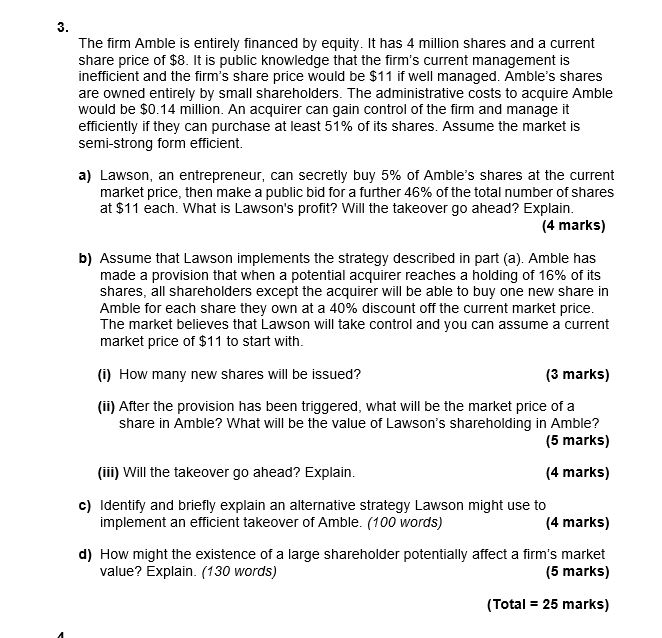

Question: Need urgent answer and correct answer. The formula list given is also attached. Please need them as soon as possible and only correct ones with

Need urgent answer and correct answer. The formula list given is also attached. Please need them as soon as possible and only correct ones with proper explanation.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts