702 7.839 7.963 6.974 7.120 7.250 7.366 7.469 6.604 6.729 6.840 6.938 7.025 6.265 6.373 6.467 6.550 6.623 5.954 6.047 6.128 6.198 6.259 Jason wants to buy a new car costing 8,000 from CarsRus Ltd. CarsRus offer him a 5-year car loan deal with annual interest at 7% p.a. with equal annual end-year repayments. Jason also asks his bank for a loan to purchase the car and they offer him a 5-year loan at 8% p.a. also with equal annual end-year repayments. b) To entice Jason into their deal, CarsRus allow him to either return the car at the end of the 3rd year and walk away owing nothing, or keep the car and continue with the loan for the remaining 2 years. This particular model of car depreciates in value by 30% in the first year, by 20% in the second year and from then on it has a constant annual rate of depreciation of 10%. What advice would you give to Jason? (50% of marks) Interest Rate per Year Number of Years 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% .971 1 2 3 4 5 .990 1970 2.941 3.902 4.853 .980 1010 2.884 3.808 4.713 1912 2.829 3.717 4.580 1962 1986 2.775 3.630 4.452 .952 1959 2.723 3.546 4.329 .943 1 222 2.673 3.465 4.212 .935 1 208 2.624 3.387 4.100 .926 .917 1.792 1 759 2.577 2.531 3.312 3.240 3.993 3.890 .909 1726 2.487 3.170 3.791 .901 1 72 2.444 3.102 3.696 .893 169 2.402 3.037 3.605 .885 1668 2.361 2.974 3.517 .877 1647 2.322 2.914 3.433 .870 1626 2.283 2.855 3.352 6 7 8 9 10 5.795 6.728 7.652 8.566 9.471 5.601 6.472 7.325 8.162 8.983 5.417 6.230 7.020 7.786 8.530 5.242 6.002 6.733 7.435 8.111 5.076 5.786 6.463 7:108 7.722 4.917 5.582 6.210 6.802 7.360 4.767 5.389 5.971 6.515 7.024 4.623 4.486 5.206 5.033 5.747 5.535 6.247 5.995 6.710 6.418 4.355 4.231 4.868 4.712 5.335 5.146 5.759 5.537 6.145 5.889 4.111 4.564 4.968 5.328 5.650 3.998 4.423 4.799 5.132 5.426 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 11 12 13 14 15 10.37 11.26 12.13 13.00 13.87 9.787 10.58 11.35 12.11 12.85 9.253 9.954 10.63 11.30 11.94 8.760 9.385 9.986 10.56 11.12 8.306 8.863 9.394 9.899 10.38 7.887 8.384 8.853 9.295 9.712 7.499 7.943 8.358 8.745 9.108 7.139 6.805 7.536 7.161 7.904 7.487 8.244 7.786 8.559 8.061 6.495 6.207 6.814 6.492 7.103 6.750 7.367 6.982 7.606 7.191 5.938 6.194 6.424 6.628 6.811 5.687 5.918 6.122 6.302 6.462 5.453 5.660 5.842 6.002 6.142 5.234 5.421 5.583 5.724 5.847 16 17 18 19 20 14.72 15.56 16.40 17.23 18.05 13.58 14.29 14.99 15.68 16.35 12.56 13.17 13.75 14.32 14.88 11.65 12.17 12.66 13.13 13.59 10.84 11.27 11.69 12.09 12.46 10.11 10.48 10.83 11.16 11.47 9.447 9.763 10.06 10.34 10.59 8.851 8.313 9.122 8.544 9.372 8.756 9.604 8.950 9.818 9.129 7.824 8.022 8.201 8.365 8.514 7.379 7.549 7.702 7.839 7.963 6.974 7.120 7.250 7.366 7.469 6.604 6.729 6.840 6.938 7.025 6.265 6.373 6.467 6.550 6.623 5.954 6.047 6.128 6.198 6.259

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts