Question: needed in 30mins please Question 4 3 Points Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry for 760 million yen payable in

needed in 30mins please

needed in 30mins please

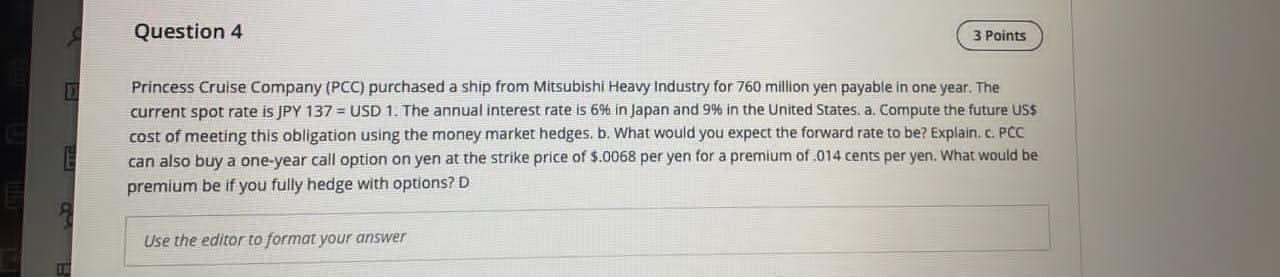

Question 4 3 Points Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry for 760 million yen payable in one year. The current spot rate is JPY 137 = USD 1. The annual interest rate is 6% in Japan and 9% in the United States. a. Compute the future US$ cost of meeting this obligation using the money market hedges, b. What would you expect the forward rate to be? Explain.c. PCC can also buy a one-year call option on yen at the strike price of $.0068 per yen for a premium of .014 cents per yen. What would be premium be if you fully hedge with options? D Use the editor to format your answer Question 4 3 Points Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry for 760 million yen payable in one year. The current spot rate is JPY 137 = USD 1. The annual interest rate is 6% in Japan and 9% in the United States. a. Compute the future US$ cost of meeting this obligation using the money market hedges, b. What would you expect the forward rate to be? Explain.c. PCC can also buy a one-year call option on yen at the strike price of $.0068 per yen for a premium of .014 cents per yen. What would be premium be if you fully hedge with options? D Use the editor to format your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts