Question: Need to work out pt ii the Basel conversion is 50 percent A3. Capital adequacy (20 marks) fal Money Bank has the following balance sheet

Need to work out pt ii the Basel conversion is 50 percent

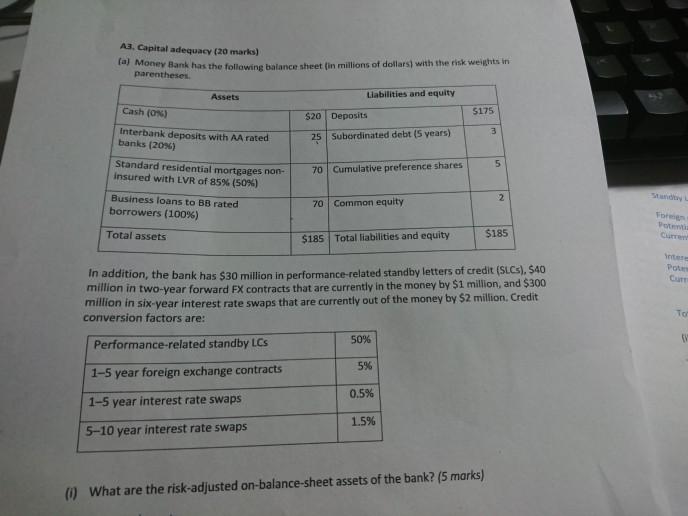

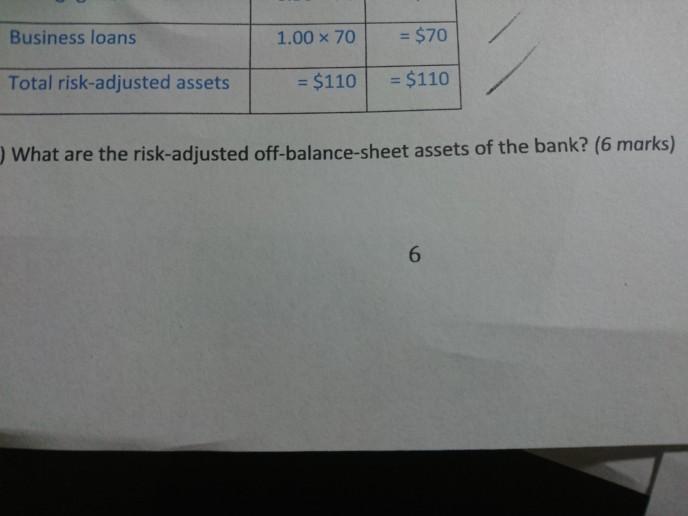

A3. Capital adequacy (20 marks) fal Money Bank has the following balance sheet (in Millions of dollars) with the risk weights in parentheses Assets Liabilities and equity 5175 $20 Deposits 3 Cash (0) Interbank deposits with MA rated banks (20%) Standard residential mortgages non- insured with LVR of 85% (50%) 25 Subordinated debt (5 years) 5 70 Cumulative preference shares 2 Business loans to BB rated borrowers (100%) 70 Common equity Formen Total assets $185 $185 Total liabilities and equity Pour In addition, the bank has $30 million in performance-related standby letters of credit (SLC), 540 million in two-year forward EX contracts that are currently in the money by $1 million, and $300 million in six-year interest rate swaps that are currently out of the money by $2 million. Credit conversion factors are: Too Performance-related standby LCS 50% 5% 1-5 year foreign exchange contracts 0.5% 1-5 year interest rate swaps 1.5% 5-10 year interest rate swaps (0) What are the risk-adjusted on-balance-sheet assets of the bank? (5 marks) Business loans 1.00 x 70 = $70 Total risk-adjusted assets = $110 = $110 What are the risk-adjusted off-balance-sheet assets of the bank? (6 marks) 6 A3. Capital adequacy (20 marks) fal Money Bank has the following balance sheet (in Millions of dollars) with the risk weights in parentheses Assets Liabilities and equity 5175 $20 Deposits 3 Cash (0) Interbank deposits with MA rated banks (20%) Standard residential mortgages non- insured with LVR of 85% (50%) 25 Subordinated debt (5 years) 5 70 Cumulative preference shares 2 Business loans to BB rated borrowers (100%) 70 Common equity Formen Total assets $185 $185 Total liabilities and equity Pour In addition, the bank has $30 million in performance-related standby letters of credit (SLC), 540 million in two-year forward EX contracts that are currently in the money by $1 million, and $300 million in six-year interest rate swaps that are currently out of the money by $2 million. Credit conversion factors are: Too Performance-related standby LCS 50% 5% 1-5 year foreign exchange contracts 0.5% 1-5 year interest rate swaps 1.5% 5-10 year interest rate swaps (0) What are the risk-adjusted on-balance-sheet assets of the bank? (5 marks) Business loans 1.00 x 70 = $70 Total risk-adjusted assets = $110 = $110 What are the risk-adjusted off-balance-sheet assets of the bank? (6 marks) 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts