Question: Need ur answer asap 5 - 3 e Il Compute for what was required in each question 20 PTS DM Corporation provided the following trial

Need ur answer asap

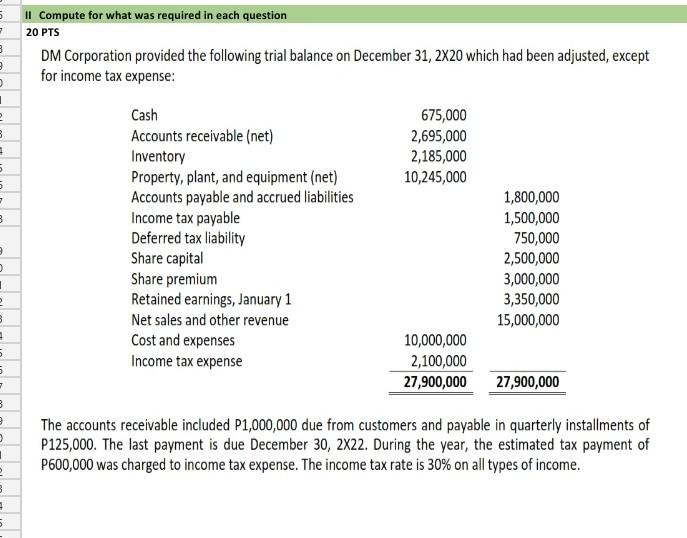

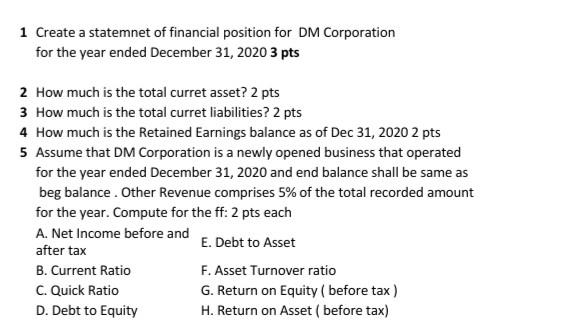

5 - 3 e Il Compute for what was required in each question 20 PTS DM Corporation provided the following trial balance on December 31, 2X20 which had been adjusted, except for income tax expense: 1 e 3 675,000 2,695,000 2,185,000 10,245,000 . 5 B Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) Accounts payable and accrued liabilities Income tax payable Deferred tax liability Share capital Share premium Retained earnings, January 1 Net sales and other revenue Cost and expenses Income tax expense 1,800,000 1,500,000 750,000 2,500,000 3,000,000 3,350,000 15,000,000 e 3 . 5 10,000,000 2,100,000 27,900,000 5 27,900,000 3 The accounts receivable included P1,000,000 due from customers and payable in quarterly installments of P125,000. The last payment is due December 30, 2X22. During the year, the estimated tax payment of P600,000 was charged to income tax expense. The income tax rate is 30% on all types of income. 1 2 3 5 1 Create a statemnet of financial position for DM Corporation for the year ended December 31, 2020 3 pts 2 How much is the total curret asset? 2 pts 3 How much is the total curret liabilities? 2 pts 4 How much is the Retained Earnings balance as of Dec 31, 2020 2 pts 5 Assume that DM Corporation is a newly opened business that operated for the year ended December 31, 2020 and end balance shall be same as beg balance. Other Revenue comprises 5% of the total recorded amount for the year. Compute for the ff: 2 pts each A. Net Income before and after tax E. Debt to Asset B. Current Ratio F. Asset Turnover ratio C. Quick Ratio G. Return on Equity ( before tax) D. Debt to Equity H. Return on Asset (before tax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts