Question: need work and answers on all please For a study guide. I've posted several times and haven't gotten anything exampie, cnaige une year zui w

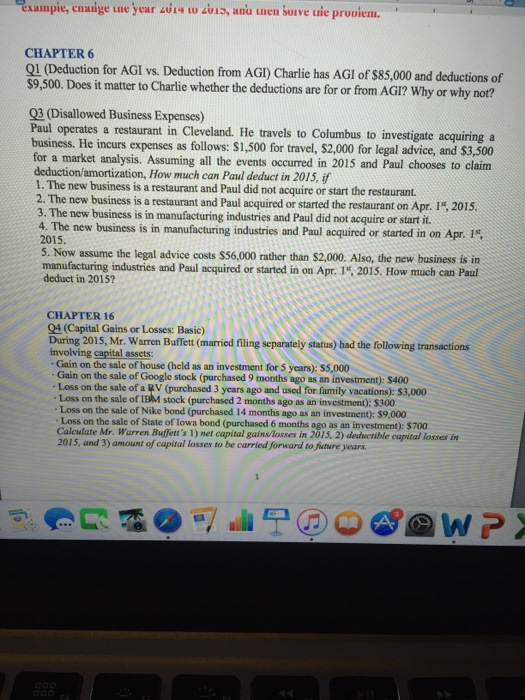

exampie, cnaige une year zui w LU, anu unen buive uie pruviem. CHAPTER6 Q1 (Deduction for AGI vs. Deduction from AGI) Charlie has AGI of $85,000 and deductions of $9,500. Does it matter to Charlie whether the deductions are for or from AGI? Why or why not? 93 (Disallowed Business Expenses) Paul operates a restaurant in Cleveland. He travels to Columbus to investigate acquiring a usiness. He incurs expenses as follows: S1,500 for travel, $2,000 for legal advice, and $3,500 for a market analysis. Assuming all the events occurred in 2015 and Paul chooses to claim deduction/amortization, How much can Paul deduct in 2015, if 1. The new business 2. The new business is a restaurant and Paul acquired or started the restaurant on Apr. 1s, 2015, 3. The new business is in manufacturing industries and Paul did not acquire or start it. 4. The new business is in manufacturing industries and Paul acquired or started in on Apr. 1 is a restaurant and Paul did not acquire or start the restaurant. 2015. 5. Now assume the legal advice costs $56,000 rather than s2,000. Also, the new business is in manufacturing industries and Paul acquired or started in on Apr. 1%2015. How much can Paul deduct in 2015? CHAPTER 16 04 (Capital Gains or Losses: Basic During 2015, Mr. Warren Buffett (married filing separately status) had the following transactions involving capital assets Gain on the sale of house (held as an investment for 5 years): $5,000 Gain on the sale of Google stock (purchased 9 months ago as an investment): $400 Loss on the sale of a V (purchased 3 years ago and used for family vacations): S3,000 Loss on the sale of IBM stock (purchased 2 months ago as an investment): $300 Loss on the sale of Nike bond (purchased 14 months ago as an investment): $9,000 Loss on the sale of State of lowa bond (purchased 6 months ago as an investment): $700 Calculate Mr. Warren Buffett's 1) net capital gains/losses in 2015, 2) deductible capital losses in 2015, and 3) amount of capital losses to be carried forward to fiuture years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts